The Bitcoin “bull-bear” indicator from the on-chain analytics firm CryptoQuant has recently flagged the cryptocurrency’s price to be “overheated.”

Bitcoin May Be Overheated According To This Indicator

As pointed out by CryptoQuant Head of Research Julio Moreno in a post on X, the BTC price has increased so fast that some on-chain indicators have started to signal a potential phase of overheating.

The first metric of interest here is the Bitcoin Bull-Bear Market Cycle Indicator made by the analytics firm that tracks the various phases of bull and bear markets.

Here is how the indicator has looked like over the past year:

The trend in the bull-bear indicator for the cryptocurrency | Source: @jjcmoreno on X

As displayed in the above graph, Bitcoin has been inside the “bull” territory since the early part of 2023 and over the course of this run, the metric has hit “overheated bull” levels during a few different instances.

From the chart, it’s visible that such values of the indicator have previously coincided with some kind of top in the cryptocurrency’s price. With the latest rally in the asset, it would appear that the market has once again entered into this territory of overheating.

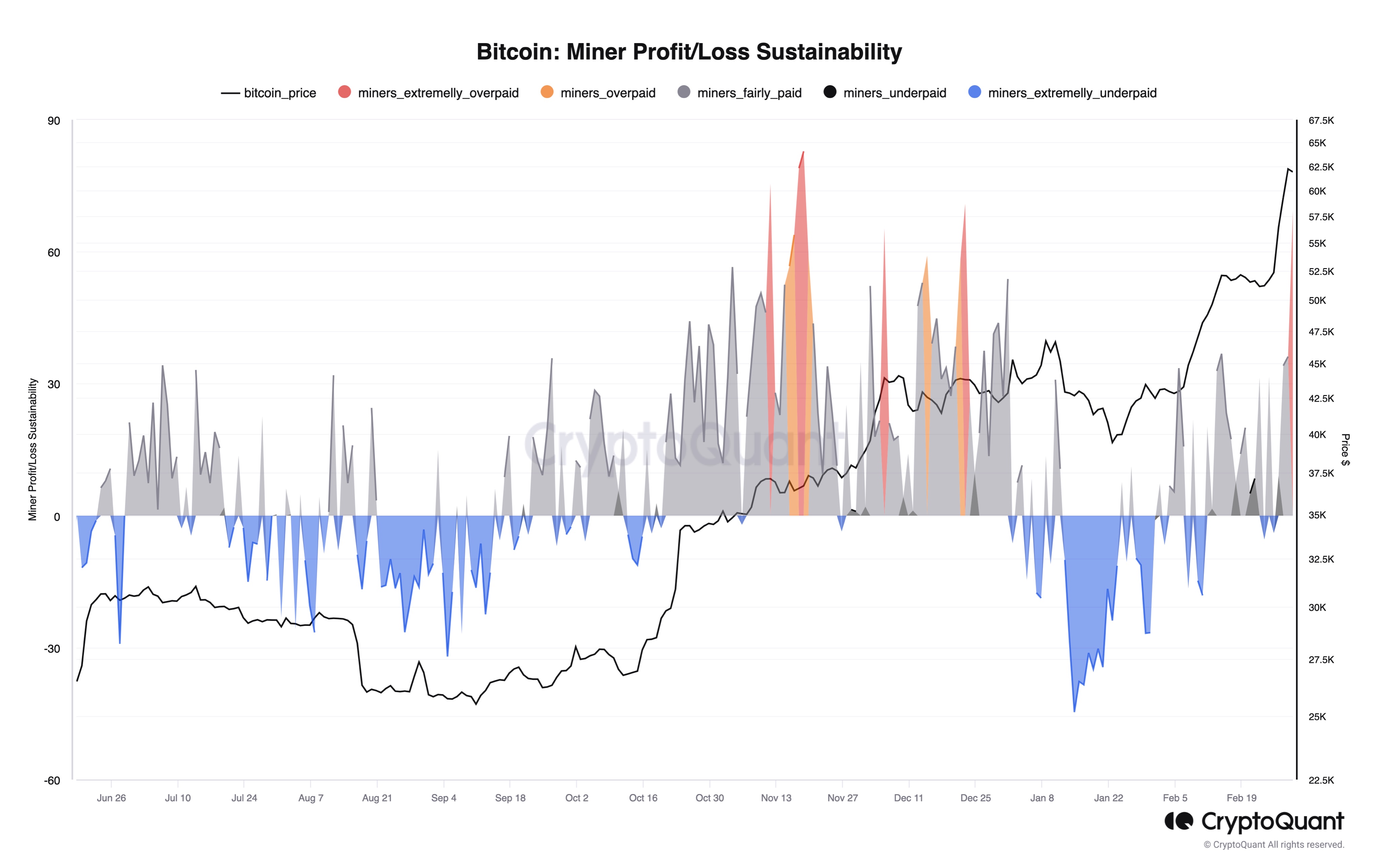

Another metric, the BTC “Miner Profit/Loss Sustainability,” is also suggesting an overheated market, according to Moreno. This indicator basically keeps track of whether the miners are being overpaid or underpaid compared to the fair value baseline.

The value of the metric appears to have spiked recently | Source: @jjcmoreno on X

As displayed in the chart, the Bitcoin Miner Profit/Loss Sustainability has entered into the “extremely overpaid” zone after the price surge, implying that a cool off might perhaps be due.

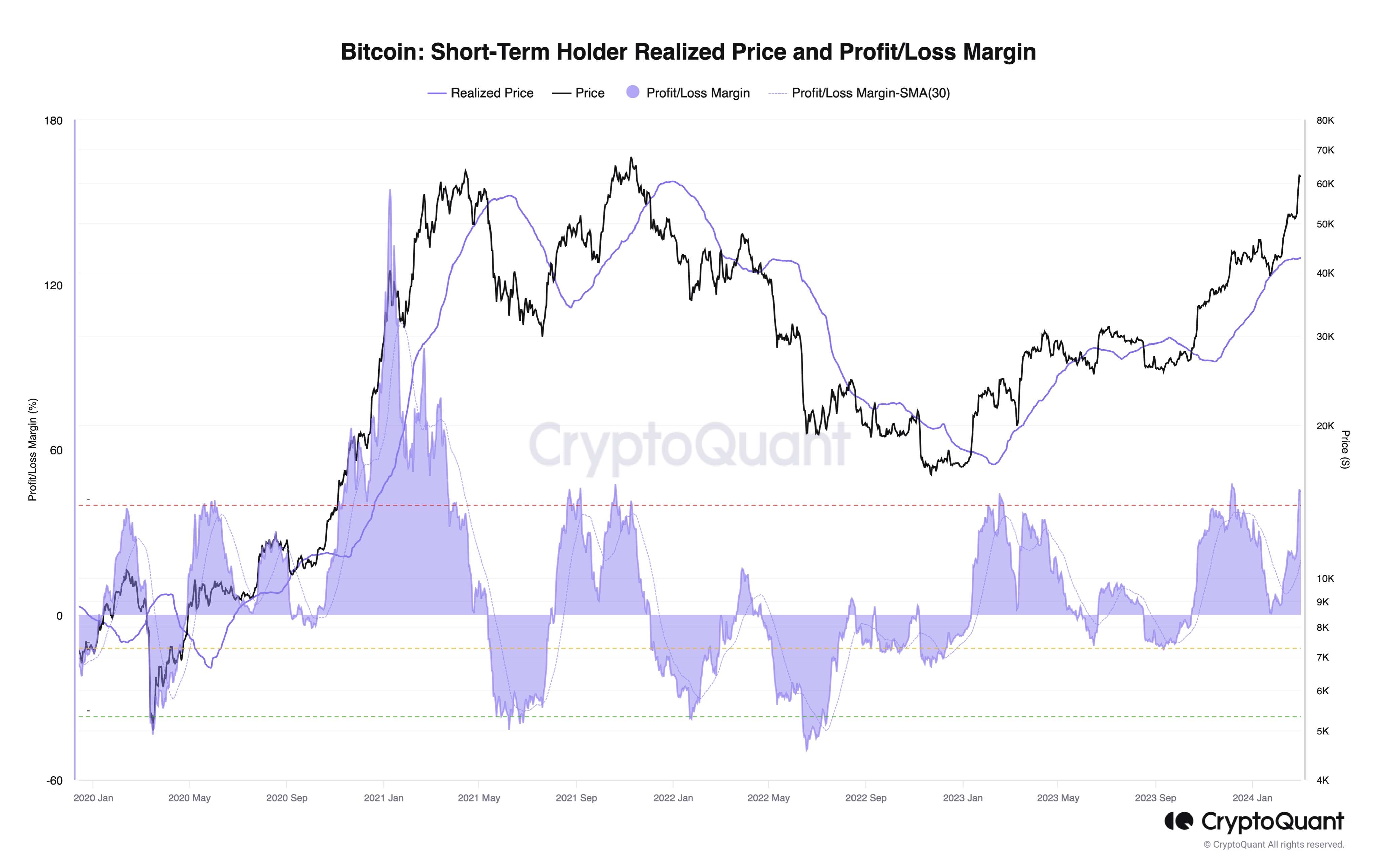

Finally, the Bitcoin short-term holders (STHs) are also sitting on large profits at the moment, which can be another sign that things have started to heat up.

Looks like the value of the metric has been quite high in recent days | Source: @jjcmoreno on X

The STHs refer to the Bitcoin investors who bought their coins within the past 155 days. These holders are considered the weak hands of the sector, who may easily sell at the sight of FUD or FOMO.

As the above chart shows, this cohort’s unrealized profits have swelled up as the Bitcoin price has enjoyed its rally. Recently, they have achieved profit margins upward of 45%.

At any point, holders in profits are more likely to sell their coins. As these profits rise, the probability of the investor buckling into the allure of profit-taking also increases.

As such, a large amount of these fickle-minded Bitcoin investors holding significant profits means that there is a high risk of a potential selloff taking place in the market.

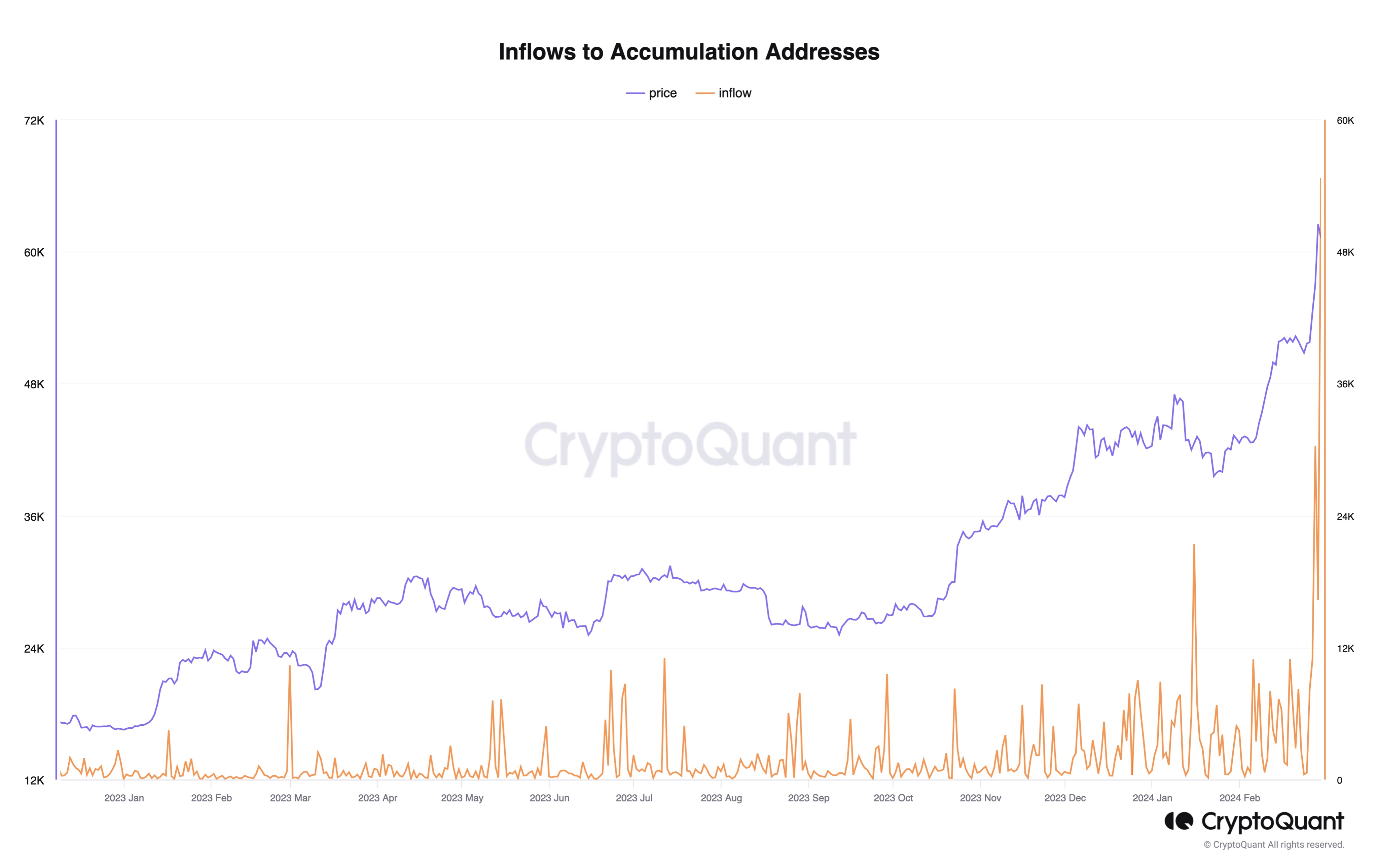

While all these indicators are pointing to the cryptocurrency perhaps being overvalued, there has still been a positive development in an indicator. This metric is the “Inflows to Accumulation Addresses.”

The indicator appears to have spiked | Source: @jjcmoreno on X

Accumulation addresses are defined as those that have a history of only buying Bitcoin and never of selling. At present, these HODLers are observing an all-time high amount of inflows, which can definitely be a bullish sign.

BTC Price

Bitcoin has seen the latest continuation to its run in the past 24 hours as its price has now broken past the $65,100 barrier.

BTC has observed a sharp surge recently | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.