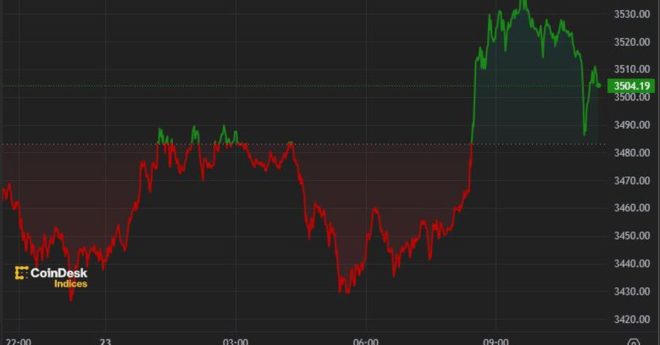

Ether was little changed after the SEC’s approval for ETH ETFs in the U.S. on Monday. The second-largest cryptocurrency traded around $3,500, just 0.2% higher than 24 hours ago. Still, it outperformed the wider digital asset market, which is 1.3% lower as measured by the CoinDesk 20 Index (CD20). Some analysts predict that the ETFs’ listings could drive the ether price up to $6,500, though inflows are not expected to be nearly as high as for their bitcoin counterparts. Steno Research predicts that the ETFs could see $15 billion-$20 billion of inflows in the first year, the same as bitcoin ETFs have taken in in just seven months.

Ether Little Changed After Spot ETF Approval