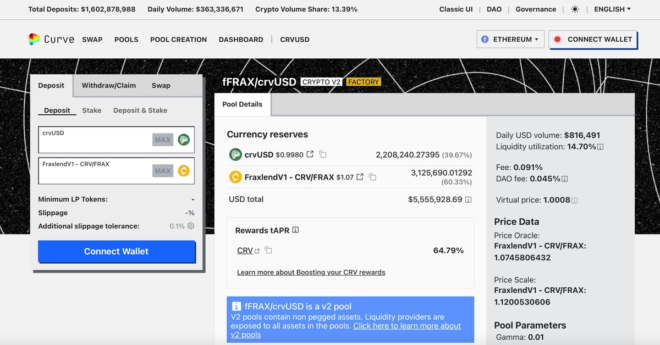

“He [Erogov] borrowed FRAX using CRV as collateral on Fraxlend. However, because people are withdrawing FRAX from the pool, fearing bad debt in the event of CRV liquidation, the APY has significantly increased,” Ignas explained. “He now needs more FRAX deposited to that CRV/FRAX lending pool. That’s why the introduction of a new pool on Curve, equipped with CRV incentives.”

Curve’s New Liquidity Pool Could Prevent Liquidation of CRV Token