Several crypto ETF issuers are reportedly scrambling to amend SEC filings as odds for approved spot Ethereum products improved in the past 24 hours.

Wall Street titan Fidelity submitted an updated spot Ethereum ETF S-1 form with the U.S. SEC and removed all staking language, signaling dialogue with the regulator.

Multiple reports also emerged claiming the securities watchdog has instructed other issuers and national exchanges like Nasdaq to expedite improved spot Ether (ETH) ETF filings ahead of possible partial approvals.

At press time, crypto.news had yet to hear back from exchanges and providers on the matter.

https://twitter.com/eleanorterrett/status/1792902060754477452?s=46&t=TMI07H21nqgKjjcESnhqEQ

Fidelity’s amended S-1 form may confirm the SEC’s status quo on staking facilities tied to Ethereum’s proof-of-stake (PoS) consensus model.

Following The Merge in 2022, the agency opened investigations into the decentralized network and sued America’s largest crypto exchange, Coinbase, for allegedly offering unregistered securities via its Ethereum staking service.

The news on Fidelity’s filing arrived hours before the commission’s deadline to issue a final decision on two bids from VanEck and ARK 21Shares this week.

Grayscale Investments, whose CEO Michael Sonnenshein stepped down on May 20, also filed an updated 19b-4 for its Ethereum Mini Trust product. Van Buren Capital GP Scott Johnsson noted that Grayscale still hopes to treat Ether as a commodity, aligning with industry sentiment championing the crypto as a non-security asset.

Variant Fund Chief Legal Officer Jake Chervinsky said a green light for the fund could translate to a clearer classification for Ether and settle a year-long debate.

ETF approval chatter boosts Ethereum market

After filings suggesting the SEC may approve spot ETH ETFs, Ethereum reclaimed its $450 billion market cap and rose more than 22% in 24 hours, according to CoinMarketCap.

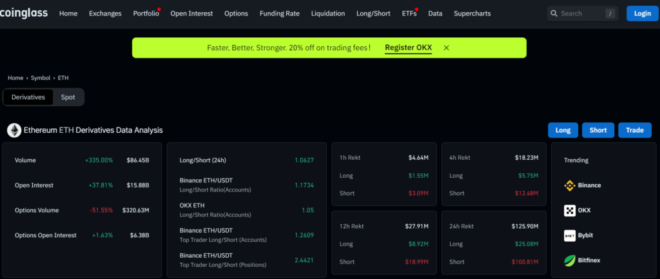

CoinGlass data also showed a record high for Ether futures on centralized exchanges. The aggregate open interest (OI) in unsettled contracts surpassed $15 billion for the first time. Binance boasted the lion’s share of trading activity with $5.97 billion in OI.