“Fundamentally, it’s due to U.S. Treasury yields being up and DeFi yields, which are higher risk, giving lower rewards,” Doo, co-founder of StableLab and Asia Lead at MakerDAO, told CoinDesk. “When yields were increased to 8%, we saw DSR [Dai Savings Rate] deposits increase by four times.”

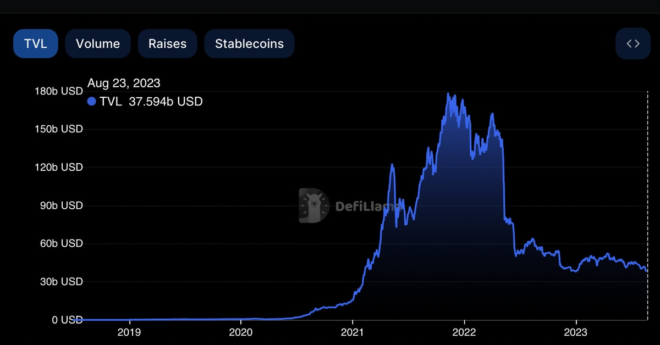

DeFi Shrinks to Multiyear Low as the Crypto-Fueled Future of Finance Falters