Data shows the crypto futures market has observed large liquidations in the past day as Bitcoin has recorded a sharp surge towards $28,000.

Crypto Futures Observed $78 Million In Liquidations In Last 24 Hours

A crypto futures contract is said to be “liquidated” when the derivative exchange with which said contract is open forcefully closes it up. This happens when the contract has accumulated losses of a certain percentage, the exact value of which may differ between platforms.

In this sector, it’s not too rare to see a flood of such liquidations occurring within a short span of time. The reason behind that is the high volatility that most of the assets display on average.

A lot of investors also like to play with extreme amounts of leverage, due to it being readily accessible in many platforms. Leverage alone can raise the risk of liquidation manyfold, so it combined with the high volatility can make it easy for contracts to be flushed down.

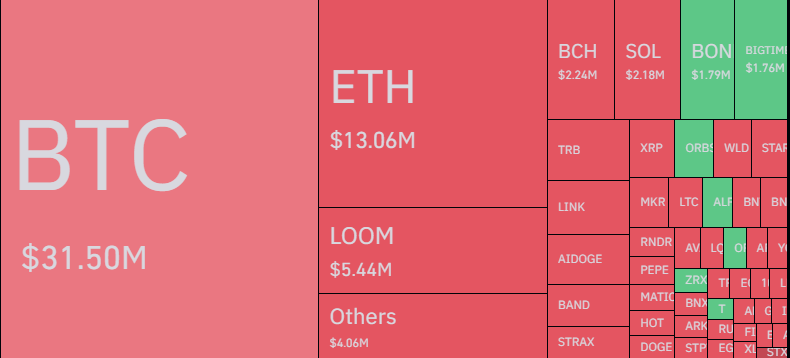

During the past day, the crypto market has once again seen some notable volatility, which has led to another mass liquidation event on the futures side, as the data below from CoinGlass shows.

Looks like the market has seen some high liquidations in the past day | Source: CoinGlass

As is visible from the table, the crypto market as a whole has seen liquidations of more than $78 million in the last 24 hours. Out of these, $61.88 million involved the short contracts, equivalent to almost 80% of the total.

This naturally makes sense, as this latest liquidation squeeze has been led by a rally in Bitcoin’s price.

The value of the asset has shot up today | Source: BTCUSD on TradingView

As displayed above, Bitcoin has enjoyed a sharp surge in the past day. At the peak of this rally, the coin had retested the $28,000 level but has since seen a bit of pullback.

The rest of the sector also followed the original crypto in this rally (as is usually the case), which is why shorts around the sector have taken a beating today. The below table shows what the individual contribution towards this liquidation squeeze has looked like for the different symbols in the sector.

The breakdown of the liquidations by asset | Source: CoinGlass

As expected, Bitcoin occupies the largest share of liquidations with $31.5 million, while Ethereum is second at $13.06 million. Interestingly, Loom Network (LOOM) is third in this list, despite the asset being just the 71st largest in the sector by market cap.

The altcoin has enjoyed a sharp rally of more than 113% in the past week, which is perhaps why the crypto has had such strong interest behind it on the futures market.

Bitcoin Open Interest Has Rebounded Since The Squeeze

As CryptoQuant analyst Maartunn has pointed out, the Bitcoin open interest, a measure of the total amount of contracts associated with the asset currently open on the futures market, has jumped back since the liquidation flush occurred.

The metric has climbed back up from its lows | Source: @JA_Maartun on X

It would appear that more speculators have jumped on the market even after seeing a large amount of traders getting liquidated. Generally, the open interest being high can lead to volatility, so the indicator retracing back to its levels from before the plunge could mean BTC would soon see more sharp price action in the near future.

Featured image from Shutterstock.com, charts from TradingView.com