“Digital euros are euros, but bank deposits are not euros. Deposits are just promises to pay euros, and if banks can’t fulfill those promises, then you get crises emerging,” he said, adding that a CBDC would have the benefit of stability, justifying the use of the digital euro instead of bank deposits.

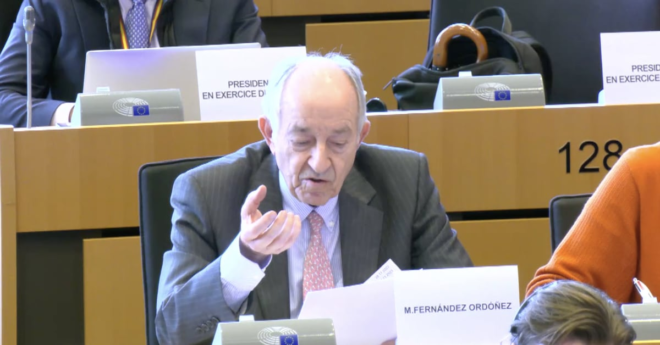

European Central Bank CBDC Can End Bank Crises, Better Than Deposits, Says Former Bank of Spain Chief Ordóñez