Read about five under-the-radar protocols that are expected to change the onchain game.

DeFi continues to defy expectations while refusing to be written off. In 2023 the decentralized finance sector has spawned new use cases while entering new ecosystems and chains. The sort of primitives that emerged in the early 2020s, for lending, borrowing, trading, and yield generation, have undergone a makeover.

The “swap token A for token B through a single liquidity pool” model popularized by Uniswap has evolved beyond all recognition: the forthcoming Uni v4 is scarcely recognizable from its predecessors. While the core of what DeFi does, supporting non-custodial transactions for onchain assets, hasn’t changed, the products available to consumers and enterprise users have. Today’s DeFi protocols are streets ahead of the first wave that blazed a trail. Here are five under-the-radar protocols that are reinventing the onchain game.

Dolomite

Dolomite is a DeFi money market that facilitates trustless lending and borrowing, but when you raise the hood, you’ll find there’s a lot more going on. Engineered to put idle capital to work, Dolomite’s primary goal is to maximize DeFi yields in a secure and transparent manner.

Primary features developed by Dolomite include loans backed by over-collateralization coupled with support for native assets. Notably, the latter feature ensures that tokens used for staking preserve their inherent functionality, such as voting rights, even as they remain locked within Dolomite’s ecosystem to generate yield.

The ultimate vision for Dolomite extends to becoming an inclusive DeFi hub, serving as a central platform for various protocols, yield aggregators, DAOs, market makers, and hedge funds. This will allow fund managers to proficiently manage their holdings and implement bespoke onchain strategies.

Aerodrome Finance

Aerodrome isn’t the first DEX to launch on Base, but it’s the first one that’s been developed specifically for Base. Created by the Velocore team, Aerodrome is a slick, feature-rich, and capital-efficient AMM that incorporates elements of Curve, Convex, and Uni v2. It uses the weights and gauges system that played a pivotal role in the last DeFi wave, with the AERO token used to reward LPs and veAERO used for governance.

Anyone can create a liquidity pool on Base using Aerodrome and veAERO holders can vote on whether it should receive incentives. Liquidity pools are separated into stable, volatile, and low TVL, allowing users to distinguish between them and the right pool for their needs. With a UX that rivals any DEX on any chain, Aerodrome is flying the flag for innovation on Base.

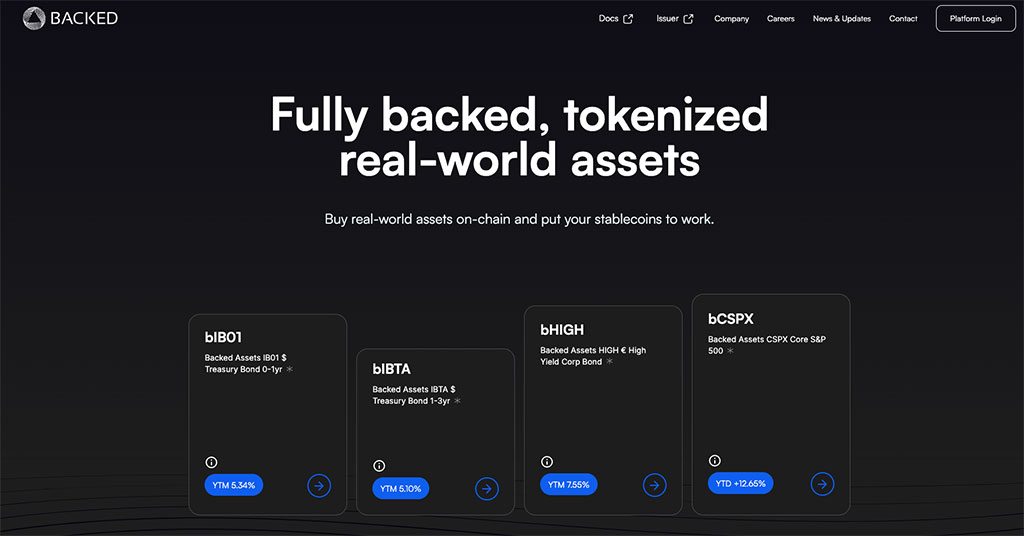

Backed Finance

Talk of real-world assets (RWAs) is everywhere right now as blockchains “discover” a new use case that has the potential to grow TVL, onboard enterprises, and demonstrate the versatility of web3. There’s a lot of noise in the RWA sector right now, but one project that’s proven capable of cutting through it and delivering tangible results is Backed. It provides an ingenious solution for earning yield on stablecoins while gaining exposure to RWAs.

Treasury bonds, stocks, and ETFs are all available, each of which is backed 1:1 by the underlying asset. These tokens can be used throughout the DeFi ecosystem, freeing protocols to create original ways of putting these assets to work. With more than $48M AUM, Backed is growing steadily while demonstrating that it’s possible to offer compliant financial products without impairing DeFi’s composability.

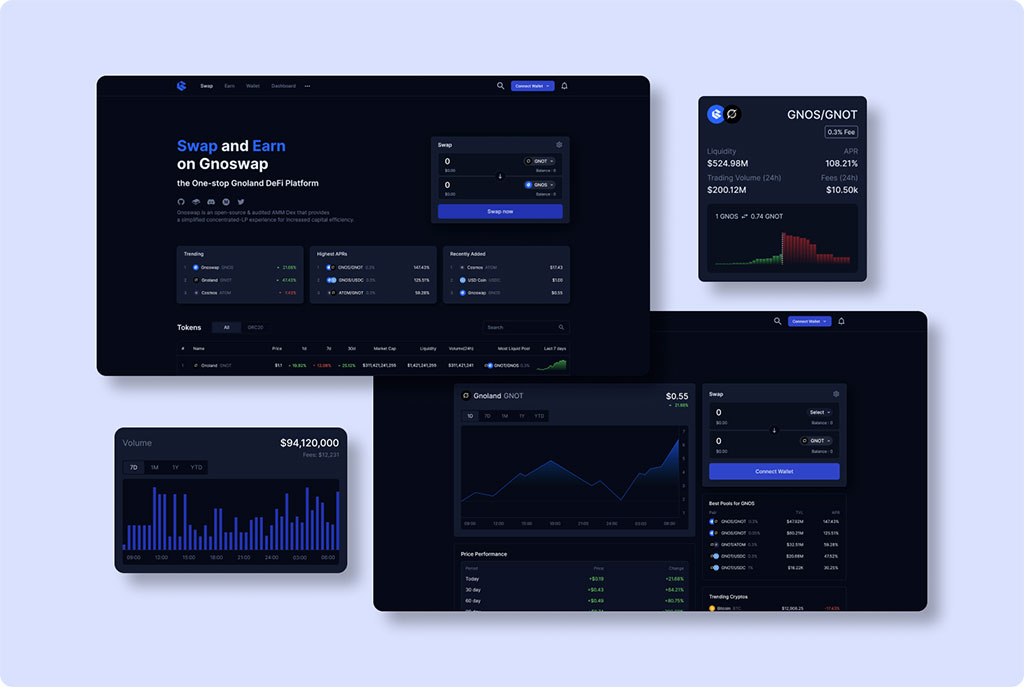

Gnoswap

As noted at the outset, DEXes have evolved greatly since Uniswap blazed a trail for non-custodial token swaps – or EtherDelta if you wanna go back further still to the origins of DEX trading. Gnoswap is an emerging exchange that’s designed for the Gnoland blockchain ecosystem, which utilizes a variant of the Go programming language, better known as Golang.

From a DeFi perspective, what’s novel with Gnoswap is its use of concentrated liquidity. By adopting the CLMM mechanism, Gnoswap enables liquidity providers to specify a price range where their liquidity becomes active, resulting in more competitive pricing and capital-efficient swaps. The CLMM ensures that liquidity is fully utilized to maximize the trading fees for LPs. Meanwhile, the DEX’s staking program offers a chance for LPs to maximize their asset’s capital efficiency and to own and govern the platform.

EquationDAO

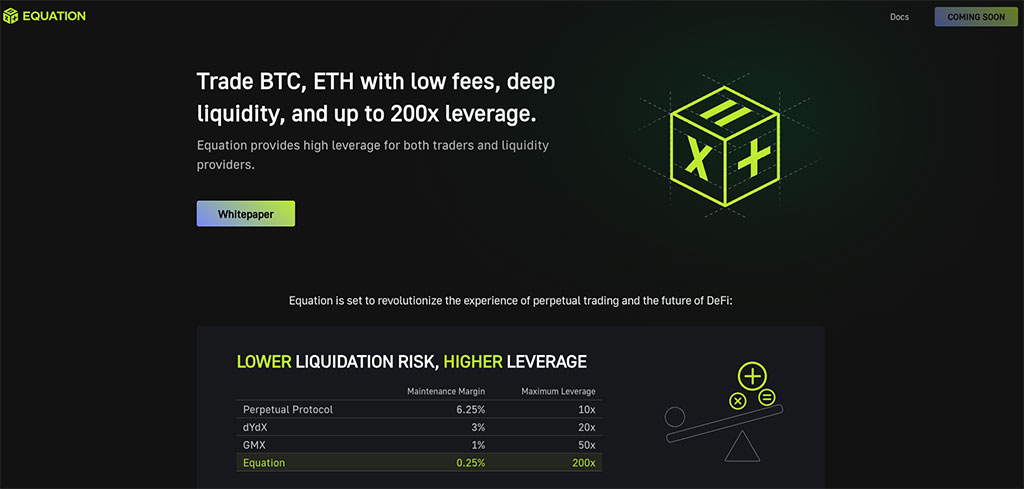

Arbitrum has become the home of onchain perps, with protocols like GMX, HMX, and GNS becoming synonymous with leveraged trading. The latest, up-and-coming player to enter the game, EquationDAO promises high-octane thrills in the form of 200x leverage coupled with deep liquidity that will enable assets like BTC and ETH to be traded on-chain.

With its innovative BRMM model, Equation aims to provide traders and Liquidity Providers (LPs) with up to 200x leverage. This model allows traders to establish larger and unrestricted positions while enhancing capital efficiency for LPs. Set to debut in September, Equation has garnered a lot of interest from perps traders seeking the potential to realize greater gains while preserving their capital.

Please check out latest news, expert comments and industry insights from Coinspeaker’s contributors.