Key takeaways:

-

Ethereum’s strong onchain metrics contrast with subdued derivatives sentiment, suggesting traders remain cautiously positioned.

-

Stablecoin flows and options data indicate only moderate fear, supporting ETH’s potential to regain bullish momentum.

Ether (ETH) fell 5.2% on Friday after investors digested weaker-than-expected US job market data. The decline came alongside a reversal in equities, sparking $90 million in liquidations of leveraged bullish ETH positions. The correction raises the question of whether Ether is destined to retest the $4,000 mark, or is the move simply a reflection of broader macroeconomic uncertainty?

ETH’s monthly futures premium versus spot markets dropped to its lowest point in two months, slipping below the neutral 5% threshold. This level signals little interest in leveraged bullish positioning but is more likely tied to four consecutive days of net outflows from US-listed Ethereum ETFs, totaling $505 million. In other words, traders’ sentiment may be more backward-looking than a true bearish forecast.

Still, it would be premature to argue that ETH is set to collapse below $4,300 solely based on weakness in derivatives. Ethereum’s onchain activity continues to show resilience. Since ETH’s primary role is paying for data processing on the Ethereum network, rising activity typically translates into healthier price dynamics.

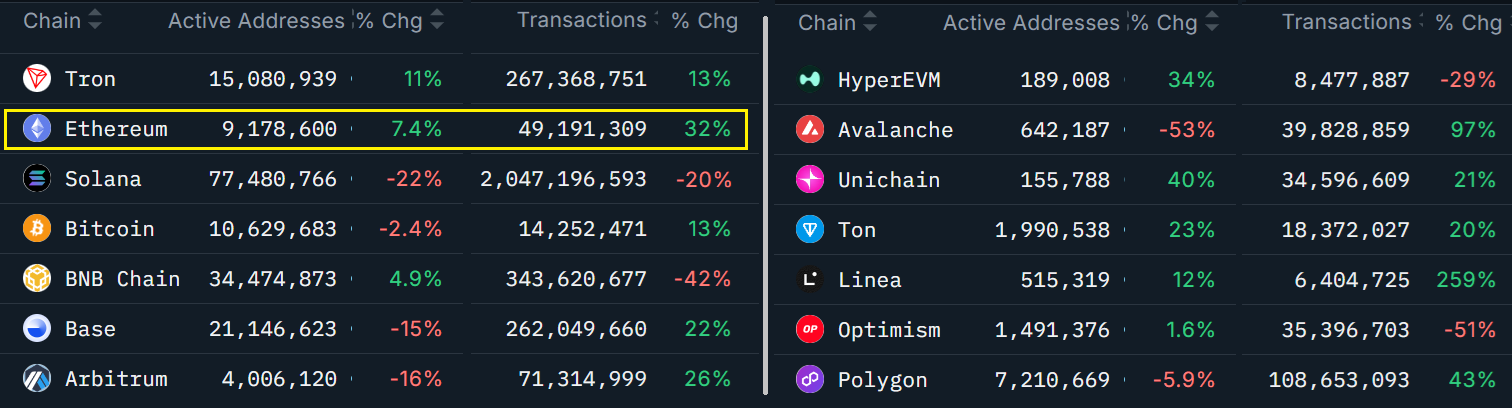

Transaction counts on the Ethereum network surged 32% over the past month. By comparison, Solana saw a steep decline, while BNB Chain managed only a 5% increase. Even more notable, Ethereum’s active addresses rose 7% in the same period, while Solana’s user base shrank 20% and BNB Chain suffered a sharp 42% contraction.

Ethereum’s total value locked (TVL) climbed to $97.4 billion, a 12% rise in 30 days. Standout gains came from Pendle, up 37%, Morpho with a 36% increase, and Ethena advancing 32%. Ethereum’s dominance remains unshaken at 60% of all TVL, or 67% when including the layer-2 ecosystem. The Base network alone now processes only 25% fewer transactions than BNB Chain.

ETH options skew signals caution as traders resist turning bullish

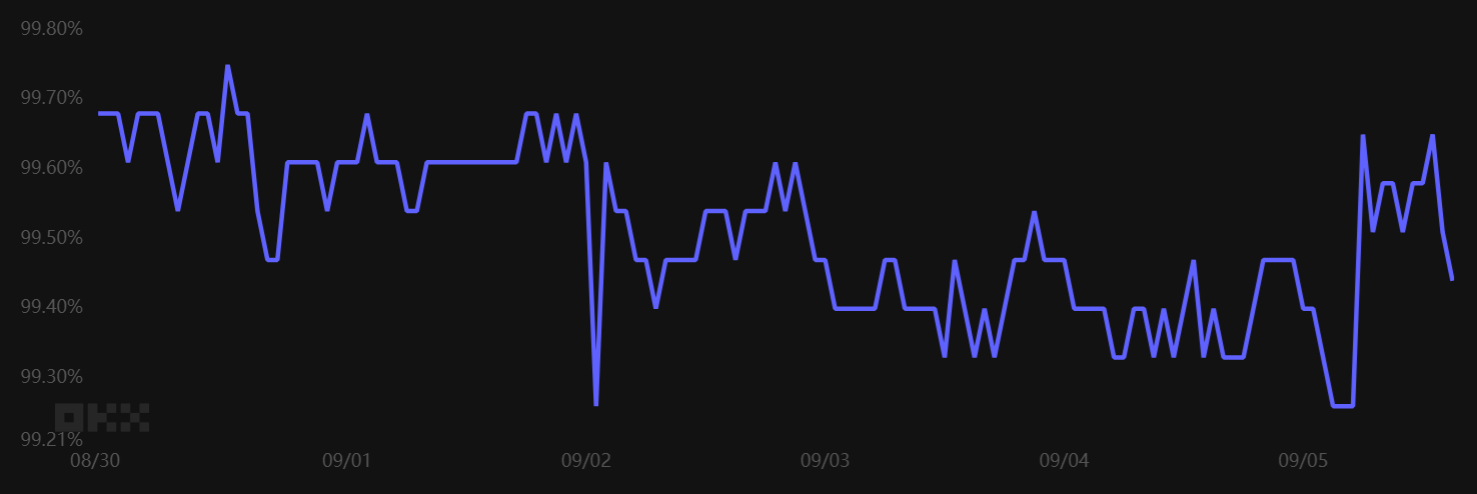

To evaluate whether the lack of bullish sentiment in ETH derivatives is limited to futures, it is useful to analyze the options skew. A heavy premium on put (sell) options typically signals downside fear, pushing the skew above the neutral 6% threshold.

Currently at 4%, ETH’s options delta skew shows no sign of elevated fear, consistent with the past week. Interestingly, demand for call (buy) options did not rise even when ETH reached its all-time high on Aug. 24. This suggests professional traders remain cautious, reluctant to flip bullish despite a 48% rally over three weeks.

Related: Ether whales have added 14% more coins since April price lows

Stablecoin activity in China also offers insight into whether risk aversion extends beyond Ether. Strong inflows into crypto usually drive stablecoins to trade at a 2% premium over the official US dollar rate. Conversely, a discount above 0.5% often points to fear, as traders exit crypto markets.

Tether’s USDt (USDT) currently trades at a 0.5% discount in China relative to the official USD/CNY rate, signaling moderate selling pressure. As a result, Ether’s price action appears tied to uncertainty about global economic growth, particularly after US unemployment climbed to 4.3% in August.

Despite these headwinds, ETH remains well-positioned to regain bullish momentum, supported by robust onchain activity and balanced conditions in the options market.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.