Ethereum price has prodded above $2,500 on Jan. 15, further stretching its post-ETF approval lead over BTC, on-chain data trends provide vital insights into the underlying drivers.

‘Buy-the-rumor, sell-the-news’ is a popular trading strategy where speculators make acquisitions ahead of a material news event in hopes of selling at a profit when news is confirmed. BTC speculators capitalized on this trading strategy to earn historic gains in the build-up to the spot Bitcoin ETF approval verdict. Vital on-chain data trends now reveal that Ethereum (ETH) has also begun to show early signs of a similar phenomenon.

BTC speculators earned 97% profits in build-up to ETF approval

The Bitcoin spot ETF approval quest suffered multiple setbacks recently, with the U.S. Securities and Exchange Commission (SEC) citing market manipulation, oversight, and liquidity concerns.

However, on June 15, 2023, things turned positive when BlackRock (NASDAQ: BLK) officially filed for a spot Bitcoin ETF with the SEC. With over $13 trillion in assets under management (AUM), BlackRock is one of the largest asset management firms in the world.

BlackRock’s entry into the fray raised optimism about Bitcoin derivatives and effectively spun the rumor mill.

As of June 15, Blackrock’s official filing date, Bitcoin price was trading around $24,800. Within the first two weeks, speculators who aped-in early on the rumor sent Bitcoin price rallying 25% to hit $30,000 for the first time in 12 months, dating back to June 2022.

Between June 15 and Jan. 11, when the SEC eventually confirmed the news, Bitcoin price nearly doubled, moving from $24,800 to a local top of $48,890. This effectively sent speculators who bought the rumor after BlackRock’s filing into 97% profit.

Unsurprisingly, the wave of profit-taking that ensued in the aftermath of the SEC approval has sent BTC price spiraling to 15% toward $42,500 as of Jan. 15. This affirms the full cycle of the buy-the-rumor, sell-the-news cycle on the spot Bitcoin ETF narrative.

With the Bitcoin ETF now at a conclusion, investors have switched focus to Ethereum. BlackRock had filed for spot Ethereum ETF on Nov. 16. In a recent interview on Jan. 12, BlackRock CEO Larry Fink re-emphasized the value of an Ethereum spot ETF as an asset class.

While the BTC price has dropped by 3.8%, Ethereum has increased by 13.5% in the past week. In effect, ETH price has outperformed BTC by approximately 10%.

Interestingly, in addition to this divergent interplay between ETH and BTC price movement over the past week, strategic on-chain movements from Ethereum whales since Jan. 11 also corroborate early signals of the buy-the-rumor strategy playing out in ETH markets.

Ethereum whales have acquired $1.4 billion ETH since Bitcoin ETF approval verdict

On paper, Ethereum price has outperformed BTC by 10% in the past week, per Coin360 data. Looking beyond the price charts, a vital on-chain indicator has revealed that ETH’s performance has been boosted by corporate entities and high net-worth investors who increased their buy pressure shortly after the Bitcoin ETF approval verdict.

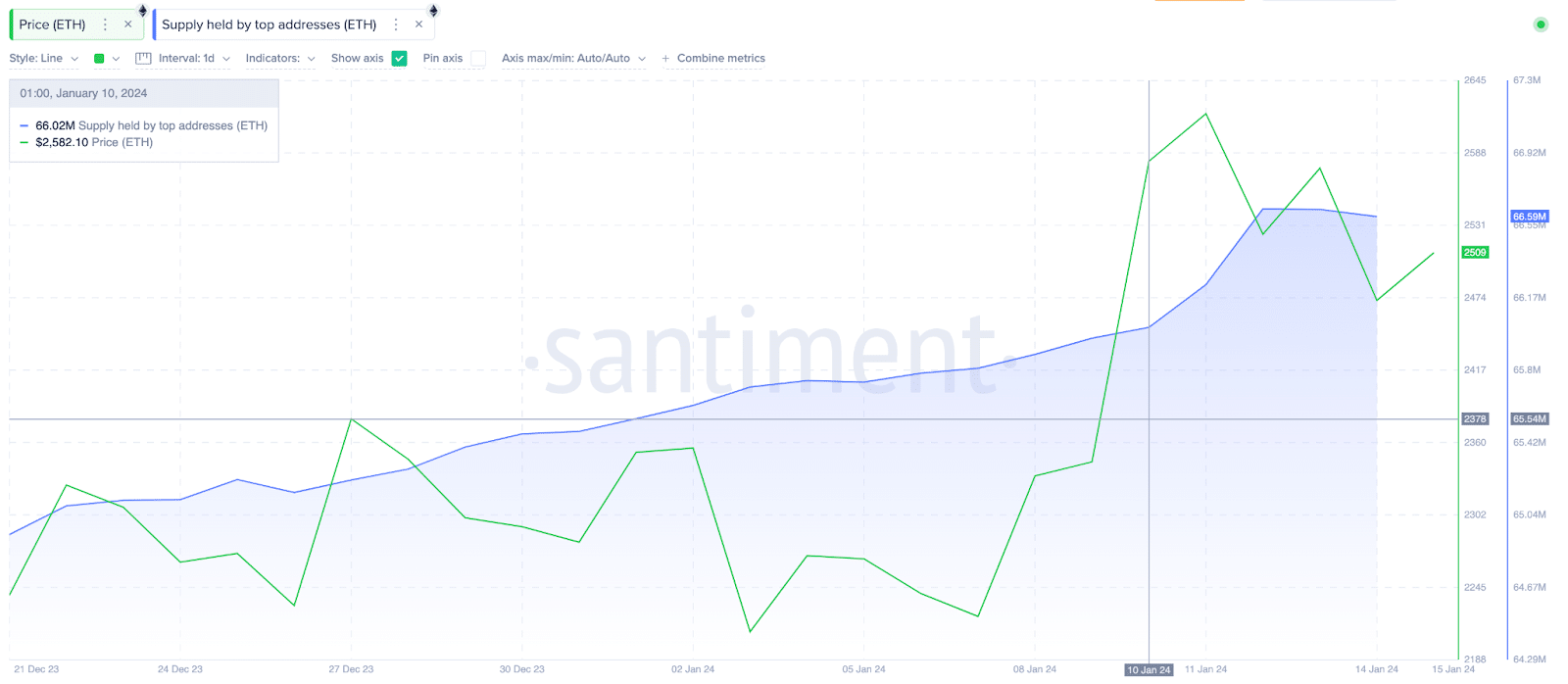

Santiment’s ‘supply held by top addresses’ metric shows a real-time snapshot of the aggregate balances currently controlled by the largest wallets in a crypto ecosystem.

The latest readings show that the top 1,000 Ethereum wallets held just 66 million ETH in cumulative balances as of Jan. 10.

But since the focus switched to spot Ethereum ETF, strategic ETH investors have entered a buying spree, adding 570,000 ETH to bring their balances to 66.5 million ETH at press time on Jan. 15.

Valued at the current price of $2,540, the Ethereum ‘top holder supply’ chart above illustrates that the top 1,000 investors have added ETH coins worth $1.4 billion to their holdings in the last four days alone.

Intuitively, when the largest stakeholders increase their balances rapidly by hundreds of millions, it is interpreted as a strong bullish signal. Firstly, the buying trend among the largest stakeholders increases overall confidence within the cryptocurrency’s ecosystem.

Given that large holders are often likely to hold longer than small-holder swing traders, this accumulation puts ETH in a prime position to score historic gains in the weeks ahead.

But more importantly, the timing of the recent buying spree suggests that investors are buying the rumor with optimism that Bitcoin’s ETF approval will increase the likelihood that ongoing ETH applications will also obtain a positive verdict from the SEC.

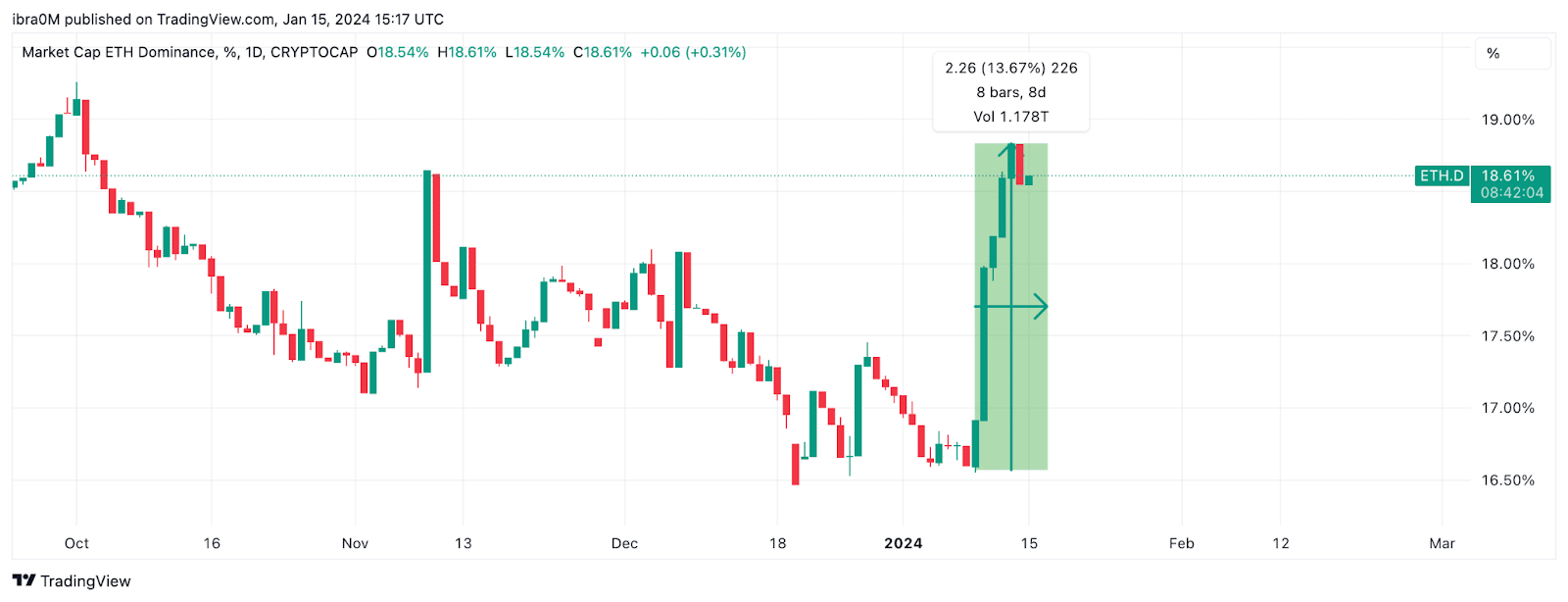

The Ethereum Dominance (ETH.D) chart further affirms this stance. Ethereum has cornered 14% more market share between Jan. 10 and Jan. 15, while Bitcoin price has declined at a nearly identical 15%.

This suggests that speculative traders are selling the news on BTC, rapidly buying the rumor ahead of a possible spot ETH ETF approval verdict.

ETH price forecast: can Ethereum reach $5,000 in 2024?

From the data points analyzed above, the large holder wallets’ accumulation and the rising ETH dominance suggest that the buy-the-rumor strategy is now widely in play in the Ethereum markets.

Given that Bitcoin had scored 97% gains in the build-up to the spot ETF approval verdict, a similar performance could put ETH in line to reach $5,000 in the instance of a positive outcome.

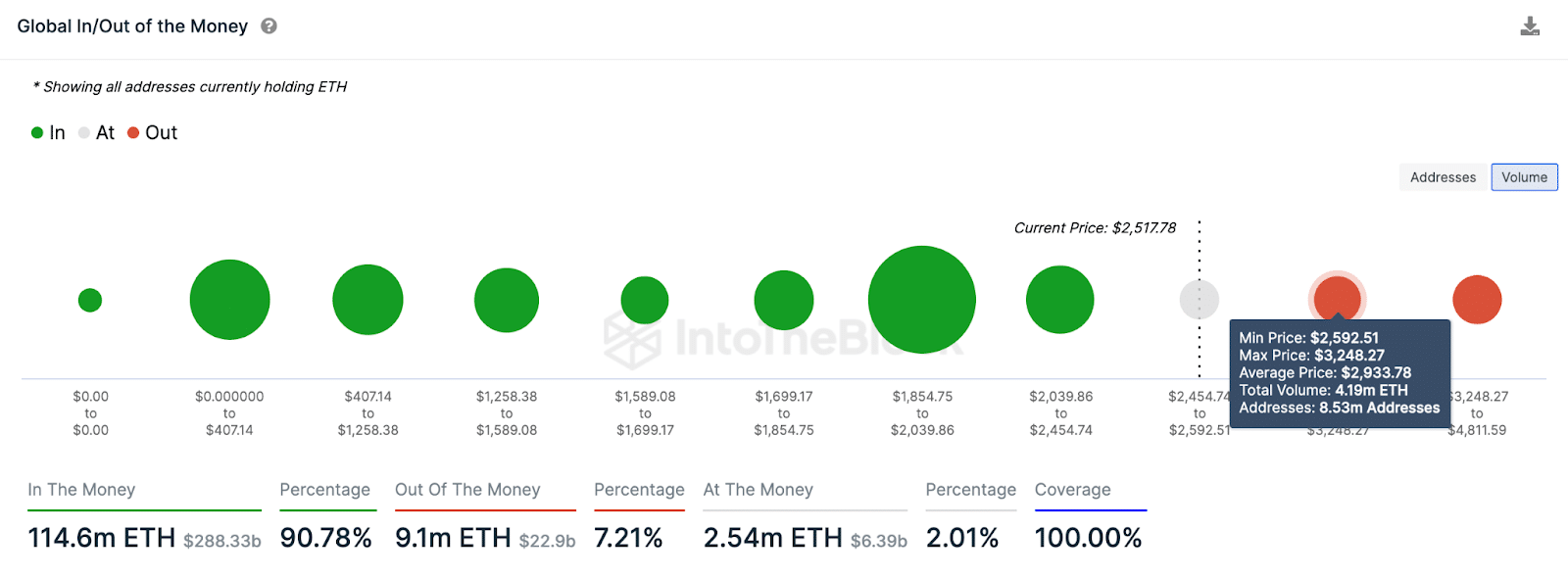

But in the short term, the ETH bulls will have to scale the $2,900 resistance to keep the momentum going. IntoTheBlock’s Global In/Out of the Money chart, which highlights potential support/resistance points using the historical entry prices of current ETH holders, also supports this ETH prediction

It shows that with ETH prices currently trading above $2,500, 91% of all ETH holders are now in profit positions. With the ETH ETF approval process on the front burner, these holders could increasingly become less inclined to sell.

However, the 8.5 million Ethereum holders who bought 4.1 million ETH coins could pose significant resistance if they book early profits as prices approach their break-even point.

The bears could negate this bullish prediction if the ETH price unexpectedly retreats below $2,000. However, 7.9 million investors acquired 43.4 million ETH at the maximum price of $2,039.

Considering this is the largest cluster of ETH current holders, they will likely have enough in the tank to overturn such bearish pressure.