Ethereum price grazed $4,100 territory in the early hours of March 12, but a profit-taking wave observed among long-term holders threatens to scuttle the rally.

After a blistering 73% rally over the last 30-days, Ethereum price rally has hit a brick wall at $4,100 mark. Can the bulls regroup for another brazen attempt at the $4,500 milestone or will ETH price surrender the $4,000 support.

Long-term investors traded 167,500 ETH within the last 24 hours

Unlike Bitcoin (BTC), which has entered the price discovery phase, Ethereum is still about 22% away from its $4,878 global peak. In essence, Ethereum price faces resistance and major historical accumulation clusters.

ETH price retraced 2% from the $4,100 to $3,967 in the early hours of March 12. On-chain data reveals unusually high trading activity among long-term investors who had been holding at a since 2021.

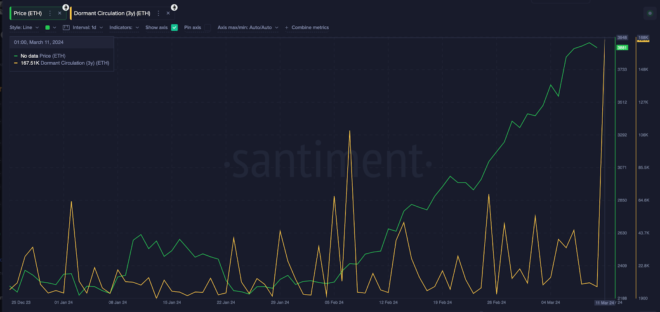

The Santiment chart below shows the number of recently traded coins that had been previously held unmoved for 3-yrs or more. This serves as a proxy for tracking impending sell-offs among long-term investors.

On March 11, investors shifted 167,500 ETH that previously held dormant since 2021 Valued at the the current ETH price of $4,020, the long-term investors have shifted over $1 billion within the last 24 hours.

When long-held coins begin to move at when prices approach a major resistance territory, it is a firm indication of an imminent profit taking spree.

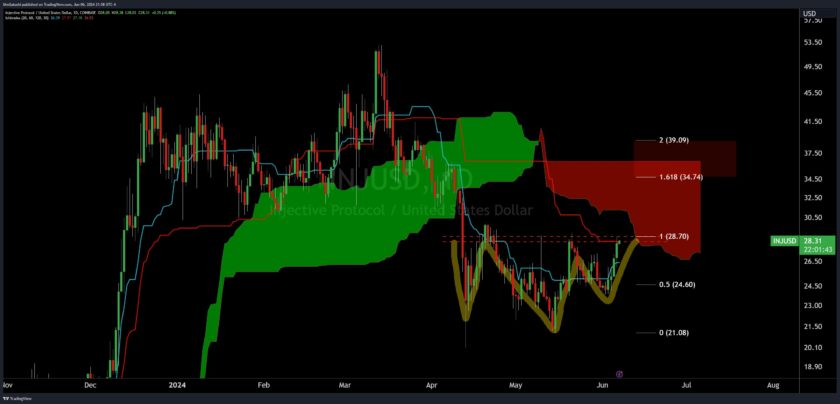

Ethereum price prediction: ETH could struggle to hold above $3,900

With over $1 billion worth of ETH flooding the market in the last 24 hours, Ethereum price could struggle to keep up the bullish momentum in the days ahead. In effect, the bears could attempt to trigger a downswing towards $3,900.

According to data pulled from IntoTheBlock, the ongoing profit-taking spree among the 1.34 million addresses acquired over 469,540 ETH at the average price of $4,100, could shift the momentum in favor of the bears.

If this scenario plays out, ETH price could slide toward $3,900.

On the upside, if the growing market demand surges high enough to absorb the $1 billion ETH supply, the bull can hold the $4,000 support and make another brazen attempt at reclaiming $4,500.