Cryptocurrency investment products experienced strong inflows during the last trading week, amid Bitcoin surging to historic highs of $118,000.

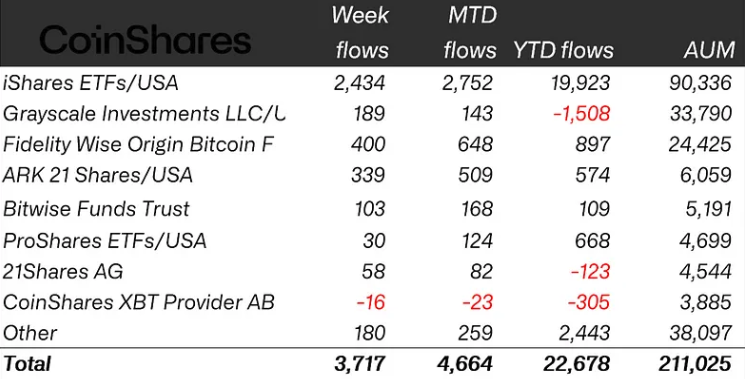

Global crypto exchange-traded products (ETPs) recorded $3.7 billion of inflows for the trading week ending Friday, CoinShares reported on Monday.

The fresh gains further increased crypto ETPs’ year-to-date (YTD) inflows, which surged to a new high of $22.7 billion, up about 20% from last week’s $19 billion.

The total market value of assets in crypto funds also broke new ground, with assets under management (AUM) for the first time reaching $211 billion.

Bitcoin ETPS lead inflows with $2.7 billion

Bitcoin (BTC) ETPs led the way last week, posting $2.7 billion of inflows, accounting for 73% of total crypto ETP inflows last week.

The new multibillion-dollar inflows marked a notable recovery from last week’s $790 million of inflows, after averaging $1.5 billion in weekly inflows during the previous three weeks.

Following last week’s inflow slowdown, CoinShares’ research head James Butterfill suggested that investors were becoming increasingly cautious about Bitcoin approaching new highs.

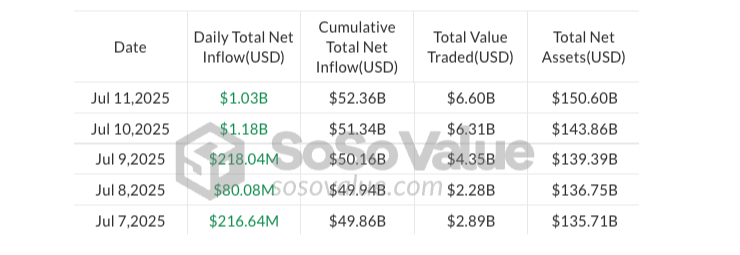

Still, ETP sentiment only surged further as daily inflows in Bitcoin exchange-traded funds (ETFs) jumped above $1 billion the next day, after BTC printed new all-time highs above $112,000 last Wednesday, according to SoSoValue data.

The new inflows drove Bitcoin ETPs’ total AUM to $179.5 billion, Butterfill noted, adding that the AUM equaled 54% of total assets held in gold ETPs for the first time ever.

Ether ETPs see 12 consecutive weeks of inflows

Ether (ETH) ETPs posted their 12th consecutive week of inflows, totaling $990 million. This marked their fourth-largest inflows on record, according to CoinShares.

“In relative terms, Ethereum’s inflows over the past 12 weeks account for 19.5% of its AUM, compared to 9.8% for Bitcoin,” Butterfill said.

Related: Bitcoin is rallying on US deficit concerns, not hype: Analyst

On the other hand, XRP (XRP) ETPs were hit with the largest weekly outflows, totalling $104 million, while Solana’s recorded strong inflows of $92.6 million.

Inflows spread across all US issuers

The latest weekly inflows were broadly distributed across all US-based issuers, with BlackRock’s iShares crypto funds leading the pack, attracting $2.4 billion.

Fidelity Investments and ARK Invest followed with $400 million and $339 million, respectively.

Meanwhile, CoinShares was among the few European issuers to experience minor outflows, totaling $16 million for the week.

Magazine: Bitcoin vs stablecoins showdown looms as GENIUS Act nears