Bitcoin (BTC) has four new key support levels to watch as a fresh wave of bearish BTC price action aims to push the market price below $50,000.

Key points:

-

Bitcoin’s realized prices remain important milestones as the market forms a long-term floor.

-

Binance users’ deposit cost basis is next up as a safety net, says analysis.

-

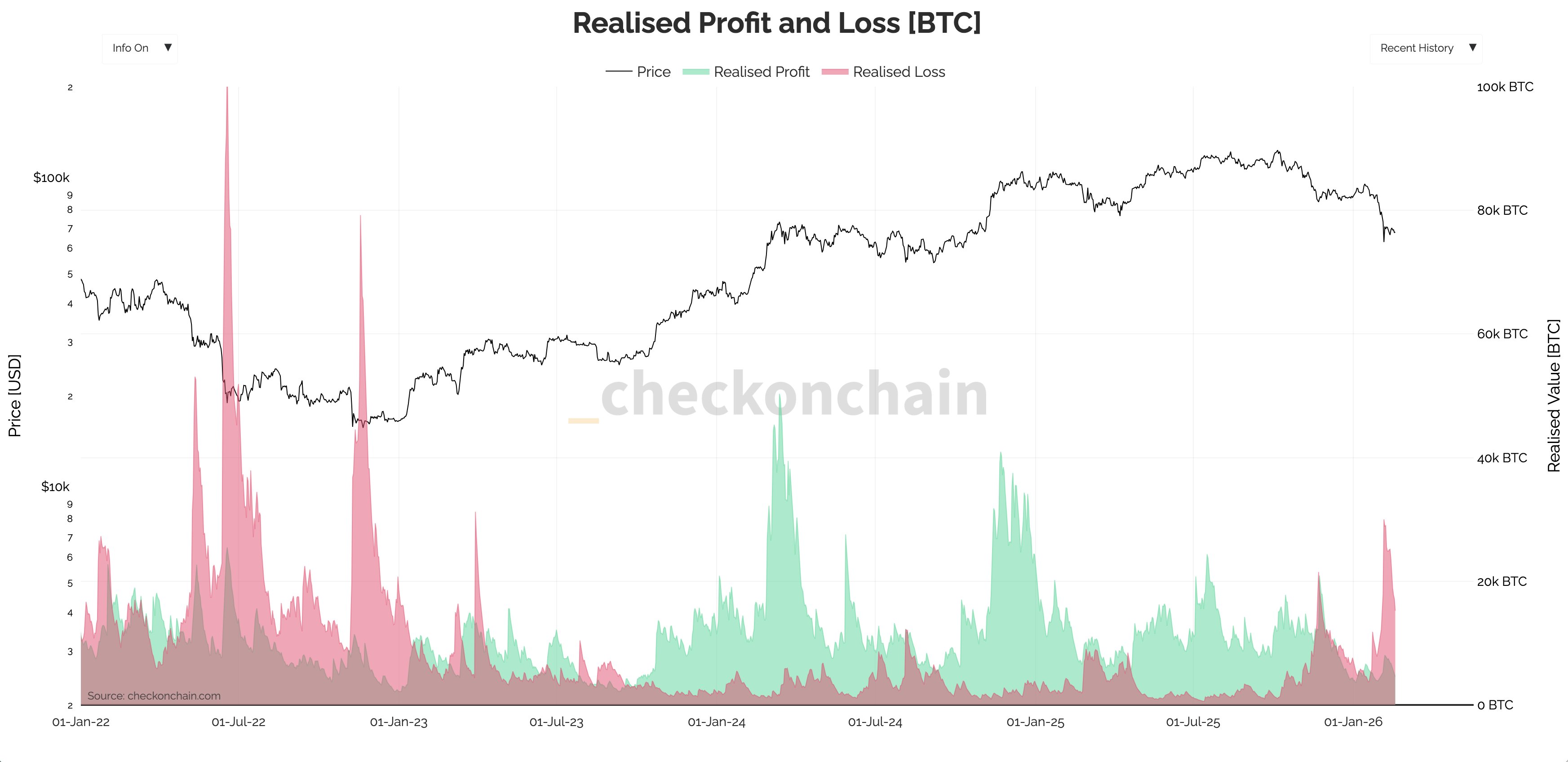

Realized losses reach levels unseen since the end of the 2022 bear market.

BTC price analysis puts focus on Binance traders

New analysis from Burak Kesmeci, a contributor to onchain analytics platform CryptoQuant, sees $58,700 as Bitcoin bulls’ next line in the sand.

“Which 4 levels am I watching in Bitcoin? 4 key realized price levels — essential for tracking the long-term trend in my view,” he wrote in one of CryptoQuant’s Quicktake blog posts on Wednesday, titled “Bitcoin’s Roadmap to the Bottom.”

Realized price refers to the aggregate cost basis of the BTC supply or a subset of it. When BTC moves onchain, its realized price becomes that at which it was last involved in a transaction.

Realized prices that involve larger groups of coins can often function as market support or resistance zones.

“Bitcoin has been dropping ever since it lost the New Whales’ cost basis — a classic bear cycle signal,” Kesmeci noted.

Newer Bitcoin whales’ aggregate buy-in price stands at $88,700, but with the price now far below, three others are on the radar. Older whales’ realized price is the lowest of the selection at $41,600, while Bitcoin’s overall cost basis now sits at $54,700.

Between the current spot price and those two levels, however, lies the realized price for deposit addresses (UDA RP) on major global crypto exchange Binance.

“From here, the 2 key supports I’ll be watching in order are Binance UDA RP and Bitcoin RP (58.7K and 54.7K),” Kesmeci added.

“The reason: once Bitcoin falls below New Whales’ cost basis, it historically tends to at least test the Realized Price. And the only support standing between here and there is 58.7K.”

Bitcoin losses echo 2022 bear market bottom

While panic selling from exchange users has cooled since BTC/USD rebounded from 15-month lows near $59,000 at the start of February, CryptoQuant data underscores the risk of further capitulation.

Related: Bitcoin 2024 buyers steady BTC price as trader sees $52K ‘next week or so’

The proportion of the BTC supply currently held at an unrealized loss has reached 46%, its highest reading since the end of Bitcoin’s 2022 bear market.

“It is worth noting that the correction has been so severe that the increase in supply held at a loss has occurred very rapidly,” CryptoQuant contributor Darkfost commented on X during the $60,000 swing lows.

Last week, meanwhile, Darkfost reported similarly conspicuous levels of realized losses from Bitcoin investors — coins moving at a lower price than in their previous transaction.

“At its peak, on February 5, realized losses exceeded 30,000 BTC,” he confirmed.

“This remains well below the extreme levels observed during the last bear market, when realized losses reached 92000 BTC and 80000 BTC on separate occasions. Nevertheless, it is still a clear sign that a capitulation phase has taken place.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.