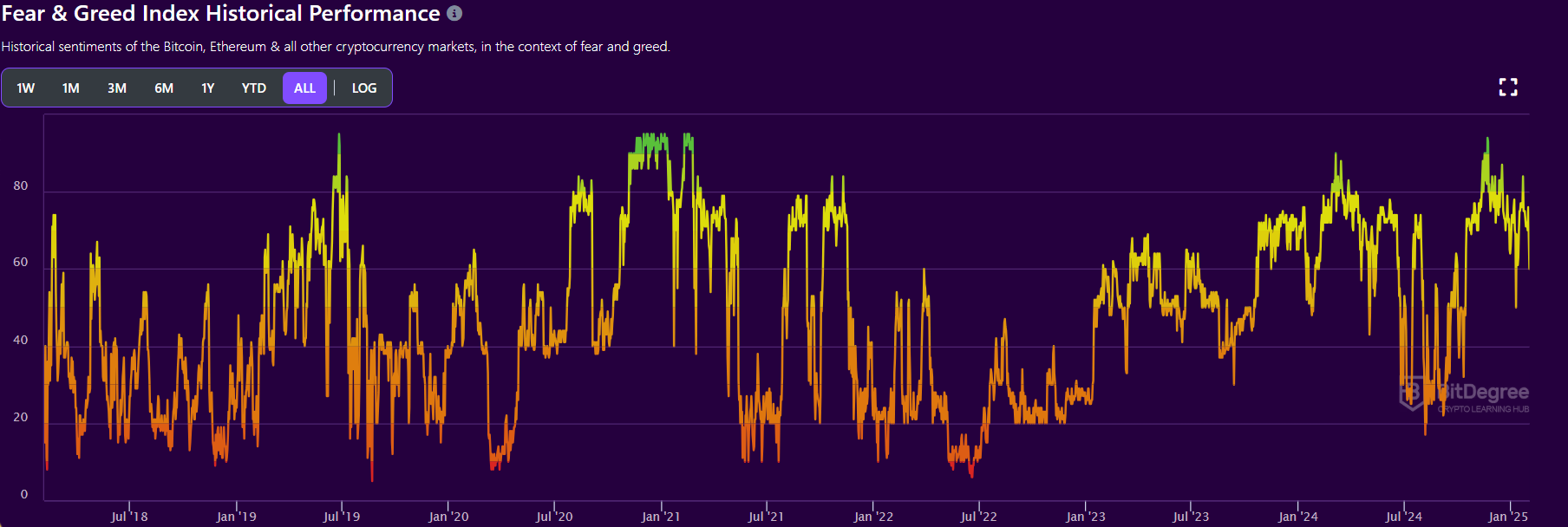

The Crypto Fear & Greed Index has fallen to a 4-month low of 44 following the $2.2 billion crypto market crash earlier today.

The index, which represents crypto market sentiments and emotions on a scale of 0 to 100, had not fallen below 50 since Oct.12. Triggered by U.S. president Donald Trump’s announcement of double digit trade tariffs on Canada, Mexico and China, the total crypto market cap fell nearly 12% in the early hours of Feb. 3, with Bitcoin (BTC) alone falling over 5%. The index immediately fell from a “moderate greed” score of 60 to a “fear” score of 44, indicating a selloff.

While the current selloff is statistically the largest liquidation event in crypto history at over over $2.2 billion at press time, the index score does not yet indicate the existence of a sustained market selloff, as was recorded during bear markets in 2018, 2019 and 2022.

Thus far, the prevailing market consensus appears to be that current market conditions are a blip in a bull market, and do not signify the start of any sustained downward trend. On-chain analyst Willy Woo captured the sentiment in an X post where he posited that Bitcoin has become such a psychologically powerful concept that it is effectively too big to fail.

At press time, the phrase “Buy the dip” was one of the top trending topics on X, while both Bitcoin and Ethereum recovered slowly from their respective 24-hour lows.

Anyone who Sell on a RED days is a Losers

BUY more RED and SELL more GREEN

Patience is Key 🔑 to success..$ETH BUY THE DIP sell #Bullrun2025 pic.twitter.com/WjVFKOCE7i

— ⭕️TheCryptoLogic 💹🧲 (@Folami_Capital) February 3, 2025

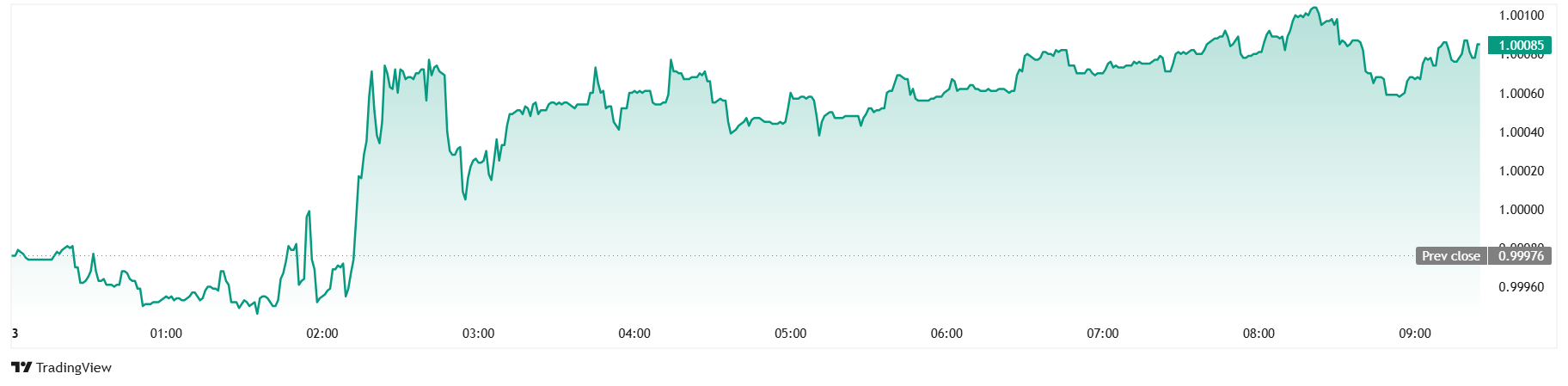

Bitcoin recovered 4 percent from a 24-hour low of $91,200 to roughly $95,000, while Ethereum moved up from its 24-hour low of $2,368 to about $2,600 at press time. Tether also recovered from a 24-hour low of $0.99946 to about $1.00085 on Monday morning.

The relatively uncharacteristic resilience of the Fear & Greed Index score versus the ongoing market bloodbath will be interpreted by some to mean that large institutional investment in Bitcoin by the likes of MicroStrategy have created a calming effect in notoriously volatile crypto markets.