Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto sits at the heart of Ray Dalio’s new message. On September 3, 2025, the Bridgewater Associates founder published a point-by-point rebuttal to what he called the Financial Times’ “mischaracterizations,” releasing the full written Q&A he says he provided to the paper. The exchange restates his “Big Debt Cycle” framework and argues that rising US debt burdens, risks to Federal Reserve independence, and mounting geopolitical fractures are eroding the dollar’s role as a store of wealth—conditions that he says are boosting gold and crypto.

Why Crypto Is An “An Attractive Alternative”

Dalio frames the US fiscal position as late-cycle and dangerously self-reinforcing. “The great excesses that are now projected as a result of the new budget will likely cause a debt-induced heart-attack in the relatively near future—I’d say three years, give or take a year or two,” he wrote. He quantified the near-term squeeze in stark terms, citing “about $1 trillion a year in interest” and “about $9 trillion needed to roll over the debt,” alongside roughly “$7 trillion” in spending versus “$5 trillion” in revenues, requiring “an additional roughly $2 trillion in debt.” That expanding supply, he argued, collides with weakening demand when investors question whether bonds “are good storeholds of wealth.”

Related Reading

The fulcrum, in Dalio’s telling, is now the Federal Reserve. If political pressure undermines the central bank’s independence, he warned, “we will see an unhealthy decline in the value of money.” Should a “politically weakened Fed” allow inflation to “run hot,” the consequence would be that “bonds and the dollar [go] down in value” and, if not remedied, becoming “an ineffective storehold of wealth and the breaking down of the monetary order as we know it.” He linked this to a broader late-cycle pattern: foreign holders “reducing their holdings of US bonds and increasing their holdings of gold due to geopolitical worries,” which he called “classically symptomatic” of the endgame.

Dalio connected the macro and political strands to a more interventionist policy backdrop, referencing actions “to take control of what businesses do” and likening the current phase to the 1928–1938 period. He did not pin the dynamic on a single administration—“this situation has been going on for a long time under presidents from both parties”—but said post-2008 and especially post-2020 policies accelerated it. “The interaction of these five forces will lead to huge and unimaginable changes over the next 5 years,” he added, listing debt, domestic politics, geopolitics, acts of nature, and technology (with AI most important) as the drivers.

Within that late-cycle schema, Dalio placed crypto squarely in the “hard currency” bucket. “Crypto is now an alternative currency that has its supply limited,” he wrote. “If the supply of dollar money rises and/or the demand for it falls, that would likely make crypto an attractive alternative currency.” He tied the recent “rises in gold and cryptocurrency prices” to “reserve currency governments’ bad debt situations,” and reiterated his long-running focus on “storeholds of wealth.”

Related Reading

On whether crypto could “meaningfully replace the dollar,” he emphasized mechanics over labels, noting that “most fiat currencies, especially those with large debts, will have problems being effective storeholds of wealth and will go down in value relative to hard currencies,” a pattern he said echoed the 1930–1940 and 1970–1980 episodes.

Dalio addressed crypto stablecoin risk in that context, separating asset price drawdowns from systemic fragility: “I don’t think so,” he said when asked if stablecoins’ Treasury exposure is a systemic risk, adding that “a fall in the real purchasing power of Treasuries” is the real hazard—mitigated “if they are well-regulated.” He also rejected the notion that deregulation alone threatens the dollar’s reserve status: “No,” he said, pointing again to debt dynamics as the primary vulnerability.

Dalio’s latest remarks fit within a decade-long evolution of his public stance on Bitcoin and crypto rather than a whiplash reversal. Early on, he emphasized gold as the superior “storehold of wealth” and warned that if Bitcoin ever became too successful, governments might restrict it—tempering enthusiasm with regulatory risk.

By 2020–2021 he began calling Bitcoin “one hell of an invention,” acknowledged owning a small amount, and increasingly framed it as a portfolio diversifier that rhymes with digital gold, while still stressing its volatility and policy sensitivities. With his latest remarks, Dalio puts the entire crypto market inside the monetary hierarchy he uses to analyze late-cycle dynamics.

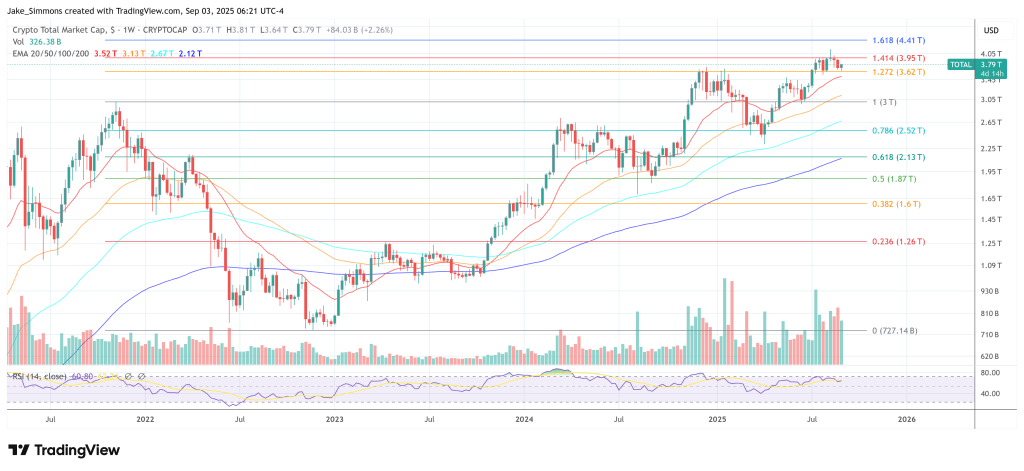

At press time, the total crypto market cap stood at $3.79 trillion.

Featured image created with DALL.E, chart from TradingView.com