Early employees of startups are often given shares as part of their compensation, which they can cash in when the company goes public. However, higher interest rates in recent years have made for an uncertain environment for IPOs. Revolut may be aiming to allow employees to raise some cash while giving the firm’s valuation an added boost ahead of an IPO.

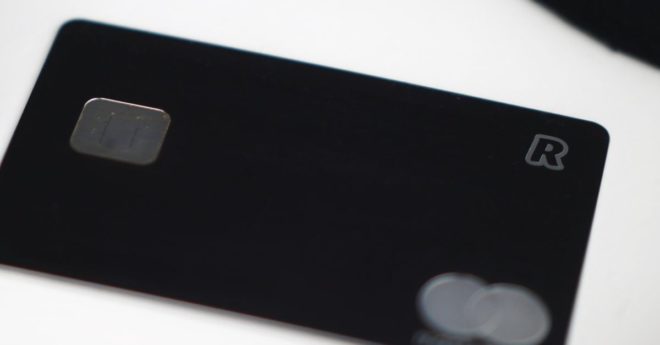

Crypto-Friendly Bank Revolut Plans to Sell $500M of Employee Shares at $45B Valuation Before Possible IPO: WSJ