The crypto market is spiraling downwards, especially Ethereum and other altcoins. The overall market cap lost $50 billion last weekend, leaving the current figure at $950 billion. Unfortunately, it eventually lost the $1 trillion mark. The price fall in Bitcoin, Ethereum, and other crypto caused the recent plunge.

The trend emerged after the August 26 Federal Reserve annual meeting. Jerome Powell made a speech reiterating the plans of the agency to continue its hawkish approach to fighting inflation. After the speech, the crypto and equities market plunged.

From then till the morning hours of August 29, crypto prices continued falling. However, at the time of writing mid-day on August 29, there is a positive move in the crypto market. Ethereum has regained 2.63% of its early morning losses and is now trading at $1,517.81.

The price correction started early on August 29, placing ETH’s price at $1,451 and reducing its market cap to $177 billion. Now, ETH is trading under two major supply zones, according to IntoTheBlock data.

Analyst Explains Bearish Prediction

According to Martinez, the two supply zones Ethereum traded were $1,475 and $1,560. In the first supply zone, 585K addresses bought a total of $2.81 million worth of ETH. 526K addresses hold 3.44 million worth of ETH in the second zone. The support can only be at $1,335, showing that 412K addresses bought 2.2 million worth of ETH.

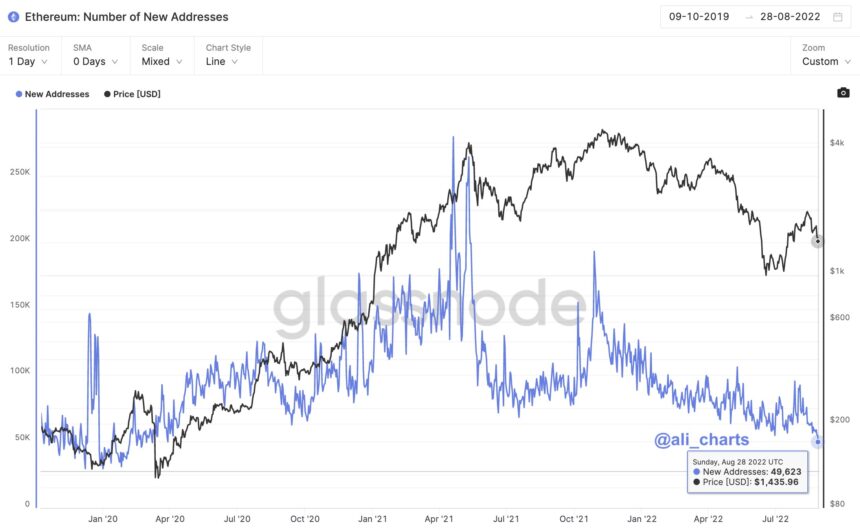

Based on the support zones, Ali Martinez predicts an imminent bearish trend. Secondly, Martinez pointed out that the daily Ethereum network growth in the space has been at its lowest in two years, which doesn’t signify a positive position.

According to Martinez, the daily new addresses on Ethereum saw the last spike in 2020 when 49,700 was created the same day.

The number of addresses created on the Ethereum network has declined instead of growing. This state is also an indication of an extended price correction period.

What About The Ethereum Merge?

Many investors were optimistic that the upcoming upgrade would push Ethereum and the overall crypto market upwards. But the current trend of events signifies that the Merge may have already been Priced In.

For instance, the end of June saw Ethereum at $1,000 after even dipping below $9,93 on June 18. But the crypto pulled back firmly, gaining more than 90%. However, the current figure shows a 25% retracement from that peak as the price keeps fluctuating between $1,450 and $1,550.

From all the indications, the power of macro has surpassed the optimism of the upcoming upgrade. Now, investors are looking at the $1,335 level, which might be ETH’s last supply zone. A more significant correction might follow if the price dips beyond that level.

Featured image from Pixabay, charts from TradingView.com