The institutional Ethereum treasury race is accelerating, as two of the biggest corporate Ether holders are raising billions of dollars to acquire more of the world’s second-largest cryptocurrency.

Public Bitcoin mining firm BitMine Immersion Technology is raising $24.5 billion through an at-the-market (ATM) stock offering, while SharpLink completed a $389 million capital raise from common shares.

Whales, or large crypto holders, have also been accumulating ahead of this week’s key US inflation reports. A new entity acquired $1.3 billion worth of Ether (ETH) across 10 fresh cryptocurrency wallets, surpassing the record-breaking $1 billion worth of Ether amassed by the exchange-traded funds (ETFs) on Monday.

In the broader economy, US federal debt ballooned to a record high of $37 trillion on Wednesday, a month after President Donald Trump signed the One Big Beautiful Bill Act into law on July 4.

Analysts said swelling deficits may eventually prompt looser policy, including quantitative easing, which is large-scale bond purchases by central banks that inject liquidity into the financial system, a development that may push Bitcoin’s (BTC) price to about $132,000 before the end of 2025, based on its correlation with the growing M2 money supply.

BitMine targets huge $24.5 billion raise as SharpLink boosts Ether war chest

The corporate Ether acquisition race is accelerating as the world’s two biggest Ether treasury firms are raising capital to acquire more of the world’s second-largest cryptocurrency, which is nearing its previous all-time high.

Public Bitcoin mining firm BitMine Immersion Technology is looking to raise $24.5 billion through a new at-the-market (ATM) stock sale to acquire more Ether tokens, according to a Tuesday US Securities and Exchange Commission filing.

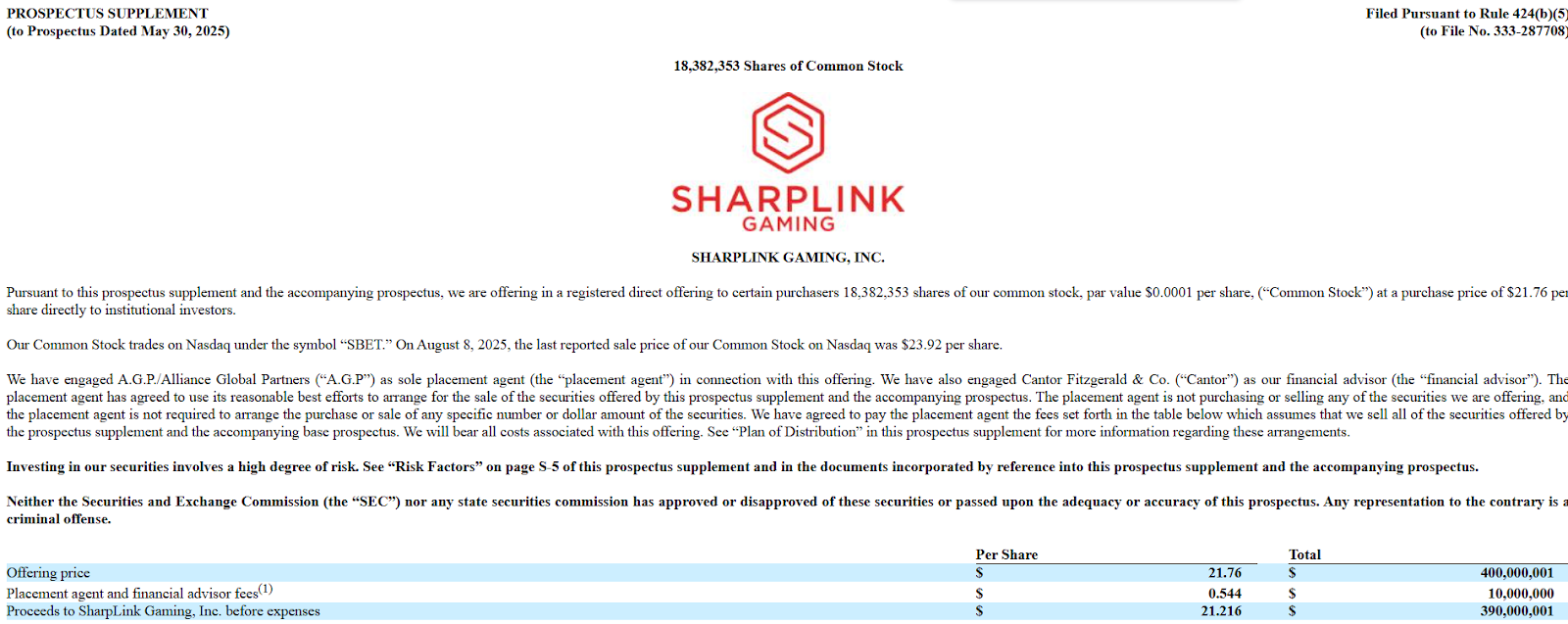

BitMine’s offering came the same day as corporate crypto treasury firm SharpLink completed a $389 million capital raise from common stock shares for select institutional investors, according to another SEC filing. “We intend to contribute substantially all of the cash proceeds that we receive to acquire ETH,” the filing said.

Part of the $389 million net proceeds will also be used for “working capital needs, general corporate purposes, operating expenses, and core affiliate marketing operations,” SharpLink said.

SharpLink has raised about $1.4 billion in gross proceeds to date from more than 71.5 million shares sold, the filing shows.

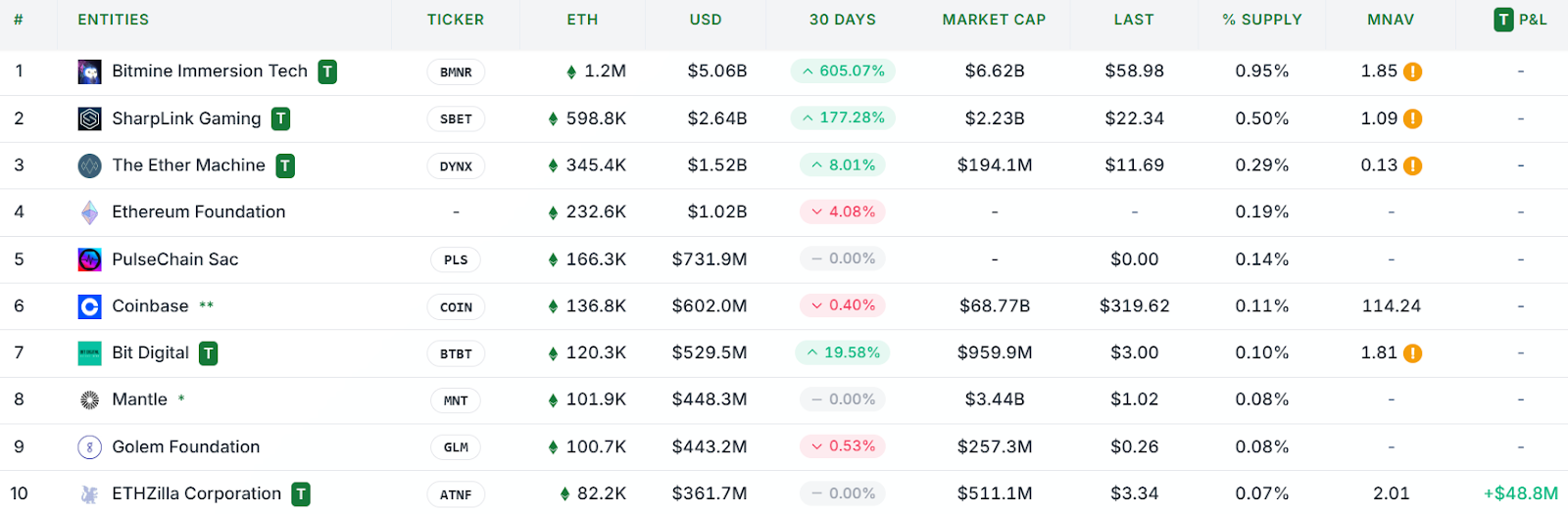

Bitmine is the world’s largest corporate holder of Ether with 1.2 billion ETH worth $5 billion on its books, followed by SharpLink with 598,000 Ether worth $2.64 billion, data from StrategicEthReserve shows.

BitMine previously announced plans to acquire up to 5% of Ether’s supply.

Record $37 trillion US debt and M2 money growth set stage for $132,000 Bitcoin

The US federal debt has reached a record $37 trillion, adding fuel to calls that rising deficits and potential money supply growth may underpin a Bitcoin rally to $132,000 by year’s end.

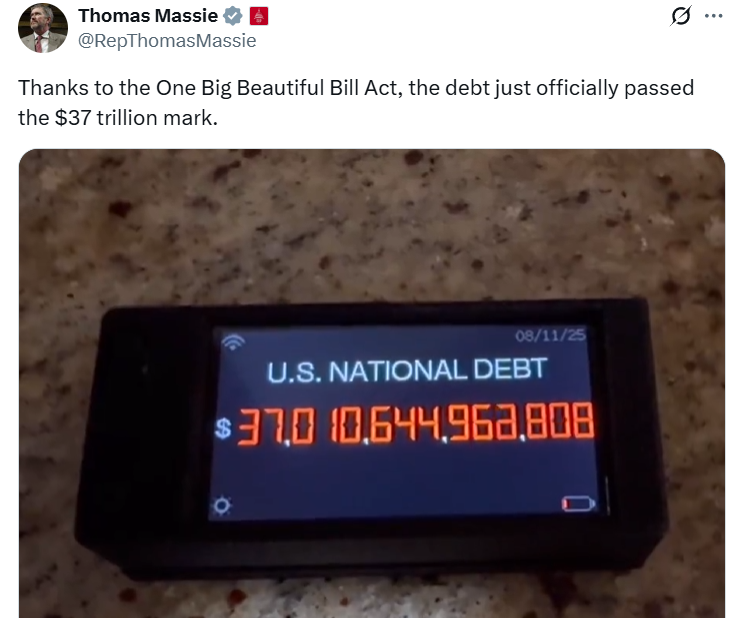

“Thanks to the One Big Beautiful Bill Act, the debt just officially passed the $37 trillion mark,” said Representative Thomas Massie in a Wednesday X post.

The US deficit has risen to its latest record high a month after Trump signed the One Big Beautiful Bill Act into law on July 4, which he said would cut as much as $1.6 trillion in federal spending.

Analysts said swelling deficits may eventually prompt looser policy, including quantitative easing, which is large-scale bond purchases by central banks that inject liquidity into the financial system.

Bitcoin advocates argue that an increasing money supply and rising inflation concerns may lead to a renewed recognition of Bitcoin’s monetary scarcity, pushing the world’s first cryptocurrency to new all-time highs.

Bitcoin will either “Godzilla” up or drop on “alt mania,” Samson Mow says

Bitcoin reached a new all-time high, and its next move will either be a surge into new price discovery or a halt to make way for the oncoming altcoin season, said Bitcoin pioneer Samson Mow.

Bitcoin prices reached $124,500 on Coinbase in early trading on Thursday, according to TradingView. The move added 3.5% to the asset on the day and pushed total crypto market capitalization to a record high of $4.26 trillion.

Mow said there are now two possible paths for Bitcoin:

“We Godzilla or Omega up, suck all the oxygen out of the room, and altcoins drop 30-40%,” or “alt mania” peaks, triggering a massive sell-off as the “Bagholder’s Dilemma loses equilibrium,” which would see BTC dipping briefly before going up again when altcoins tank, he said on Thursday.

The Bitcoin maximalist couldn’t resist having another bash at Ether (ETH), as he compared market capitalizations and said, “But no matter what, it’s impossible that Ethereum is worth 4,600,000 BTC,” before adding, “this has to correct sooner or later.”

Bitcoin briefly flips Google market cap as investors eye rally above $124,000

Bitcoin climbed to an all-time high above $124,000 on Thursday, stoking fresh optimism that the next leg of price discovery could push the cryptocurrency’s market value toward Apple’s $3.4 trillion.

Bitcoin hit an all-time high of $124,457, leading the world’s first cryptocurrency to briefly surpass Google’s $2.45 trillion market capitalization, becoming the fifth-largest global asset.

“Bitcoin all-time high and it’s only Wednesday,” said Gemini co-founder Tyler Winklevoss in an X post, triggering optimistic responses, including from popular investor Kyle Chassé, who predicted that this would be the “best week for Bitcoin.”

Bitcoin’s new milestone has inspired a new wave of optimism, as investors now eye the continuation of the price discovery phase, which may see Bitcoin surpass Apple’s market capitalization next.

Bitcoin would need to rise above $175,000 to flip Apple’s current $3.4 trillion market capitalization, which may occur before the end of August, said crypto analyst and Taproot developer Udi Wertheimer in a Thursday X post.

SEC to focus on “clear” crypto regulations after Ripple case: Atkins

The United States Securities and Exchange Commission is signaling an increasing focus on developing a clear cryptocurrency regulatory framework after ending one of the industry’s longest-running legal battles.

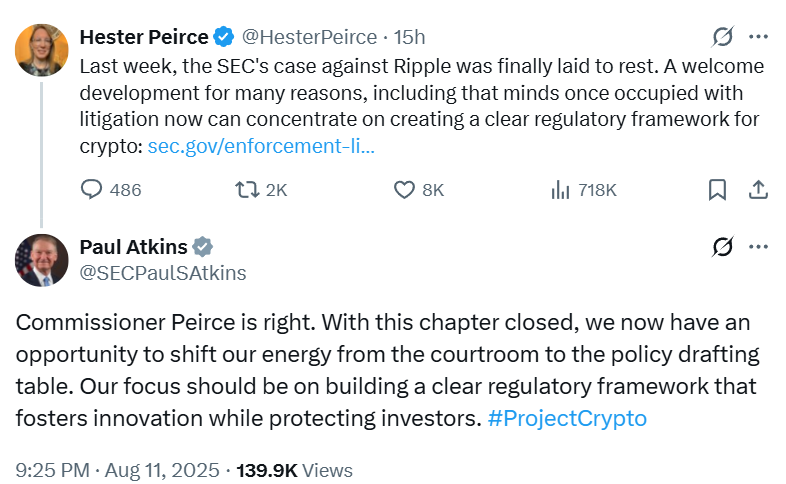

The SEC and Ripple Labs ended their almost five-year dispute after both parties filed to drop their legal appeals and bear their costs and fees, according to a filing last Thursday with the Second Circuit Appeals Court.

The case’s conclusion is a “welcome development” that ensures “minds once occupied with litigation now can concentrate on creating a clear regulatory framework for crypto,” said SEC Commissioner Hester Peirce in a Monday X post.

“With this chapter closed, we now have an opportunity to shift our energy from the courtroom to the policy drafting table,” said SEC Chair Paul Atkins in response to Peirce’s post. “Our focus should be on building a clear regulatory framework that fosters innovation while protecting investors,” he added.

The SEC sued Ripple in December 2020, alleging the company raised $1.3 billion through unregistered XRP securities sales. In July 2023, Judge Analisa Torres ruled that XRP was not a security when sold to retail investors but was a security in sales to institutions. Ripple was fined $125 million in August 2024.

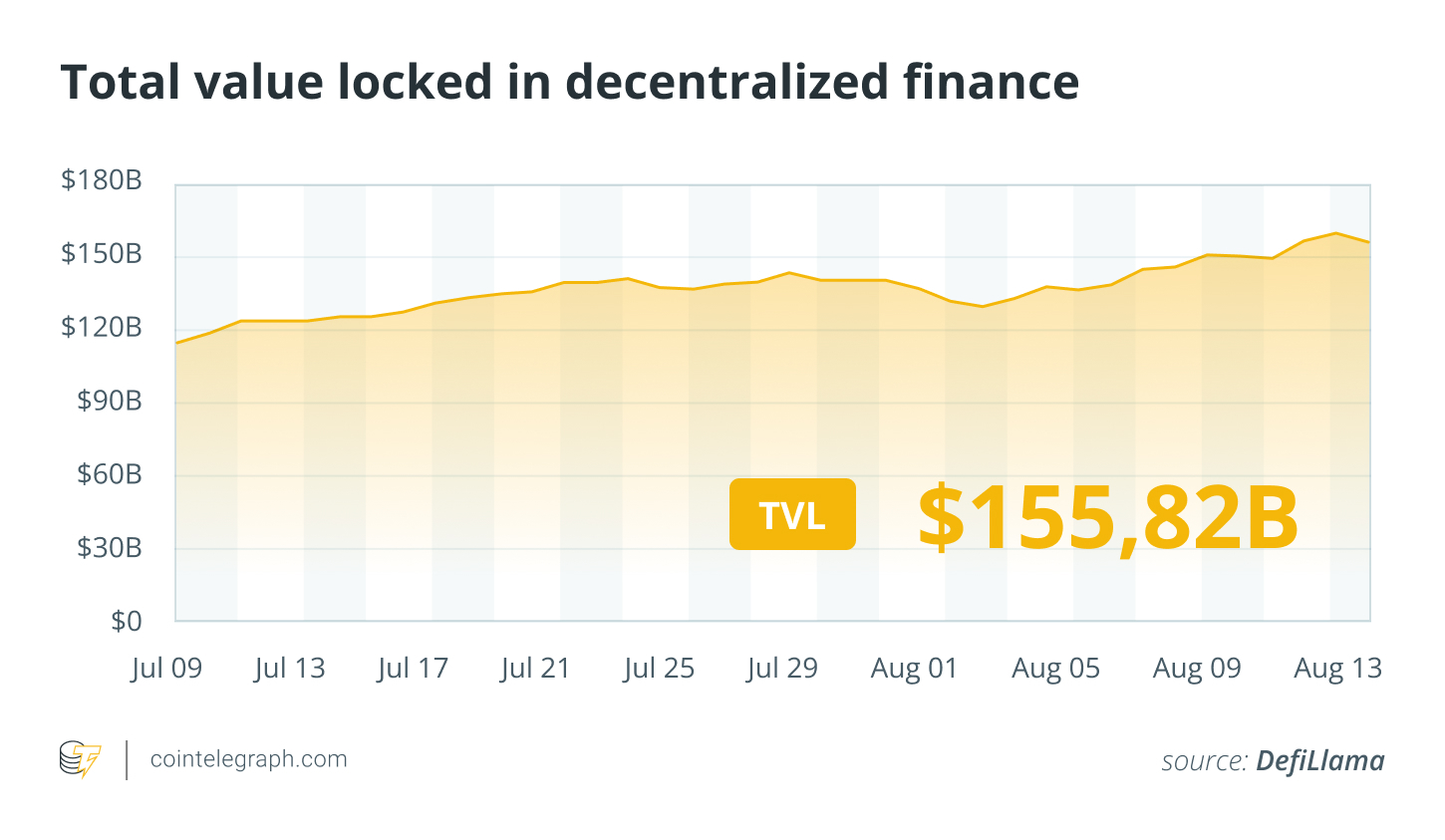

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

The OKB (OKB) token rose over 110% as the week’s biggest gainer, followed by the Aerodrome Finance (AERO) token, up over 60% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.