In a recent commentary on X, Daniel Yan, co-founder of Matrixport and CIO at Kryptanium Capital, offered a detailed comparison between the current crypto market dynamics and those observed in early June. His insights are especially relevant as the market approaches several key economic releases that could significantly influence the trajectory of major cryptocurrencies like Bitcoin (BTC) and Solana (SOL).

History Repeating For The Crypto Market?

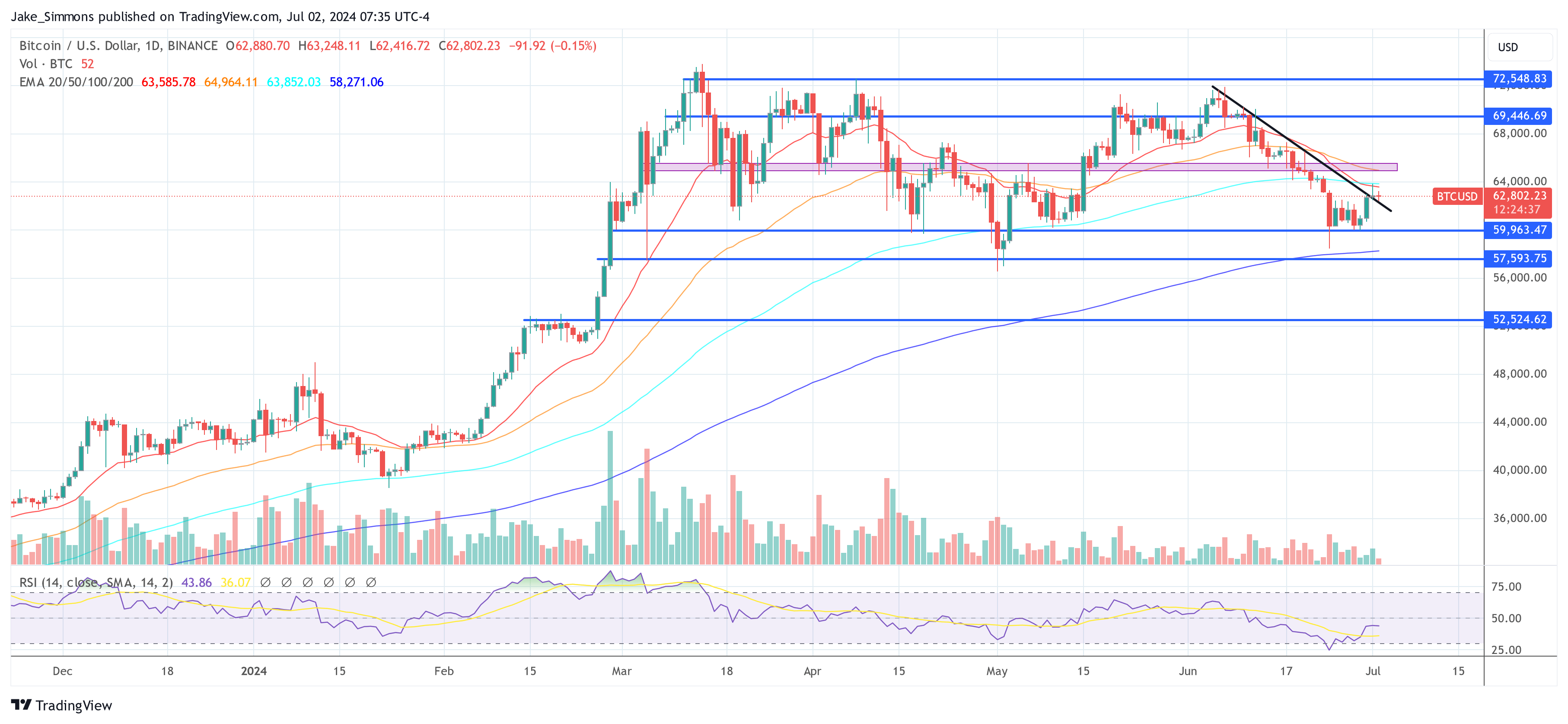

Yan’s analysis began with an overview of the current market recovery, noting that both BTC and SOL are “grinding at key technical levels nicely now,” suggesting a potential setup for a breakout similar to the situation in early June. During that period, Bitcoin was challenging a major resistance level at $71,500, influenced by positive Personal Consumption Expenditures (PCE) data and weaker-than-expected ADP employment change numbers, which fueled optimism about a potentially dovish stance from the Federal Reserve.

Related Reading

However, Yan drew attention to the volatility that followed, when a stronger than expected Non-Farm Payroll (NFP) report reversed the bullish sentiment, causing Bitcoin to plummet from highs of $72,000 to around $58,000 within two weeks. He highlighted this pattern to caution investors about the potential for similar market reactions in the current context.

Looking forward, Yan expressed a generally bullish outlook for Q3 2023, citing improving liquidity conditions and the resolution of the Mt. Gox case, which has loomed over the market for years. Yet, he remains wary of the short-term impacts of the upcoming NFP release, scheduled for this Friday. “I’m getting cautious going into the NFP Friday – a similar first half of the pattern may happen,” he warned.

Yan also pointed to the CPI release as the next crucial data point, with the Cleveland Fed providing modest estimates for June but less favorable projections for July. He emphasized the impact of summer energy prices on inflation metrics, noting that rising crude oil and gas prices since early June are likely to influence both headline CPI and PCE directly, and core inflation numbers indirectly.

“A 0.3% MoM Core CPI expectation is already bad, imagine it realizes worse,” he remarked, underscoring the potential for these figures to exceed expectations to the upside, further complicating the Fed’s inflation management efforts.

Related Reading

The immediate focus for Yan and many in the crypto community is Federal Reserve Chairman Jerome Powell’s speech tonight at the European Central Bank. His comments are highly anticipated for hints on how the Fed views the current macroeconomic conditions and its potential policy actions in the near term. “Let’s see what he thinks of the current macro situations,” Yan stated, indicating the significant market-moving potential of Powell’s address.

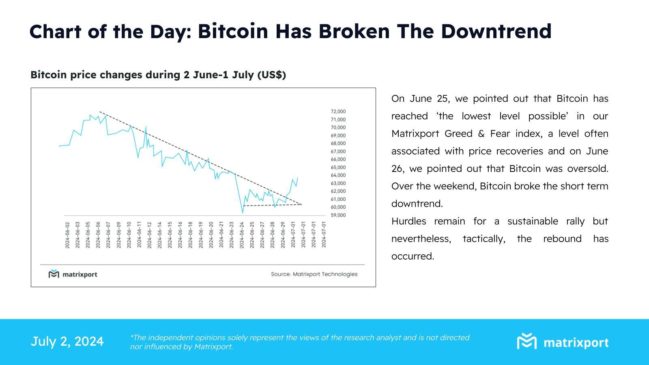

Bitcoin Breakout Needs Confirmation

Matrixport released a “Chart of the Day” featuring Bitcoin’s price movements from June 2 to July 1, highlighting the cryptocurrency’s recent break from a short-term downtrend. After signaling a bottom on June 25 on their Matrixport Greed & Fear index—a tool often used to predict potential reversals—Bitcoin showed signs of an oversold condition, which typically precedes a price recovery. Indeed, Bitcoin’s price began to rebound tactically over the weekend, overcoming some of the immediate technical hurdles.

While the market appears to be setting up for a potential rally, Yan’s analysis and the impending economic updates suggest that investors should brace for possible fluctuations. As these events unfold, the crypto market’s response to economic indicators and central bank communications will be pivotal in shaping its short-term direction.

At press time, BTC traded at $62,802.

Featured image created with DALL·E, chart from TradingView.com