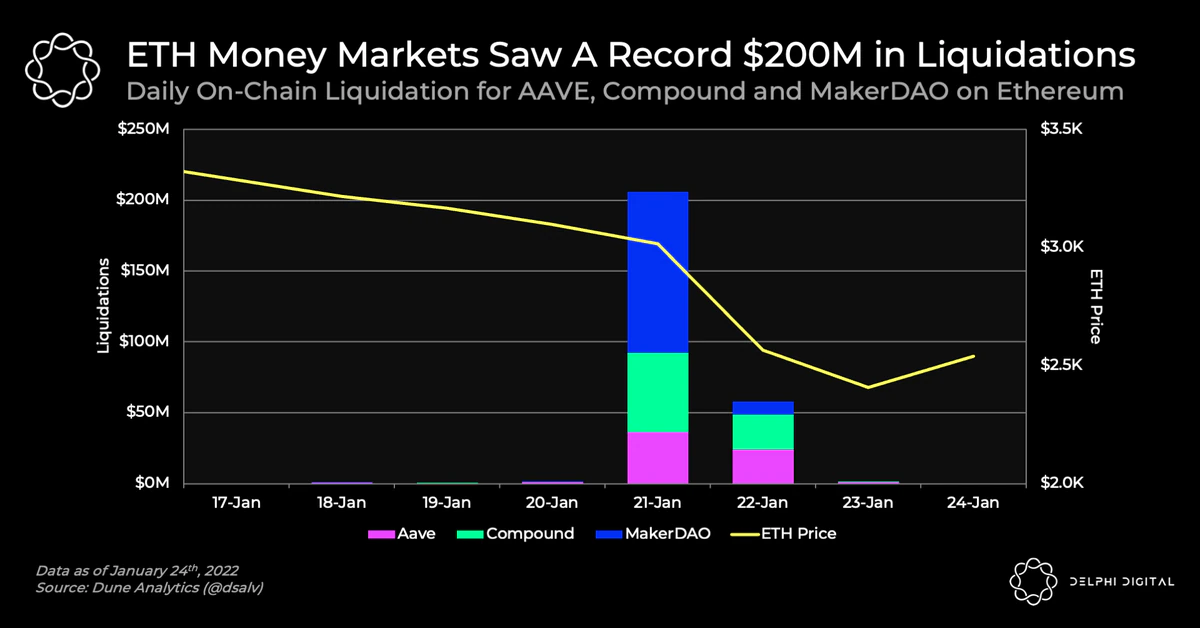

“As a major correction sent ETH falling from $3,200 to $2,500 in the past week, on-chain liquidations surged as positions started to hit their liquidation point,” analysts at Delphi Digital said in Monday’s newsletter, adding that MakerDAO has profited from the liquidation event.

Ethereum Money Markets See Record Liquidations as Ether Tanks; MakerDAO Revenue Surges