Millions of dollars have been spent on rare mementos from Bitcoin’s past — with some auctions for NFTs breaking records.

Bitcoin’s now a teenager — and that means there’s a growing appetite for memorabilia from the cryptocurrency’s early days.

It’s like when an unsealed, first-generation iPod hits the market. Bidders go absolutely berserk and end up paying $29,000 for sentimental value.

Here, we’re going to look at five of the biggest (and craziest) crypto-related auctions of all time.

1. The ‘Buy Bitcoin’ sign

Being a digital asset, there aren’t all that many tangible mementos associated with Bitcoin. An honorable exception is a single piece of paper.

Back in 2017, then Federal Reserve chair Janet Yellen was giving evidence to Congress on the state of the economy. In remarks that could have easily been from yesterday, she warned that the U.S. was some way off returning to its 2% inflation target.

In the background, a 22-year-old then hastily scribbled “Buy Bitcoin” on his legal pad — and held it to the camera during Yellen’s testimony. Screenshots of the stunt quickly went viral on social media, with BTC rallying to $2,398 (yes, we know) as a result.

Christian Langalis — otherwise known as “Bitcoin Sign Guy” — told the auction site Scarce City:

“It’s good to finally liberate this number from my sock drawer and offer it back to the Bitcoin public. The message was subversive then, but now merely obvious: Bitcoin is flowing. Control is dead.”

Christian Langalis

Bidding lasted for more than a week, with the grand finale hosted at the crypto-themed Pubkey Bar in New York City. It ended up selling for 16 BTC, worth about $1 million at the time of writing.

2. An epic sat

The rise of Ordinals now means that a single satoshi, the smallest possible denomination of one Bitcoin, can be numbered and even turned into an NFT.

Ordinals creator Casey Rodarmor says this also means some sats are significantly more valuable than others — with varying degrees of rarity.

Sats sitting in the “epic” tier include the very first to be mined after a halving event.

Only four of them currently exist — and after the mining company ViaBTC was chosen to add the 840,000th block to the blockchain, it decided to sell the debut sat of this current cycle. The auction was held on CoinEx, and went under the hammer for 33.3 BTC — approximately $2.1 million. The exchange said afterward:

“This epic satoshi symbolizes a historic moment in Bitcoin’s history and holds significant collectible and symbolic value for Bitcoin enthusiasts, collectors, and cryptocurrency community investors.”

CoinEx

3. Extraordinary Ordinals

The mania surrounding NFTs was initially isolated to the Ethereum blockchain, but the rise of Ordinals now means that Bitcoin has become the dominant network for sales.

Back in December 2023, the esteemed auction house Sotheby’s held an auction for BitcoinShrooms — with creator Shroomtoshi declaring:

“The BitcoinShrooms collection is a pixelated recap of the first 13 years of Bitcoin, a homage to the 8-bit style of art that expresses a slight nostalgia for the 90s.”

Shroomtoshi

A select few were available for bidding, each with an estimated value of up to $30,000. But appetite far exceeded expectations — and they sold for a grand total of $450,000.

While not as eye-watering as the price of OG Ethereum NFTs when the market was at its frothiest, it’s still a sign that the digital collectibles space isn’t dead yet.

4. Beeple breaks records

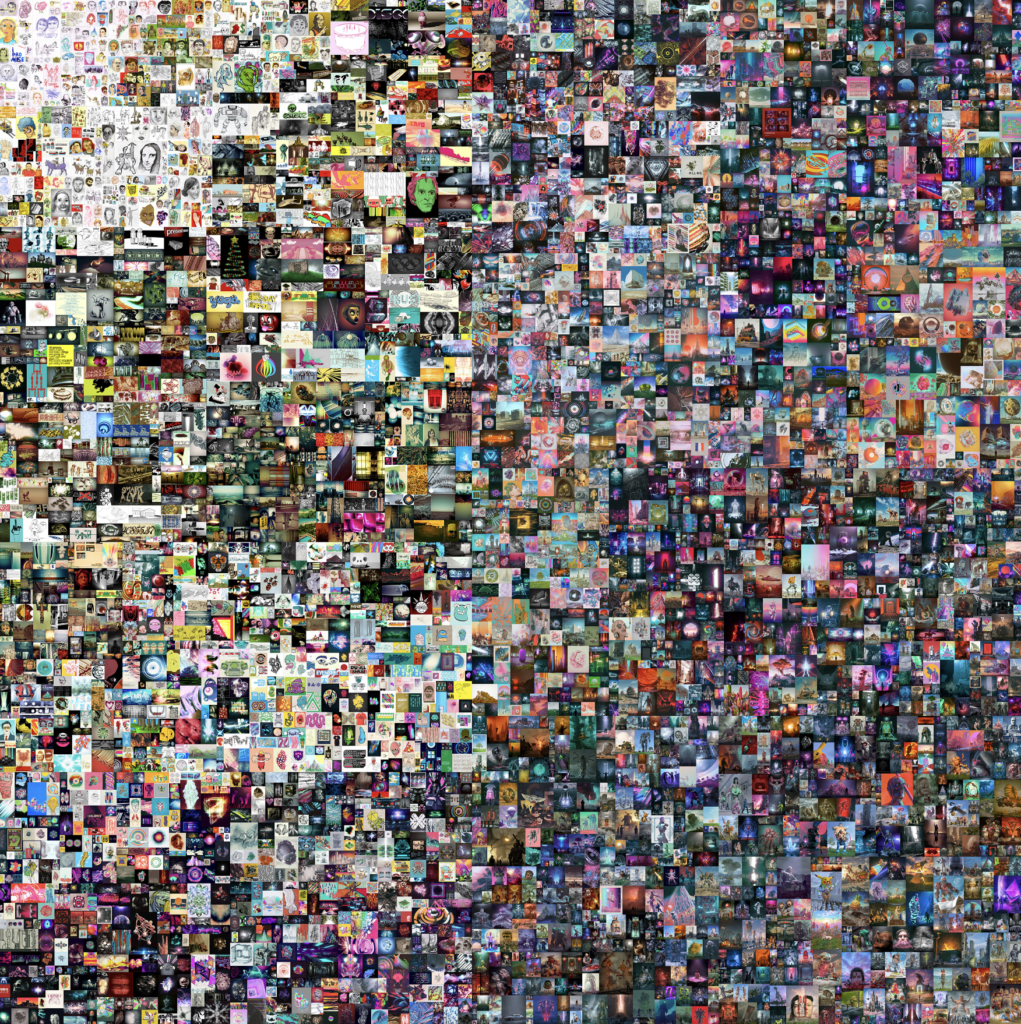

No rundown of the biggest auctions in crypto’s history would be complete without a nod to Beeple, who began sharing pieces of digital art on a daily basis in 2007.

The first 5,000 were then stitched together in a vibrant collage and minted as an NFT in 2021. What was the final selling price at the Christie’s auction house, we hear you ask? $69.3 million.

Not only did Everydays: The First 5,000 Days smash records for the most valuable piece of digital art in history, but Beeple became the third most-valuable living artist. Accurately predicting what the future held for NFTs, he told Fox News Sunday soon afterward:

“I absolutely think it’s a bubble, to be quite honest. I go back to the analogy of the beginning of the internet. There was a bubble. And the bubble burst.”

Beeple

5. Real-life Bitcoin

Last but not least, there have been some feverish auctions for Casascius coins of late — physical BTC that was created in the early 2010s.

Within each metal coin is the private key to a set denomination of Bitcoin, effectively making it an incredibly sophisticated form of cold storage.

Their rarity, and the fact they haven’t been produced in over a decade, means they often command much higher prices than the value of BTC they hold.

A brass Casascius 1 Bitcoin minted in 2011 recently sold for $96,000 at Stack’s Bowers Galleries — breaking world records in the process — while a silver one was flogged off for a cool $102,000.