The crypto market has returned to the green with Ethereum (ETH) leading the recovery. The second crypto by market cap has seen bullish momentum on the back of a potential full transition to a Proof-of-Stake (PoS) consensus. The date for this event was announced two days ago.

Related Reading | TA: Ethereum Outpaces Bitcoin, Why ETH Could Rise To $1,500

This process will be completed with “The Merge”, an event set for September 19, 2022, with the objective of combining Ethereum’s execution layer with its consensus layer. ETH core developers have successfully carried out this process on the network’s main testnet.

As uncertainty around “The Merge” mitigates, crypto investors, grow increasingly bullish. At the time of writing, Ethereum (ETH) trades at $1,480 with a 10% profit in the last 24 hours and a 27% profit in the past week.

In the crypto top 10 by market cap, only ETH’s price records such an increase. Bitcoin records a 7% profit in the past week, while XRP and Solana record a 12% and 15% profit over the same period.

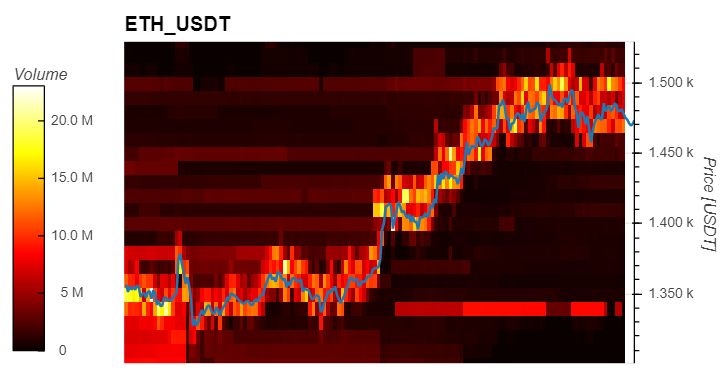

Data from Material Indicators shows liquidity for the ETH/USDT trading pair has been trending upwards with the price of the cryptocurrency. When ETH’s price broke above $1,350 it was able to quickly move into the $1,400 area.

This suggests that $1,300 has been flipped from resistance to support making it a key level in case of future downside price action. As seen below, bids have been moving up with ETH’s price with over $7 million buy orders at around $1,450 hinting at sustainable bullish price action.

Analyst Ali Martinez believes ETH printed a bullish four-hour candlestick when it broke below $1,300. At that time, the cryptocurrency broke from a multi-month consolidation gaining enough momentum to reclaim levels above $1,650.

The analyst believes ETH’s price is heading towards this area with the potential to hit $1,670. The next area to watch if ETH sees follow through into this area is $1,700.

Why The $1,700 Are Important For The Price Of Ethereum?

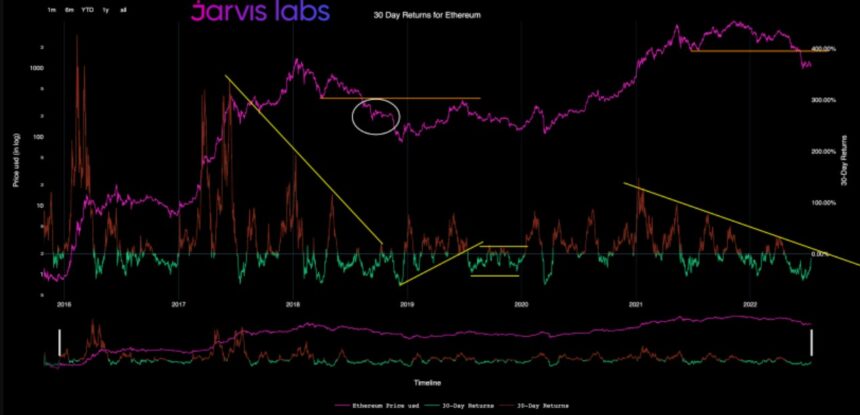

Additional data provided by JarvisLabs hints at an important shift in Ethereum market dynamics. The cryptocurrency saw a flipped in its 30-day returns, used to measure the short-term profit and loss for crypto investors in this period.

This metric has been trending towards 0% after moving in negative territory for multiple months. According to Jarvis Labs, a flip above 0% for Ethereum’s 30D returns could present investors with a selling opportunity.

Related Reading | XRP Must Breach This Key Level To Avert The Downturn

In the past, and during a bear market, whenever ETH’s 30D returns experienced a period of consolidation with a subsequent positive flip in the metric, the cryptocurrency saw severe crashes. Below there is a chart on what has happened to ETH’s price when it sees a similar performance, Jarvis Labs added:

If this fractal were to replay itself all pumps up to the $1700 level will trigger sell-offs for the next 1 year. Conversely, a flip of 1700 from resistance back to support would be equal to summer 2020’s flip of ~$350 and could signal the start of a brand new bull run.