Ethereum price crossed the $2,900 milestone on Feb. 19, but rising volume of trading activity across the ETH spot markets could propel it even further.

With investors placing bullish bets ahead of Bitcoin ETFs trading hours, is Ethereum price set for the much-anticipated bounce toward $3,500?

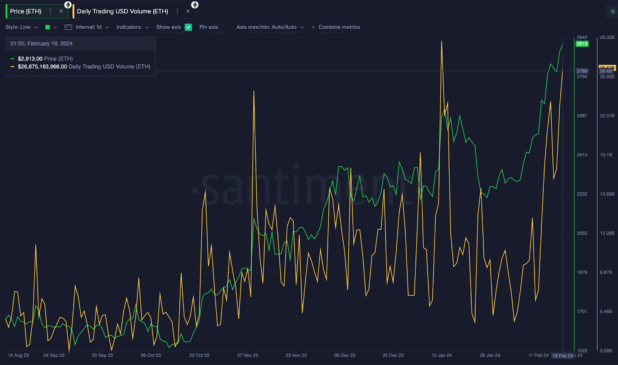

Ethereum trading volume crosses $25 billion milestone

Ethereum price made another giant stride on Feb. 19 as it crossed the $2,900 territory to bring its gains for February 2024 to the 30% mark. Record-breaking inflows from Bitcoin ETFs and institutional entities in recent weeks has been a major driver behind the market rally.

ETH witnessed an unusual spurt in the trading activity in UTC morning hours on Feb. 19, likely due to strategic investors looking to place bullish bets ahead of the resumption of Bitcoin ETF trading sessions in the US.

Santiment’s daily trading volume tracks the nominal value of confirmed transactions involving a particular cryptocurrency within a 24 hour period.

The chart below illustrates an initial drop-off in ETH trading at the close of Bitcoin ETF trading on Friday Feb. 16. But since then, it has been on a remarkable rise.

At the time of writing around 10:30 hrs GMT on Feb. 19, ETH trading volume has surged to $26.7 billion, the highest since Jan. 11.

Typically, rising trading volume is bullish for a number of reasons. Firstly, it signals strong investor interest in the underlying cryptocurrency. But more importantly, heightened market liquidity allows investors to execute trades at favorable prices without scuttling the upward price momentum

Bitcoin ETFs acquired over 17,000 BTC in the last trading week between Feb. 12 and Feb. 16. If they continue on the same trajectory, the trading volume on Ethereum and other mega-cap altcoins could rise even further, during the previous week.

Investors shifted ETH worth $220M into long-term savings in 3 days

The flow of Ethereum on exchanges since the close of trading on Feb. 16 is another critical metric pointing towards investors’ conviction of another bullish week ahead.

CryptoQuant’s Exchange Reserves metric tracks the total number of coins deposited in exchange-hosted wallets and recognized trading platforms. This serves as a proxy for measuring investors’ tendency to sell in the short-term.

As depicted in the chart below, investors held opening balances of 14,060,510 ETH as of Feb. 16.

But interestingly, investors shipped over 80,222 ETH coins into long-term storage and staking contracts in the last 3 days, leaving only 13,980,288 ETH in their trading wallets at press time on Feb. 19.

A decline in exchange reserves often impacts asset price positively, as it effectively leads to a temporary cut in market supply. Unsurprisingly, a closer look at the chart shows how ETH price has been on an uptrend since the exchange reserves began to drop rapidly in November 2023.

Valued at the 5-day Simple Moving Average price of $2,730, investors have shifted approximately $220 million worth of ETH into long-term storage.

Reducing the market supply, by such a large margin could further accelerate the rally if the market momentum remains bullish in the week ahead.

Forecast: can Ethereum price reach $3,500?

Based on the trading volume and exchange reserves trends analyzed above, there’s an overwhelming bullish sentiment among investors that ETH price could make another leg-up toward $3,500 in the week ahead.

However, ETH currently faces a looming sell-wall at the $3,000 psychological resistance.

IntoTheBlock’s global in/out of the money data shows that 4.5 million addresses received 1.7 million ETH inflows at the average price of $3,049. Considering they had been holding at a loss for nearly 3-years a number of them could look to take some profits.

But if the bull can scale this resistance zone, a breakout toward $3,500 could be on the cards.

On the downside, the bears could regain a foothold in the market if they can force a reversal below $2,000. However, as seen above, the 4 million addresses acquired 3.3 million ETH at a minimum price of $2,640.

To avoid dipping into losses, those investors could make frantic purchases to cover their positions, and possibly, trigger an instant ETH price rebound.