Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

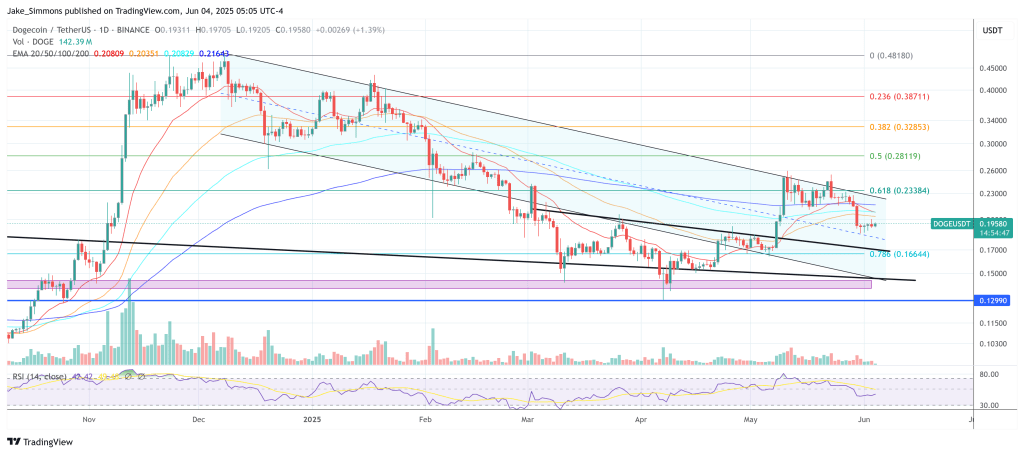

Dogecoin is approaching a decisive inflection point, according to crypto-market commentator VisionPulsed. Throughout his latest analysis he argued that the coming fortnight must deliver an upside resolution—otherwise the meme-coin risks locking in a sequence of red monthly closes that would echo bear-market conditions.

Dogecoin On The Brink Of 6-Month Meltdown

The analyst anchored his outlook to several recurring signals on Dogecoin’s multi-time-frame charts. “We’re going to get a large move in June. It’s going to happen. The question is, is it up or down?” he began, pointing to the Bollinger Band Width Percentile (BBWP) squeezing toward levels that historically precede violent price expansion. In his view, the compression cannot last beyond the next two weekly candles: “BBWP is screaming that we’re about to get something … probably this week; if not this week, then next week.”

Related Reading

VisionPulsed balanced that volatility warning against a newly triggered hash-ribbon buy signal—a metric generated when network hashrate recovers after miner capitulation. “We’ve been making the case that in this bull run, when we have gotten the weekly buy signals, the market actually went down and then it went up,” he explained. The fractal, observed twice since 2024, invited cautious optimism that the latest cross could again invert short-term weakness into a rally: “If history is going to repeat itself, we should go down, which we did … and I would make the case that we really should hopefully get a move up in June.”

Yet momentum oscillators threaten that scenario. On his two-day chart the stock-RSI has curled lower for the first time since last year. “This may be the first time we print the overbought RSI and don’t go up,” he conceded, warning that a failure to rebound quickly would undermine the hash-ribbon signal and oblige traders “to get tucked in and go to sleep because it’s just always bearish.”

Related Reading

Timing is equally unforgiving. VisionPulsed framed Dogecoin’s rallies inside a 70-to-80-day cycle measured from major swing lows; the current window expires in mid-June. “Technically 70 days would be the second week of June, which we’re in that box right now,” he said. “If we don’t actually go up in June, then it is worrisome,” because history suggests that a bearish June would bleed into July and August, while September is “always bearish,” producing what he dryly labels a “one-month bull run.”

He added that macro cross-currents raise the stakes. “The S&P 500 is starting to get close to the all-time high,” he noted, suggesting that a decisive move in equities could tip crypto sentiment. At the same time Dogecoin continues to carve incrementally higher lows, a constructive but fragile pattern that now collides with the expiring cycle window: “If we’re actually bullish, we kind of got to go.”

For traders the message is binary. A breakout to the upside in the next ten trading days would validate the hash-ribbon cross, keep the rising-lows structure intact, and reset sentiment after what the analyst counts as “six out of seven red months” in the making. Failure, on the other hand, risks cementing a “bearish spiral” that could dominate the rest of the summer and revive memories of genuine bear-market grind. As VisionPulsed put it while signing off: “We’re definitely at an inflection point. The potential energy is building up.”

At press time, DOGE traded at $0.1958.

Featured image created with DALL.E, chart from TradingView.com