Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

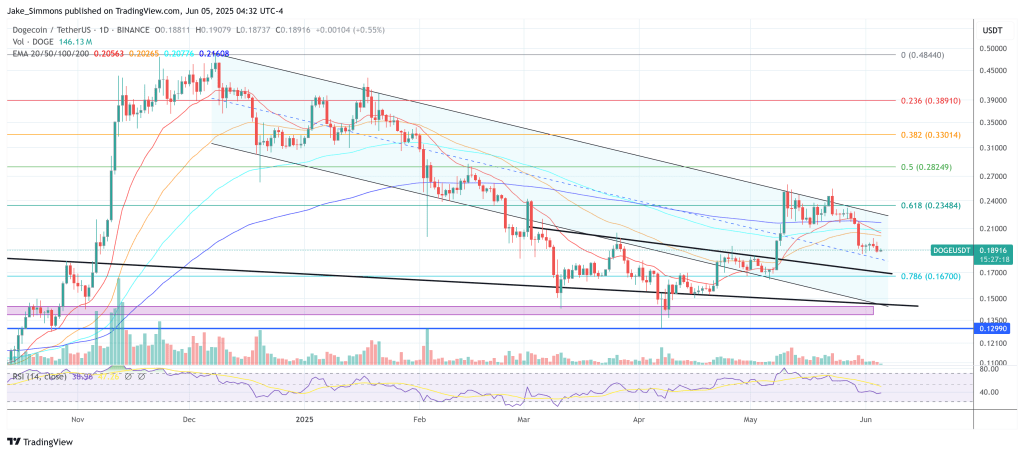

Dogecoin’s six-month slide may be about to reach its moment of truth, according to independent market commentator VisionPulsed, who told followers on June 4 that the memecoin must vault the long-standing ceiling at roughly $0.40 “either this week or next” if the broader bullish structure is to survive the summer.

In a video analysis, the analyst pointed to a second consecutive “blue bar” flashing on Ethereum’s momentum oscillator, a signal he treats as a reliable harbinger of imminent, high-magnitude moves across the digital-asset complex. “The last time we had two blue bars on Ethereum was way back when we were still young and optimistic,” he said, invoking memories of August 2023. “We printed five that time and the market moved sixteen percent. We’re at two now; by Sunday we’ll probably have four, which tells me the move should come next week.”

Dogecoin Needs June Rally To Avert Summer Slump

Although the blue-bar framework is native to Ethereum, VisionPulsed argued that its read-through for Bitcoin and, by correlation, Dogecoin is more important than ever. He noted that Bitcoin’s own hash-ribbon metric—formed when the network’s 30-day and 60-day hash-rate moving averages compress—has followed a strictly “sell for two weeks, then rally” pattern through the current cycle. “We’ve already been selling off for two weeks,” he said. “Historically in this bull market, that’s when Bitcoin resets and moves higher. If that plays out again, Dogecoin should finally get the lift it’s been denied since February.”

Related Reading

The crux of his thesis sits on a 70-day timing model derived from Dogecoin’s prior impulse lows. Measuring from the most recent trough, the 70-day mark falls on 14 June. “Every major upswing in Dogecoin during this cycle has come 60 to 80 days after a bottom,” he explained, scrolling through historical candles on screen. “We’re right on that window—if we’re going to break higher, it almost has to be now.”

VisionPulsed acknowledged his own track record of slipping deadlines—“one for five hundred,” he joked—but insisted the structure remains statistically sound. “If we don’t rally next week, I’m never putting dates on anything again,” he told viewers, before adding a caveat that has become the headline takeaway. “Dogecoin has to clear $0.40. If we can’t do that, the bear case strengthens dramatically: June down, July probably down, September seasonally weak, and suddenly you’re talking eight red months out of nine.”

Pressed by commenters about the depth of a potential downside scenario, the analyst pointed to Ethereum for context. A bullish resolution, he said, could lift ETH to roughly $3,200 before a summer consolidation and possibly $4,200 by early autumn, a path that in his view would drag Dogecoin well north of the $0.40 trigger.

Failure, however, “sets up a very large move down, maybe sub-$2,000 on ETH,” a slide that would likely leave Dogecoin retesting multi-month lows. “Whichever way we go,” he concluded, “is going to determine the rest of the summer.”

Related Reading

The urgency is aggravated by Dogecoin’s mounting sequence of monthly losses: five red candles since January, with only a brief reprieve in April. “Six red months out of seven is staring us in the face,” VisionPulsed said. “June doesn’t have to be a vertical move, but it does have to be green—or at least show a decisive breakout—because otherwise, where is the bull run?”

Market structure rather than sentiment, he stressed, underpins the call. Bitcoin already sits near cycle highs while Dogecoin still trades markedly below its own year-to-date peak, a divergence he interprets as latent leverage. “If Bitcoin punches through its local top, it typically drags Doge,” he said, referencing earlier intervals in 2024 when BTC strength eventually translated into delayed but exaggerated moves in the memecoin.

Whether that historical choreography can repeat depends, in his framework, on the next few daily closes. “We’re definitely getting more energy built up,” he said, pointing to narrowing Bollinger Bands and declining on-chain activity. “I don’t think the large move is here yet, but by late this week—or early next week at the latest—you should get your answer.”

For traders who still believe the four-year cycle remains intact, the analyst’s $0.40 line in the sand arrives almost exactly one calendar year before the next projected Bitcoin top in October 2026. “If Doge can’t start moving now, the entire timing model gets pushed off course,” he warned. “I genuinely think June is a make-or-break month.”

At press time, DOGE traded at $0.189.

Featured image created with DALL.E, chart from TradingView.com