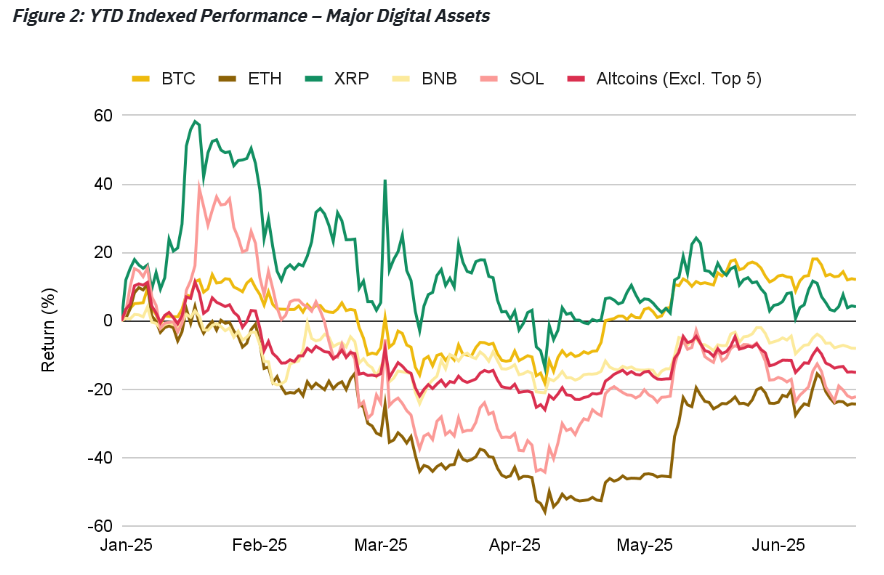

Ether whales are betting hundreds of millions of dollars on the price recovery of the world’s second-largest cryptocurrency despite geopolitical tensions that are sidelining investors and dampening risk appetite.

One whale (a large cryptocurrency investor) has opened an Ether (ETH) long position of over $101 million with 25x leverage at the entry price of $2,247, according to blockchain data from Hypurrscan.

The investor generated over $900,000 in unrealized profit, but paid over $2.5 million in funding fees. His position stands to be liquidated if Ether’s price falls below $2,196.

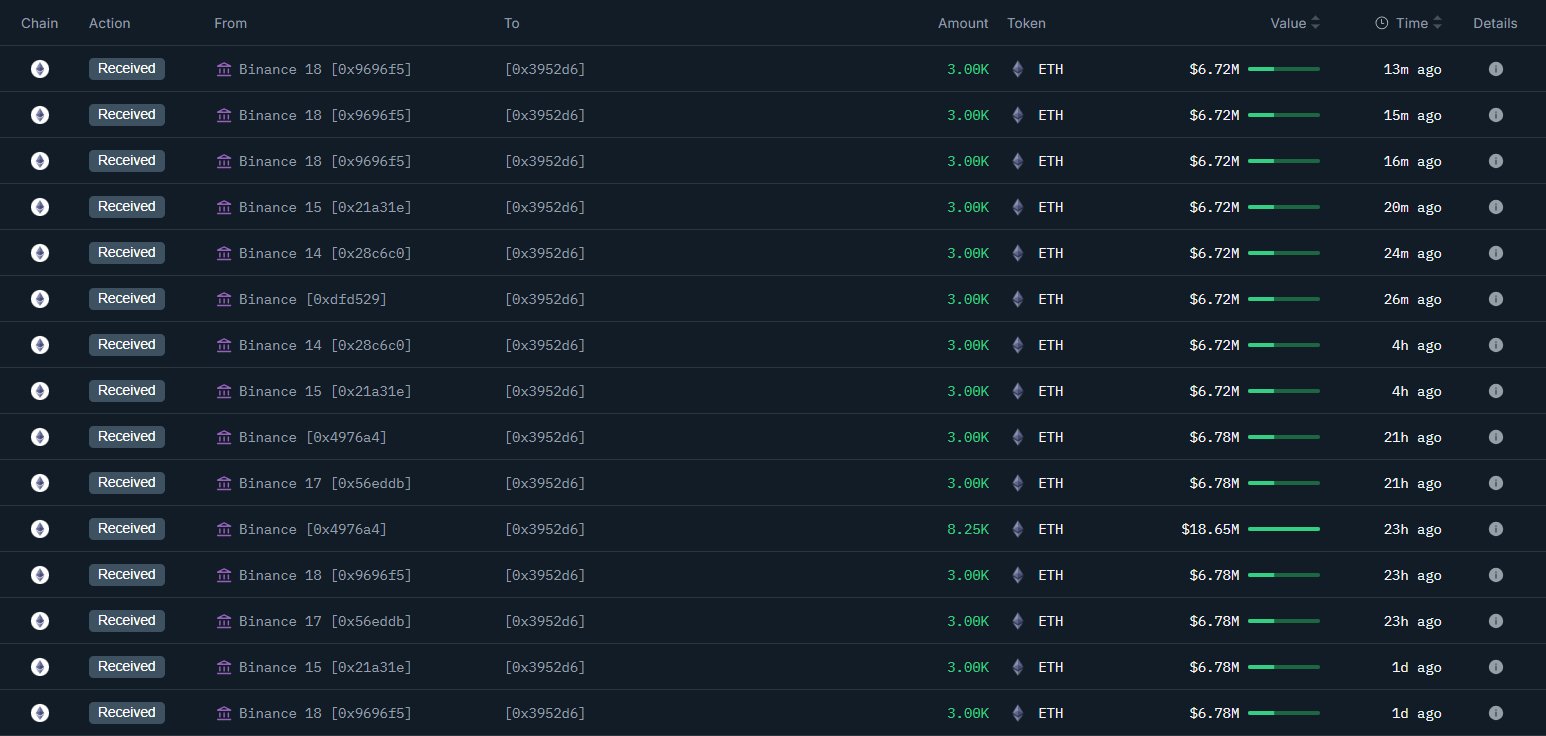

The leveraged bet was opened hours before a second whale withdrew over $40 million worth of ETH from Binance, reaching a total of $112 million worth of ETH holdings, according to blockchain data provider Onchain Lens.

The activity comes as Ether slumped to a one-month low of $2,113 on Sunday, following US airstrikes on Iran’s nuclear sites. US President Donald Trump called the attacks a “spectacular military success” and warned of further strikes unless Iran agreed to peace, Reuters reported.

The two countries have been engaging in strategic missile warfare since June 13, when Israel launched multiple strikes on Iran, marking its largest attack on the country since the Iran-Iraq War in the 1980s.

Related: Ether crypto funds see $296M inflows in best week since Trump election

Most Bitcoin (BTC) and Ether traders expect a further correction after the latest escalation in the ongoing conflict.

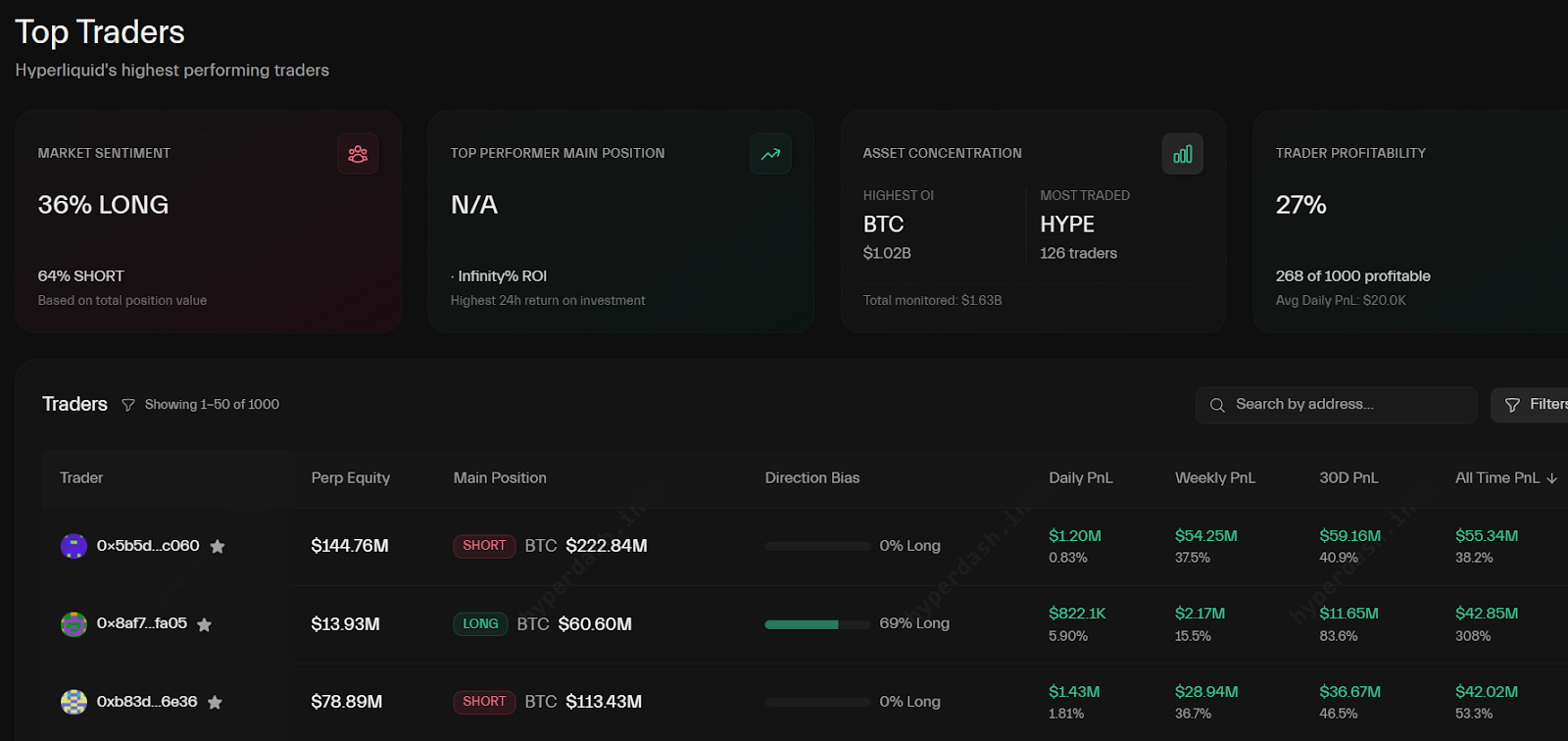

Around 64% of the industry’s most successful cryptocurrency traders are currently shorting the world’s two largest cryptocurrencies, while only 36% remain long, according to the top Hyperliquid traders tracked by HyperDash.

Related: Stablecoin legislation to drive Bitcoin market cycle in 2025: Finance Redefined

Ether investors in “wait-and-see” mode

Most Ether investors are currently sidelined due to the ongoing geopolitical tensions and monetary uncertainty, according to Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen.

“We also still have a lot of market uncertainty, whether it’s macro or war,” the analyst told Cointelegraph, adding:

“These factors, combined with the fact that if we look at options data, the view is still somewhat neutral, we are still in a sort of wait-and-see stage.”

Binance researchers also attributed the price drop to geopolitical escalations, adding that a wider correction may still occur.

“Whether the familiar ‘panic-then-recover’ pattern re-emerges will hinge on how quickly the geopolitical narrative cools,” according to a Friday report from Binance Research. “Macro-driven pullbacks are still being treated as opportunities — not signs of a broader directional reversal,” the report said.

On June 17, the staked Ether supply reached a new all-time high of over 35 million, signaling that Ether’s sellable supply is decreasing as investors prepare to hold their ETH to generate passive yield rather than sell at current prices.

Magazine: 3 reasons Ethereum could turn a corner: Kain Warwick, X Hall of Flame