Crypto venture capital investments surged by 20% in August, reaching $660 million, up from $550 million in July.

In a potential shift of tides, the crypto venture capital sector witnessed a slight uptick in funding during August despite the ongoing bear market. The latest data suggests that while the number of projects securing funds has decreased, the total amount of funding has risen.

According to a Sept. 7 monthly report by Wu Blockchain, the venture capital investments in the crypto space amounted to $660 million in August, marking a 20% increase from July’s $550 million.

However, this figure is still notably lower, down by 57% compared to last year’s period, which saw a substantial $1.54 billion in venture capital funding.

The report utilized data from the crypto project database RootData, highlighting 73 publicly announced investment projects in August. This is a slight decrease from July’s 78 projects and a significant drop from August 2022’s 132 projects.

Despite the marginal increase in investment figures for August, the overall trend in venture capital funding seems to be downward.

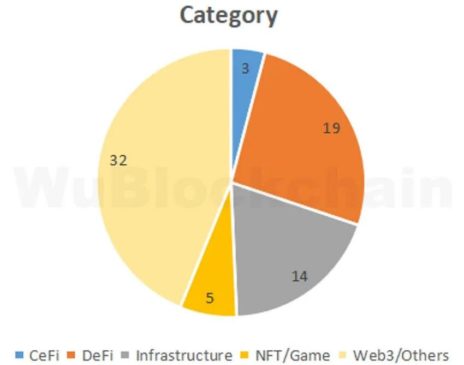

A closer look at the funding distribution reveals a preference for web3 projects, which garnered nearly a third of the total investments. Following closely were DeFi projects, with a 19% share, and infrastructure projects, which secured 14% of the total funding.

It is important to note that different data sources present varying figures. For instance, DeFiLlama reported $283 million in funding rounds for August, a drop from July’s $460 million, and recorded only 41 investment projects, a figure significantly lower than that reported by RootData.

In August, several companies announced substantial funding rounds. Ramp, a payment company, led the way with a $300 million round, catapulting its valuation to $5.8 billion. Additionally, crypto custody firm BitGo raised $100 million, reaching a valuation of $1.75 billion.

Other notable mentions include Pendle Finance and Maple Finance, both of which are DeFi platforms concentrating on the tokenization of real-world assets. This trend is steadily gaining momentum in the crypto narrative.

VC investments continue to flow in

On Sept. 7, decentralized exchange Brine Fi announced a successful funding round, securing $16.5 million at a notable valuation of $100 million in a venture prominently led by Pantera Capital.

This influx of capital is particularly significant given the recent slump in venture capital investments for digital asset firms, which saw a 76% decrease in the second quarter of 2023 compared to last year, as reported by Crunchbase in July.

Despite a brief surge in the spring, trading volumes have dwindled to multi-year lows over the summer, with daily volumes on decentralized exchanges averaging just around $1 billion recently, according to data from DeFiLlama.

The majority of the trading volume remains on centralized platforms like Binance and Coinbase, which report over $10.3 billion in daily trading volumes, as per data from The Block.

As the crypto sector navigates through a period of reduced enthusiasm and investment, these recent developments may hint at a gradual revival, signaling brighter days ahead for the industry.