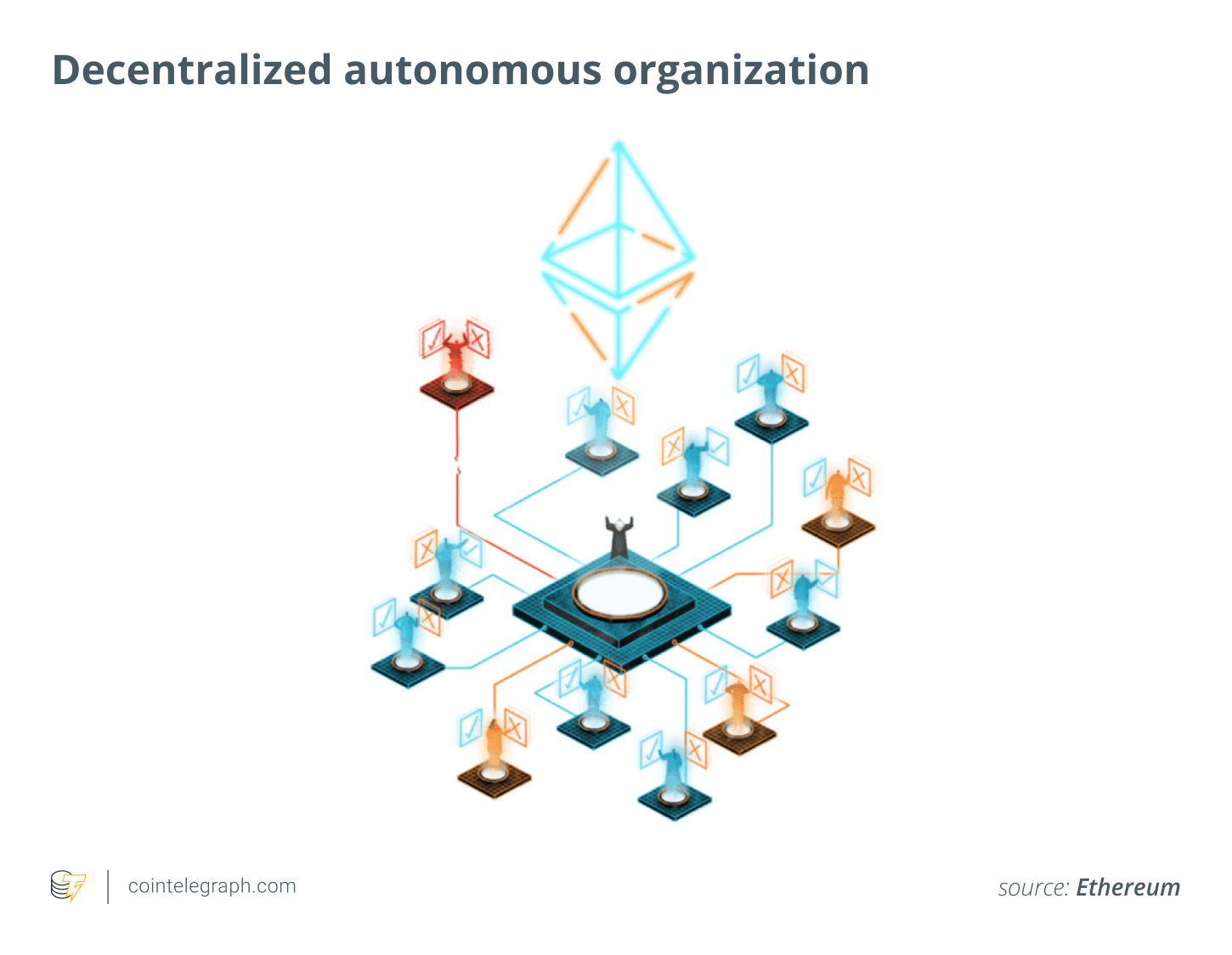

Decentralized autonomous organizations (DAOs) started out as a simple concept envisioned as organizations, created by an idea and fueled by developers, that automate business functions and processes by leveraging smart contracts and all the fundamental tenets of blockchain. The core idea was to flatten the complex business process that various organizations are mired in and facilitate movement of assets to a very future-oriented digital interaction that needed no intermediaries — promising faster, cheaper and more transparent transaction processing.

By replacing many intermediaries, the DAOs themselves acted as digital intermediaries that provide transparency and scale, giving them the stature of an organization without the traditional organizational constructs of entities, groups, management, charters and other forms of collective action. While the traditional centralized organizational structure is being challenged, the key organizational elements that remain are fueling a new economic revolution that is giving birth to a new creator economy and bringing artists, lawyers, developers and creators together from all around the globe to create ideas and monetize them at global scale in permissionless crypto economic systems built upon blockchain and Web3 technologies — and essentially defining the future of work.

Reduced dependence on trusted parties, tokenization of assets, and new stores of value enabled by blockchain technology can themselves enable new types of organizational structures and reduce the power of intermediaries. Ronald Coase’s famous essay on the raison d’être for the firm, “The Nature of the Firm,” explored why firms exist and what elements comprise them.

From a transaction cost perspective, the firm creates an economic structure where the transaction cost within its boundaries is reduced by greater control of standardized contracts with its employees and ownership of resources. As the cost of internalizing resources increases, contractual arrangements with other firms in specialized areas result. Transaction costs associated with contracting can be drastically reduced by the decentralized verification and smart contracts enabled by blockchain.

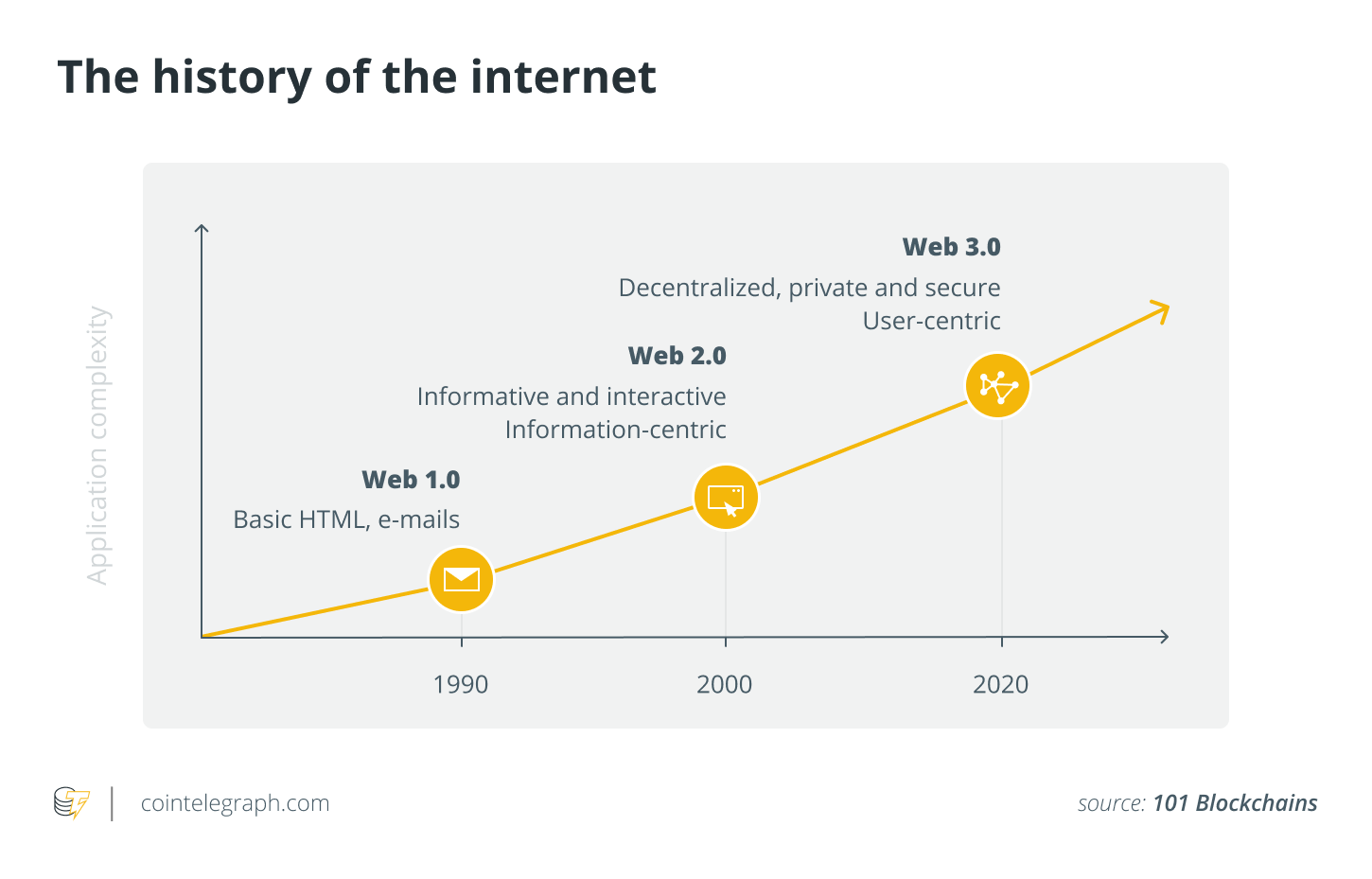

While this was the initial thesis behind DAOs, with speed, efficiency and costs bring primary objectives, DAOs now represent a significant piece of the mindshare governing and the primary driving force behind value extraction from the base layer, or layer one blockchain platforms. These layer one blockchain platforms represent the emerging Web3 technologies that aim to provide greater control to participants by fundamentally decentralizing computing, storing, and interconnecting. Many DAOs will emerge that represent the collaboration of a global talent pool, digital natives, and the ingenuity of a community that shares a common belief system — and bring the term “organization” to life.

Related: DAOs will be the future of online communities in five years

DAOs: Pillars of the creator economy

A broad definition of a DAO would be an organization that records its membership, rules and responsibilities on an immutable ledger enabled by blockchain technology. Its charter and evolution are public and unchangeable. Generally, joining requires resources and community membership of sorts, in the form of tokens, to either participate or vote as a participant. Tokens are denominated in monetary assets (fungible or nonfungible tokens), whether crypto or fiat. Acquisition of tokens, in most cases, requires either time and talent participation, or a buy-in using fiat or crypto.

DAOs provide a unique structure that naturally supports a creator economy, in which an economic model supports a structure through which you rent your talent and time, obtain flexibility and earnings, and leverage it to facilitate fractional ownership in the system supported and governed by the community. Blockchain and, by association, DAOs embody a natural governance structure for borderless online collaboration on crypto-native projects by digital natives which, incidentally, can be leveraged by traditional organizations that embrace the principles, similar to how brick-and-mortar businesses found an on-ramp to digital equivalents in the Web 2.0 era.

While the issues around regulatory clarity and a framework for investor protection persist, these digital entities embody a digital reality like that of a nation — the state attempts to attract talent, capital, and innovation. Although the governance and rules of engagement may not be perfect, they are an ongoing experiment with innovation aiming to change the way we live and empower every willing community’s participation. While the arguments for autonomy and collectivization are employed to defend the lack of regulation, the ability to purchase voting power and the lack of protection provide a strong counter to this argument. If DAOs become digital analogs to existing corporate and organizational structures, will they continue to serve as an avenue to, or promoter for, a creator economy and support Web3 principles?

Related: Bull or bear market, creators are diving headfirst into crypto

The future of work

Web3 as a technology paradigm aims to provide rails for creation, tokenization and movement of value and assets. The Web3 aim to solve content ownership and provide portability of digital assets by tokenizing them paves the way to trade this tokenized value for other fungible tokenized assets, thereby enabling creators to monetize their work effort. These work efforts may include (but are not limited to) mining and the creation of content, such as art, music, and other forms of nonfungible tokens, that represent a stake in an ecosystem, much like game tokens.

In a future where dynamic, borderless organizations without hierarchy can undertake much of the value creation, a supply of services is more conceivable with interconnected value networks, exchanges and bridges providing connectivity between these ecosystems. These decentralized exchanges or asset bridges not only provide an avenue to exchange various asset classes but also facilitate the global movement of assets, thereby creating truly global economies that attract digital natives and a talent pool.

The innovation driven by decentralized and transparent token economic models aims to deliver great end-user and employee experience, while ensuring that the organization reaps the cost savings and competitive benefits of superior participant experiences. DAOs involved with DeFi, NFTs, and various other Metaverse projects deliver just that, where a handful of developers or founders conceive initiatives and pursue decentralized development via platform projects or crowdsource development with token incentives and participants who are not only consumers, but also earn from their meaningful participation.

Related: DeFi and Web 3.0: Unleashing creative juices with decentralized finance

DAOs represent the emerging trend that is driving a deep, long-lasting transformation of the workplace that combines cultural, digital, and philosophical belief systems. This is attracting investment from other token projects and talent from digital natives from across the globe, thereby creating an experience for all participants that results in a more resilient and empowered workforce and more community participation.

This article was co-authored by Ananth Natrajan and Nitin Gaur.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Ananth Natrajan has over 18 years of experience worldwide in several roles, including research and development, business acquisition, systems engineering, product development, construction management and project management. His startup is building cybereum, a blockchain based platform for collaboratively managing complex projects with multiple stakeholders. He holds BEng & MS degrees in Mechanical Engineering, an MBA from IESE, and an MSc in major programme management from the University of Oxford. He is a professional engineer (PE) and project management professional (PMP). He has led multi-disciplinary teams in several complex projects and technology/product development efforts. Ananth has several patents in offshore wind turbines and blockchain technology.

Nitin Gaur is the founder and director of IBM Digital Asset Labs, where he devises industry standards and use cases, and works toward making blockchain for the enterprise a reality. He previously served as chief technology officer of IBM World Wire and of IBM Mobile Payments and Enterprise Mobile Solutions, and he founded IBM Blockchain Labs, where he led the effort in establishing the blockchain practice for the enterprise. Gaur is also an IBM-distinguished engineer and an IBM master inventor with a rich patent portfolio. Additionally, he serves as research and portfolio manager for Portal Asset Management, a multi-manager fund specializing in digital assets and DeFi investment strategies.