The collateral feature allowed users to hold assets such as bitcoin, ether, stablecoins or even lower-market capitalization altcoins, and trade derivatives – effectively allowing traders to hold a diverse portfolio while being able to trade perpetual swap contracts that can be used to hedge or increase exposure. And while this feature was lauded by users, it was ultimately unsustainable. If FTX comes back without such features, the bugs and sluggish software could matter more.

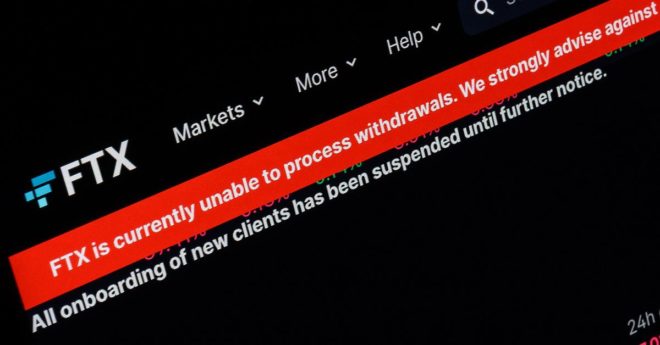

Dreams of Rebooting FTX Face Cold Reality That Its Technology Wasn’t Well-Regarded