Trend Research’s emergency ETH dump

One of the largest Ethereum whales has entered survival mode and sold chunks of its ETH holdings to repay DeFi loans.

Trend Research emerged as one of the largest institutional ETH buyers in late 2025. The company surfaced in November and quickly drew the attention of onchain trackers after accumulating more than 600,000 ETH by year’s end.

Trend Research has been linked to Yi Lihua, also known as Jack Yi, the founder of Hong Kong-based crypto venture firm Liquid Capital. According to Arkham, Trend Research’s ETH holdings peaked at roughly 651,000 ETH (wrapped) on Jan. 21. But after a series of deleveraging moves, it held about 578,058 ETH at 11 a.m. UTC on Monday.

Yi built his position using leverage. His accumulation strategy involved purchasing ETH on centralized exchanges, depositing it as collateral on Aave to borrow stablecoins, and then using those funds to acquire more ETH.

While the firm continued accumulating ETH through January despite weakening crypto momentum, the strategy appears to have reached its limits as Ether dipped below $2,200 on Monday.

“As the person currently under the greatest pressure across the entire network, I first have to admit this: after fully exiting at the top, turning bullish on ETH too early was indeed a mistake,” Yi said, according to a machine translation of his tweet.

“With BTC around $100,000 while ETH stayed around $3,000, we believed ETH was undervalued. The current pullback is a retracement of the previous round’s profits.”

Trend Research is not a publicly listed company, meaning its Ether holdings do not appear in standard digital asset treasury rankings. By contrast, Bitmine, led by Tom Lee and listed on the New York Stock Exchange, is the largest publicly disclosed ETH holder.

Bitmine has committed more than $15.6 billion to its Ether strategy and, on Monday, was facing an unrealized loss of nearly $6.6 billion.

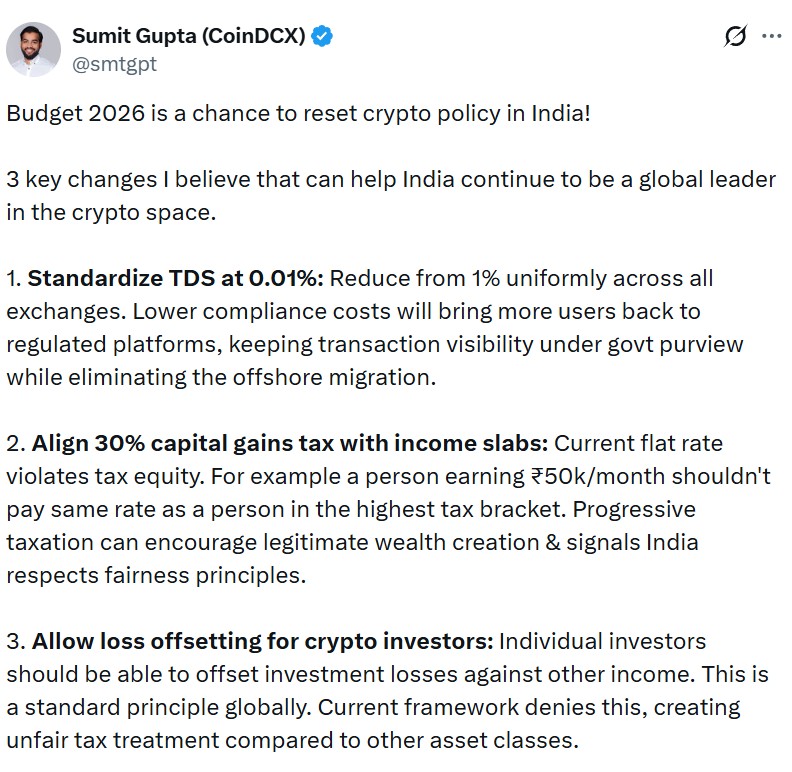

India’s unmovable crypto tax

Indian crypto investors were once again denied calls for the government to reduce some of the harshest levies in the world.

In the 2026 Union Budget, the government’s annual financial plan, no crypto tax reforms were discussed.

India imposes a flat 30% tax on crypto gains and restricts the offsetting of losses. One of the most controversial measures is the 1% tax deducted at source (TDS), which applies to crypto transactions even when profits have not been realized.

The Indian crypto industry has lobbied for revisions to the tax regime for years, arguing that the rules have damaged the sector and pushed traders, businesses and talent overseas. They have called for the tax deducted at source to be reduced to at most 0.1%.

The finance minister did not completely ignore crypto in her speech. She proposed the introduction of penalty provisions for taxpayers who provide inaccurate information.

Under the proposal, taxpayers could be fined 200 rupees per day (about $2.20) for failing to file required statements. A separate penalty of 50,000 rupees would apply to those who submit incorrect information or fail to correct errors after they are identified.

Read also

South Korea deploys AI in ongoing crypto manipulation crackdown

South Korea’s Financial Supervisory Service announced that it is ramping up the use of artificial intelligence to combat crypto market manipulation.

The regulator said it built and upgraded an in-house analytics platform, Virtual Assets Intelligence System for Trading Analysis (VISTA), and developed an algorithm that automatically detects suspected price manipulation periods down to the second.

VISTA ingests large trading data and calculates indicators that flag dodgy behaviors, like sudden price spikes or coordinated buying and selling patterns consistent with market manipulation.

The system’s latest upgrade adds AI-driven automation. Using a technique called a sliding window grid search, VISTA breaks a trader’s activity into hundreds of thousands of overlapping time segments. The platform can identify suspicious periods that human investigators might miss, allowing regulators to detect manipulation faster.

South Korean regulators have been ramping up its crackdown on crypto market manipulators, which is treated similarly to traditional markets under the nation’s crypto investor protection rules.

Read also

HKMA narrows stablecoin licensing timeline from Q1 to March

Hong Kong regulators are nearing the first licensing decisions under the city’s new stablecoin regime, with approvals potentially coming by March.

Speaking at the Legislative Council, Eddie Yue, chief executive of the Hong Kong Monetary Authority, said the regulator has received 36 stablecoin license applications. The HKMA is close to completing its initial assessment, though several applicants have been asked to submit more information.

Yue said the timeline for issuing licenses now depends on how quickly applicants respond to requests for supplementary disclosures. If the information is provided promptly, the HKMA expects to make licensing decisions by March. Otherwise, the process could extend beyond that timeframe.

The regulator plans to take a cautious approach at the outset. Yue said the HKMA’s initial objective is to issue only a small number of stablecoin licenses.

Yue’s timeline, shared with lawmakers, aligns with Financial Secretary Paul Chan Mo-po’s expectation, shared recently at the World Economic Forum in Davos.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Yohan Yun

Yohan (Hyoseop) Yun is a Cointelegraph staff writer and multimedia journalist who has been covering blockchain-related topics since 2017. His background includes roles as an assignment editor and producer at Forkast, as well as reporting positions focused on technology and policy for Forbes and Bloomberg BNA. He holds a degree in Journalism and owns Bitcoin, Ethereum, and Solana in amounts exceeding Cointelegraph’s disclosure threshold of $1,000.

Read also

‘Make or break’ for Bitcoin, Binance under pressure, Strike attacks Coinbase: Hodler’s Digest, June 27–July 3

The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — one week on Cointelegraph in one link!

ETH ‘god candle,’ $6K next? Coinbase tightens security: Hodler’s Digest, Aug. 17 – 23

All eyes are on Ether as it hits new highs for the first time since 2021, while Coinbase ramps up workplace security: Hodler’s Digest