Bitcoin (BTC) price had a mixed reaction on Jan. 25 after the United States reported a 2.9% gross domestic product growth in the fourth quarter, slightly better than expected. Still, the sum of all goods and services commercialized between October and December grew less than 3.2% from the previous quarter.

Albeit somewhat optimistic, another data set limiting investors’ confidence was news that the U.S. Federal Reserve (FED) would revert its contractive measures anytime soon as U.S. durable goods orders jumped 5.6% in December. The indicator came in much higher than anticipated, so it could potentially mean that interest rates could be increased for a little longer than expected.

Oil prices are also still a focus for investors, with crude WTI approaching its highest level since mid-September, currently trading at $81.50. The underlying reason is the escalation of the Russia-Ukraine conflict after the U.S. and Germany decided on Dec. 25 to send battle tanks to Ukraine.

The United States dollar index (DXY), a measure of the dollar’s strength against a basket of top foreign currencies, sustained 102, near its lowest levels in eight months. This signals low confidence in the U.S. Federal Reserve’s ability to curb inflation without causing a significant recession.

Regulatory uncertainty could also have been vital in limiting Bitcoin’s upside. De Nederlandsche Bank, the Dutch central Bank, fined cryptocurrency exchange Coinbase $3.6 million due to non-compliance with local regulations for financial service providers — the news was released on Jan. 26.

Let’s look at derivatives metrics to understand better how professional traders are positioned in the current market conditions.

Bitcoin margin longs slightly increase

Margin markets provide insight into how professional traders are positioned because it allows investors to borrow cryptocurrency to leverage their positions.

For example, one can increase exposure by borrowing stablecoins to buy Bitcoin. On the other hand, Bitcoin borrowers can only short the cryptocurrency as they bet on its price declining. Unlike futures contracts, the balance between margin longs and shorts isn’t always matched.

The above chart shows that OKX traders’ margin lending ratio slightly increased from Jan. 20 to Jan. 20, signaling that professional traders added leverage long after Bitcoin broke above the $21,500 resistance.

One might argue that the demand for borrowing stablecoins for bullish positioning is far less than levels seen earlier in January. However, a stablecoin/BTC margin lending ratio above 30 is unusual and typically excessively optimistic.

More importantly, the current metric at 17 favors stablecoin borrowing by a wide margin and it indicates that shorts are not confident about building bearish leveraged positions.

Options traders flirt with an optimistic bias

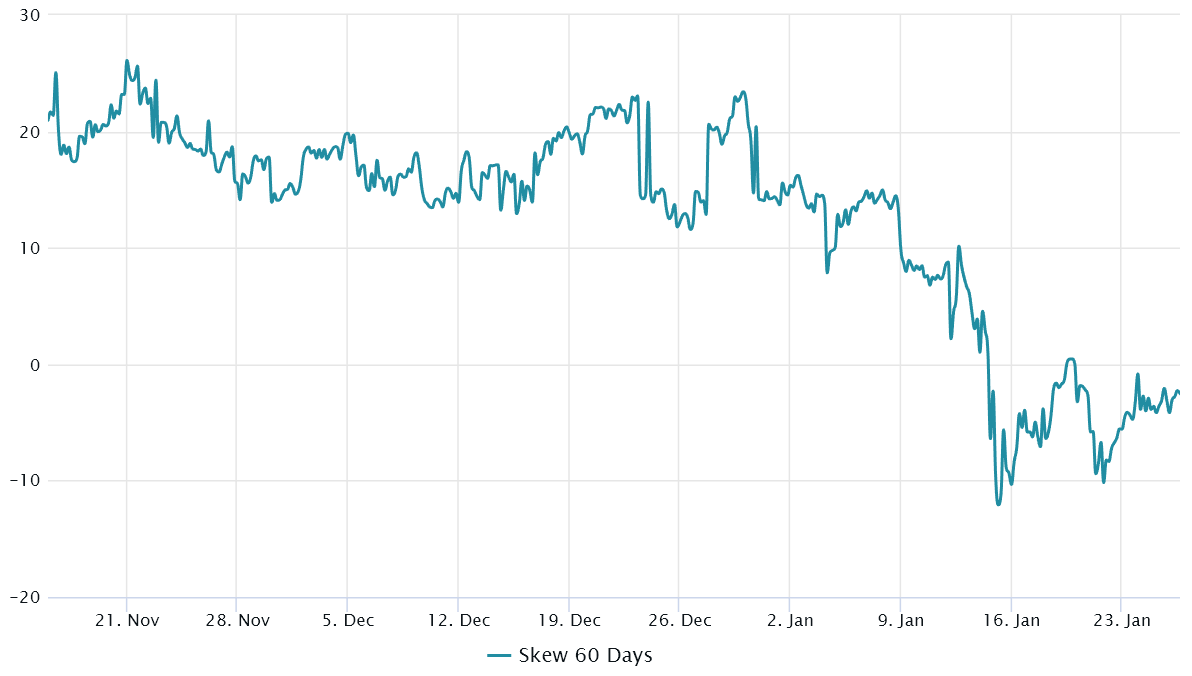

Traders should also analyze options markets to understand whether the recent rally has caused investors to become more risk-averse. The 25% delta skew is a telling sign whenever arbitrage desks and market makers are overcharging for upside or downside protection.

The indicator compares similar call (buy) and put (sell) options and will turn positive when fear is prevalent because the protective put options premium is higher than risk call options.

In short, the skew metric will move above 10% if traders fear a Bitcoin price crash. On the other hand, generalized excitement reflects a negative 10% skew.

The 25% delta skew flirted with the optimistic bias on Jan. 21 as the indicator reached the threshold at minus 10. The movement coincides with the 11.5% BTC price increase and its subsequent rejection at $23,375. From then on, options traders increased their risk aversion for unexpected price dumps.

Related: Here’s why Bitcoin price could correct after the US government resolves the debt limit impasse

Currently, near zero, the delta skew signals investors are pricing similar risks for the downside and the upside. So, from one side, the lack of demand from margin traders willing to short Bitcoin seems promising, but at the same time, options traders were not confident enough to become optimistic.

The longer Bitcoin remains above $22,500, the riskier it becomes for those betting on BTC price decline (shorts). Still, traditional markets continue to play an essential role in setting the trend, so the odds of another price pump ahead of the FED’s decision on Feb. 1 are slim.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.