Former Binance CEO Changpeng “CZ” Zhao has pushed back against allegations that the cryptocurrency exchange played a role in the largest liquidation event in crypto history, a sell-off whose effects are still rippling through markets more than three months later.

Speaking during a Q&A session on Binance’s social media channels, Zhao denied that Binance was a major contributor to the record wave of forced liquidations on Oct. 10, when roughly $19 billion in positions were wiped out across the crypto market.

Zhao described claims that Binance was responsible for the crash as “far-fetched,” according to Bloomberg.

“There are a larger group who claim the October 10th crash was caused by Binance and wants Binance to compensate everything,” Zhao said, rejecting the accusations outright.

Zhao led Binance from its founding in 2017 until stepping down as CEO in November 2023 after pleading guilty to US federal charges related to violations of anti-money laundering laws. He later served a prison sentence in connection with the case but was pardoned by US President Donald Trump last October.

As a result, Zhao said Friday he was speaking in his capacity as a Binance shareholder and user, not as a representative of the exchange.

Despite no longer running Binance, Zhao remains active in the industry. He currently oversees YZi Labs, an independent investment company that evolved from Binance’s former venture capital arm and manages about $10 billion in assets.

Related: CZ rules out return to Binance, predicts 2026 Bitcoin supercycle

October crash caused a brief USDe depeg on Binance

Binance was at the center of scrutiny during the Oct. 10 market crash, following a sharp depeg of Ethena’s USDe (USDE) stablecoin on the exchange.

During the sell-off, USDe briefly fell from its $1 peg to about $0.65 on Binance, an event later attributed to a platform-specific internal oracle issue.

At the time, Ethena Labs founder Guy Young said the price dislocation was isolated to a single trading venue.

“The severe price discrepancy was isolated to one venue that referenced an oracle index from its own order book rather than the deepest liquidity pool,” Young said. “The venue was also experiencing deposit and withdrawal issues during the event, which prevented market makers from closing the arbitrage loop.”

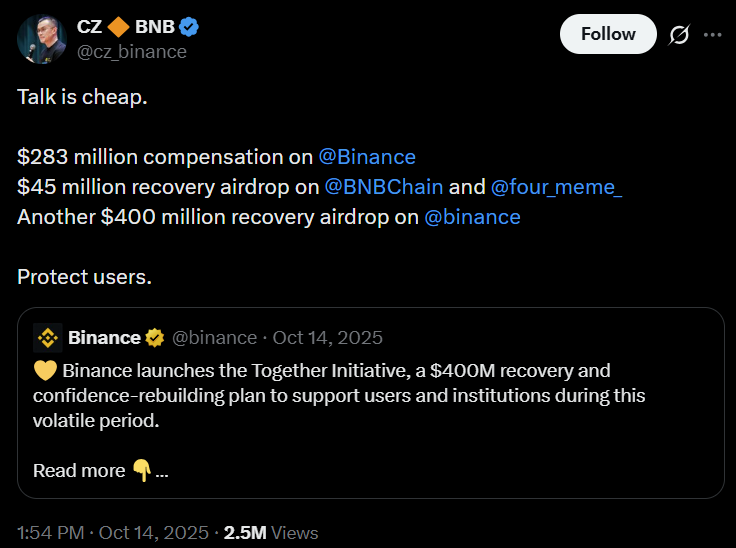

Following the incident, Binance compensated affected users about $283 million.

Since the market-wide sell-off, crypto prices have struggled to recover. Bitcoin (BTC), which traded above $126,000 in early October, briefly fell below $80,000 in November, contributing to a broader crypto market decline that saw more than $1 trillion in total market capitalization erased from early October levels.

Related: Liquidations knock Bitcoin out of world’s top 10 assets