Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tom Lee, co-founder and head of research at Fundstrat Global Advisors and chairman of Bitmine, used his appearance on Natalie Brunell’s Coin Stories to press a sweeping thesis for Ethereum: institutional tokenization is arriving at scale, stablecoins have become crypto’s first mass-market product, and the dominant smart-contract network is positioned to intermediate both.

“Ethereum is arguably the biggest macro trade over the next 10-15 years as Wall Street runs onto the blockchain and as AI drives adoption of token economics – the largest layer 1 is ethereum,” he commented via X, framing Ethereum’s moment as analogous to Bitcoin’s institutional validation.

Why Ethereum Might Be The Biggest Macro Trade

Lee argued there is no contradiction between his longstanding Bitcoin optimism and his conviction on Ethereum. Bitcoin, in his telling, remains the monetary primitive and store of value. Ethereum, by contrast, is the execution layer for tokenized finance. “I don’t see this as a conflict,” he said when asked why he champions both assets. Drawing an analogy to equities, he added that investors can sensibly own scarce, category-defining names in parallel: “You know you should own both.”

Related Reading

The crux of Lee’s Ethereum case is the convergence of Wall Street’s tokenization push with real-world adoption of stablecoins. He described stablecoins as crypto’s first ubiquitous application and the accelerant for institutional on-chain activity. “That is the ChatGPT moment for crypto,” he said. “The first killer app for crypto has emerged… which is stablecoins, and now Wall Street is running to tokenize and maybe even financialize their entire system on the blockchain. But that means they require smart contracts.”

In Lee’s assessment, “the biggest and most secure blockchain with no downtime is Ethereum. And it’s legally compliant.” He further contended that “the majority of stablecoins and real-world assets that have been tokenized are taking place on Ethereum,” positioning the network as the default venue for capital-markets infrastructure to migrate on-chain.

Brunell pressed on perceived weaknesses introduced since Ethereum’s transition to proof-of-stake, including increased complexity, centralization vectors, bridge and Layer-2 attack surfaces. Lee acknowledged those critiques but weighed them against what he views as the incumbent system’s brittleness.

“These risks that you describe seem like smaller risks compared to the fragility of the existing financial system,” he said, pointing to legacy “trust vectors” and fraud rates in traditional rails. In other words, even with Ethereum’s trade-offs, the relative security-and-efficiency frontier still tilts in its favor for modern financial plumbing.

Related Reading

Lee linked his timeline to the institutional learning curve. When he first wrote about Bitcoin in 2017, he said, the investment community was just beginning to recognize a credible digital-gold thesis. “I think Ethereum is having its 2017 moment now because now is the time that Wall Street will take tokenization seriously and it’s taking place on Ethereum,” he said. That adoption vector—tokenized dollars and securities settling under programmable contracts—underpins his claim that Ethereum is the preeminent macro trade ahead.

Asked to choose a single asset for the next decade, Lee resisted the premise but ultimately answered in line with his current mandate. “If I had to choose… because I’m chairman of Bitmine, which is an Ethereum treasury, then I of course would choose Ethereum,” he said.

He closed by reiterating that generational shifts in technology and attitudes will keep compounding crypto’s addressable market, with both Bitcoin and Ethereum benefiting. But on the specific question of where institutional financial infrastructure is most likely to land, his stance was unambiguous: “Wall Street will take tokenization seriously and it’s taking place on Ethereum.”

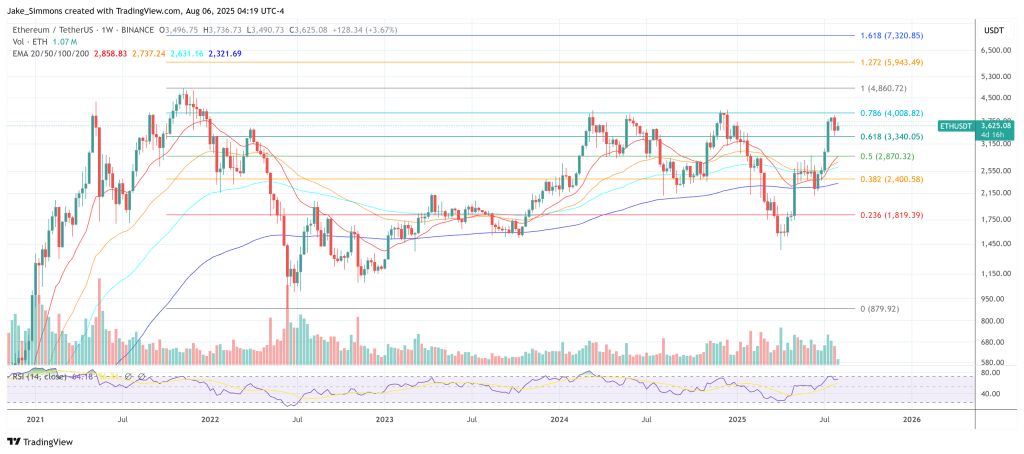

At press time, ETH traded at $3,625.

Featured image created with DALL.E, chart from TradingView.com