Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Federal Reserve Chair Jerome Powell’s appearance on Capitol Hill Tuesday left risk-asset traders with a single, binary question: does the most interest-sensitive summer in years end with a crypto breakout or a macro-driven crash? In a prepared statement, Powell stressed that “inflation has eased significantly from its highs in mid-2022 but remains somewhat elevated,” adding that the Federal Open Market Committee is “well-positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.”

Crypto’s Fate May Be Sealed In July

For crypto markets already oscillating on every nuance of policy guidance, the message was clear: the next four weeks—anchored by the 12 July CPI release and the 19 July payrolls report—will decide whether July’s FOMC delivers relief or a reality check.

POWELL: WE WOULD EXPECT TO SEE MEANINGFUL TARIFF INFLATION EFFECTS JUNE, JULY AUGUST

POWELL: IF WE DON’T SEE THAT, THAT WOULD LEAD TO CUTTING EARLIER

— *Walter Bloomberg (@DeItaone) June 24, 2025

Powell’s caution sits atop a rare public split inside the Board itself. Governors Michelle Bowman and Christopher Waller, both Trump appointees, have openly argued that tariff-related price spikes are likely to be “one-time shifts” and therefore should not stand in the way of an early cut—potentially as soon as the 30 July meeting.

Seven of their colleagues disagree, laying out projections that keep policy unchanged through December. Powell, for his part, told lawmakers: “I don’t think we need to be in any rush, because the economy is still strong.”

Related Reading

Markets reacted by flattening the front end of the curve. Two-year Treasury yields fell to 3.806 percent, while the benchmark 10-year dipped to 4.285 percent—both lows not seen since early May—after the testimony and a surprise cease-fire in the Middle East turbo-charged a global “risk-on” bid. Yet expectations for July remain finely balanced: CME FedWatch shows that traders have whittled the probability of a first 25-basis-point cut to roughly 19%.

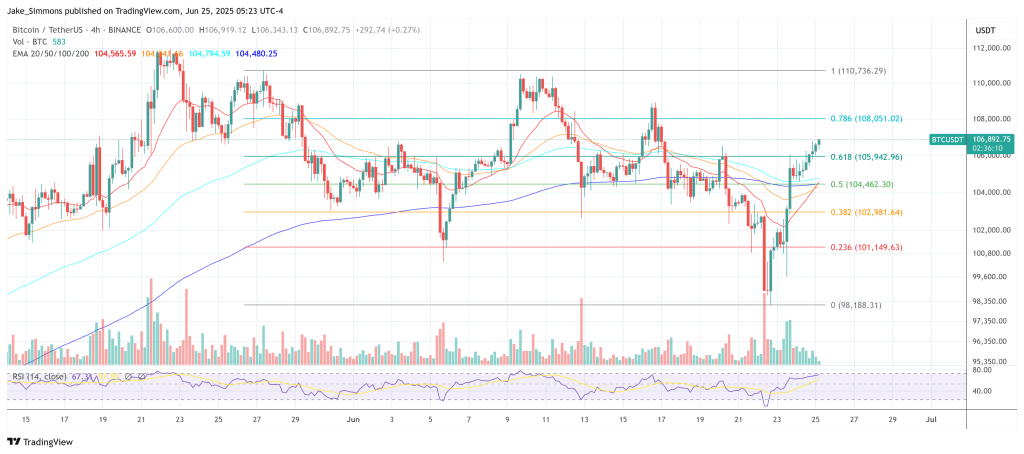

Crypto traded the cross-currents rather than the headline. Bitcoin, which had cratered to $99,000 on Monday, reclaimed $106,000 by Wednesday morning, mirroring the rebound in equities and high-beta currencies as the dollar slumped on falling yields. Ethereum, meanwhile, held above $2,400—even as Powell’s tone was widely described as hawkish. The broader crypto complex moved in sympathy, with BNB punching through $644 and Solana stabilising near $146.

Related Reading

Veteran traders on X distilled the stakes. Pseudonymous analyst Byzantine General wrote, “We got a lot of clarity now. All eyes on the July CPI print.” Nic from CoinBureau added that July “is in play—maybe—but nothing’s locked in,” as Powell’s testimony brought no big surprises.

Meanwhile, Jim Bianco commented: “Trump appointees Waller and Bowman are suggesting a July cut. Powell is reiterating ‘no.’ Will the July FOMC meeting see at least two dissenters?”

For now, Powell’s “watch and wait” stance has bought the FOMC four more weeks of optionality. If July inflation confirms the down-trend, the policy door swings open, and the next rally for crypto could morph into a full-blown melt-up. If it doesn’t, the crash could come just as fast. As Byzantine General put it, the market “got clarity.” What it did not get is comfort.

At press time, Bitcoin traded at $106,892.

Featured image created with DALL.E, chart from TradingView.com