Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

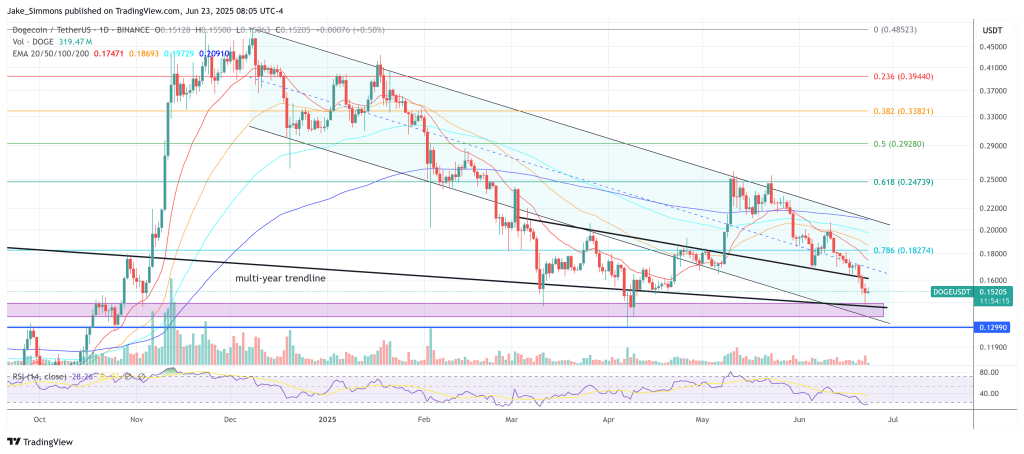

The price of Dogecoin continues to bleed, and crypto analyst Kevin (@Kev_Capital_TA) warns that the worst may still lie ahead. Citing an earlier bearish pattern, Kevin emphasized over the weekend that Dogecoin’s Head and Shoulders formation—identified nearly two weeks ago—is rapidly approaching its technical “measured move” target. But he also made it clear that the full downside potential has not yet played out.

Dogecoin Collapse Far From Over?

“I didn’t say we are there now,” Kevin clarified in a follow-up post, “the orange circle represents a zone of where the measured move could go, with a precise measured move target of the .786 fib at .119.”

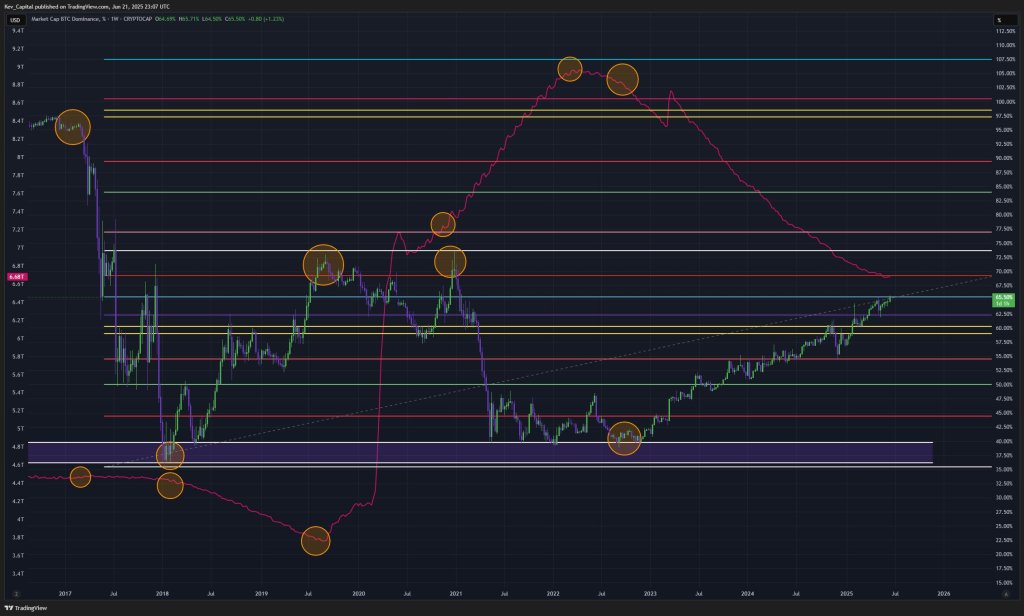

This $0.119 level aligns with a broader confluence of technical supports that are quickly becoming critical for DOGE’s structure. “The Head n Shoulders I pointed out on Dogecoin almost a couple of weeks ago is almost at its measured move target range. Certain daily indicators are also starting to enter inciting levels. Watching closely along with BTC and USDT Dominance for further confirmations,” he wrote.

Kevin also highlighted the importance of the weekly 200 Simple Moving Average (SMA) and Exponential Moving Average (EMA), along with the macro .382 Fibonacci retracement and a long-term descending trendline.

Related Reading

Together, these levels form what he described as the “must-hold” zone, specifically between $0.1434 and $0.1265. A sustained breakdown below that region would likely confirm a macro bearish shift for the meme asset.

What To Monitor Now

Zooming out, Kevin sees Dogecoin’s fate as inseparably tied to Bitcoin and the wider altcoin market, which he describes as being in its weakest state in years. “So far 2025 has been more bearish for altcoins than 2024 and 2023,” he noted. “Worst year for Alts since the bear market in 2022.” The overwhelming strength of Bitcoin’s dominance has been a key factor in that trend.

That dominance, Kevin argues, is not a temporary spike. “Fresh highs for BTC Dominance on the back of restrictive monetary policy and an uncertain geopolitical environment,” he wrote, referring to global macro conditions including persistent quantitative tightening (QT). He has long warned that without a pivot in central bank policy, any talk of a true “altseason” is premature.

Related Reading

“Been saying since late 2023, early 2024—when AI coins were running crazy and people were saying it was #Altseason—that until QT ends and the terminal rate comes down, you will not see real sustainable altcoin outperformance. That continues to hold true.”

His caution extends well beyond Dogecoin. In previous posts, Kevin identified key danger zones for Bitcoin and Ethereum, which he argues must be reclaimed to prevent broader market deterioration. “As long as BTC cannot break the $106.8K level and show real follow-through on 3D-1W time frames, then the market is in real danger,” he wrote. “Same for ETH not being able to break the $2700-2800 level.”

For Dogecoin traders, the message is clear. The meme coin’s fate rests not just on its own technical health, but on a wider macro and intermarket structure that remains fragile. As long as Bitcoin struggles to hold above key breakout levels and US monetary conditions remain tight, the probability of a deeper Dogecoin correction remains high.

Whether DOGE can stabilize above the $0.1265 level will be closely watched by traders in the days and weeks ahead. A loss of that zone, especially in conjunction with renewed Bitcoin weakness, could mark the beginning of a deeper and more painful phase for the once-beloved meme coin.

At press time, DOGE traded at $0.152.

Featured image created with DALL.E, chart from TradingView.com