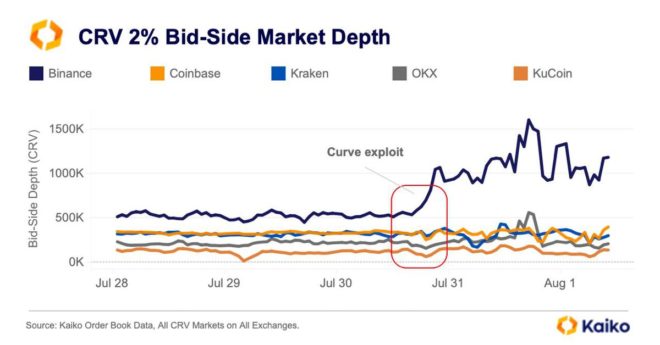

“Market makers tend to pull orders to avoid getting caught in an unfavorable price swing,” Medalie told CoinDesk. “That is why liquidity disappeared on order books during big market events, such as the March banking crisis or FTX collapse,” she continued. “Right after the Curve exploit, we saw the opposite trend, with liquidity being added to the CRV order books, specifically on the bid side.”

Curve Finance’s CRV Gets Plunge Protection on Binance