A study published by financial giant Charles Schwab shows that cryptocurrency is a top method for retirement savings. “Gen Z and millennial workers are more likely to also invest in cryptocurrency, real estate, annuities, and small businesses, unlike older generations.”

Crypto Investments in 401(k) Accounts

Financial giant Charles Schwab published a report titled “401(k) Participant Study – Gen Z/Millennial Focus” Tuesday. The report features the results of an annual online survey of U.S. 401(k) participants conducted by Logica Research for Schwab Retirement Plan Services Inc.

A total of 1,000 401(k) plan participants aged between 21 and 70, who are actively employed by companies with at least 25 employees, completed the survey. The report details:

While the 401(k) remains the top retirement savings vehicle for today’s workers overall, Gen Z and millennial workers are more likely to also invest in cryptocurrency, real estate, annuities, and small businesses, unlike older generations.

In addition, “More than 4 in 10 Gen Z and millennial workers wish they could invest in annuities and cryptocurrency in their 401(k),” the report adds.

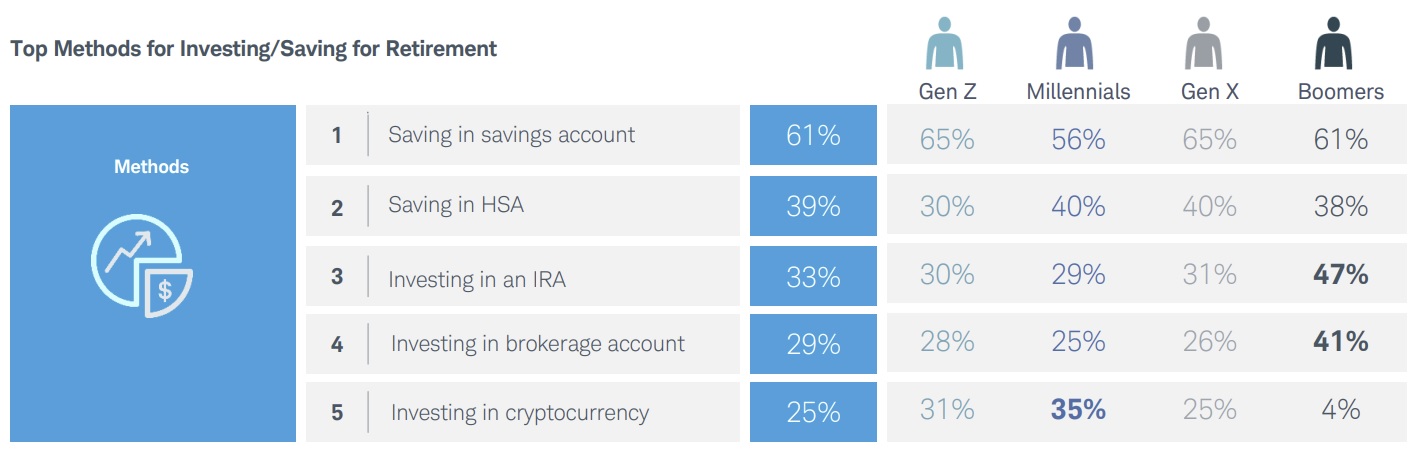

Regarding how workers save for retirement, the report states that “Outside of their 401(k), participants are still more likely to be saving for retirement in a savings account than investing, although a quarter are investing in cryptocurrencies.”

When asked about their current investments, 43% of Gen Z respondents said they invest in crypto, compared to 47% of millennial respondents, 33% of Gen X respondents, and 4% of boomers.

Investing in cryptocurrency is one of the top five methods for retirement savings, the report further shows. It is the second most popular method for retirement savings for Gen Z respondents and the third most popular for millennial respondents.

Regarding ways respondents wish they could invest in their 401(k) accounts, 39% said annuities, which offer guaranteed income after they retire, while 32% said cryptocurrency. Gen Z and millennial respondents picked crypto as their top answer.

The U.S. Labor Department expressed concerns about Americans investing in bitcoin and other cryptocurrencies in their 401(k) accounts earlier this year. Treasury Secretary Janet Yellen also said in June that crypto is “very risky,” emphasizing that they are unsuitable for most retirement savers.

Despite the Labor Department’s warning, Fidelity Investments made bitcoin an option for 401(k) plans. A bill has also been introduced to allow crypto investments in 401(k) plans.

What do you think about this Charles Schwab study of how people save for retirement? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.