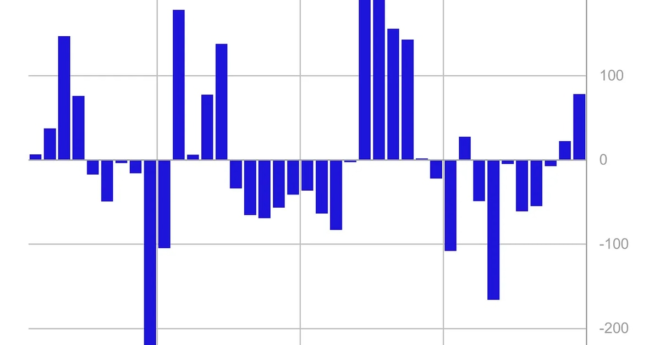

Digital asset investment funds witnessed inflows for the second week totalling $78 million, the largest inflows since July, according to data from CoinShares. Bitcoin investment funds saw the largest proportion of inflows, totalling $43 million. Bitcoin trading volumes also rose by 16% last week, said the report. CoinShares noted that some investors poured some $1.2 million into short-bitcoin positions after recent price strength. Bitcoin ended September trading at lows of around $26,200 and rose to around $28,400 by the start of October. The Ethereum futures ETF launch in the U.S., attracted under $10 million in its first week, highlighting a muted investor appetite, said the report.

Crypto Funds See Largest Inflows Since July