Uniswap recently surpassed Coinbase Pro in trading volume, overtaking one of the most popular centralized exchanges in the space after reaching around half a billion dollars in daily volume.

Although Coinbase Pro is by no means the largest exchange out there, it seems that the decentralized sector is catching up to traditional crypto trading platforms.

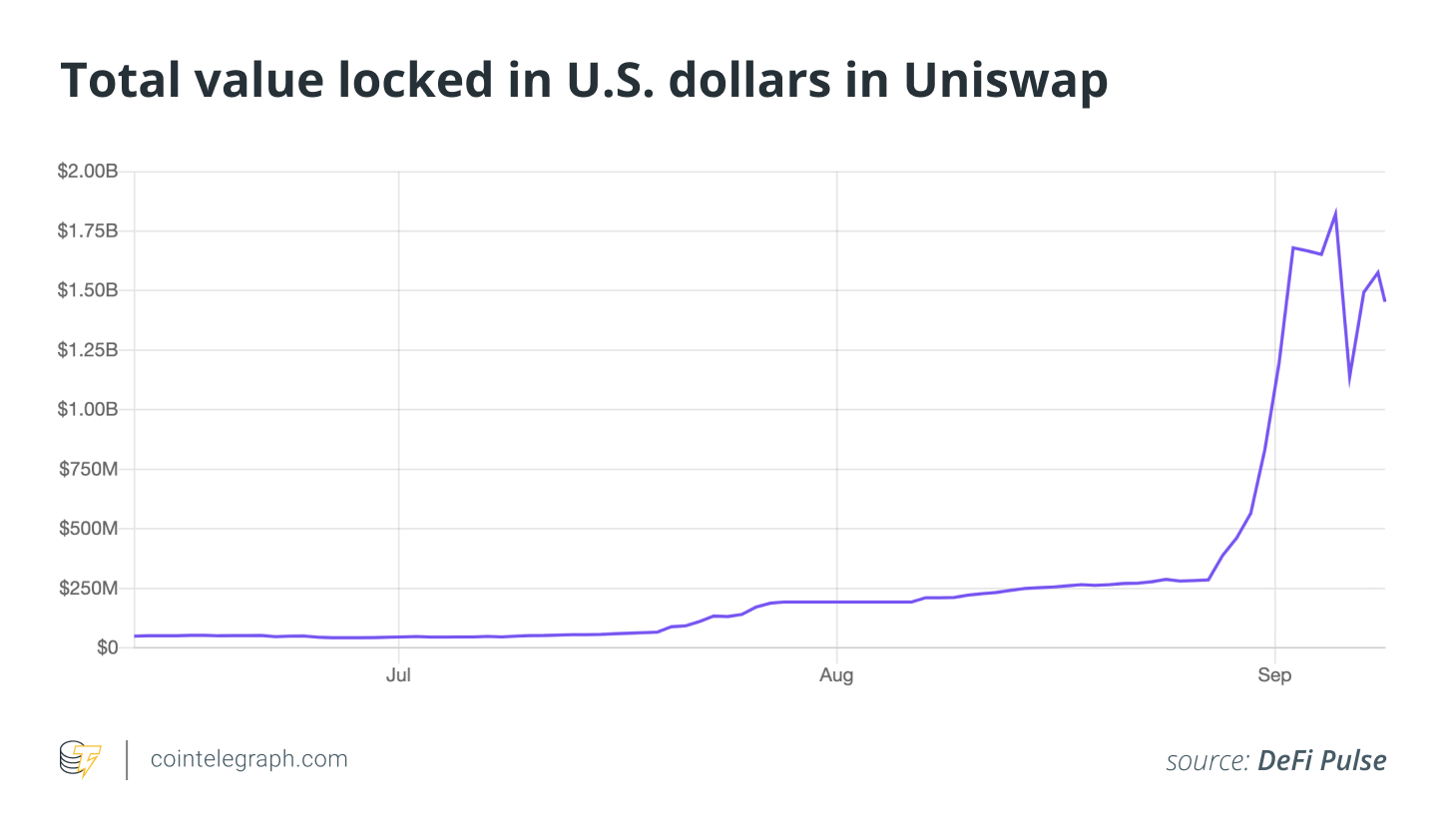

Uniswap is a decentralized exchange and automated liquidity protocol where users can buy and sell ERC-20 tokens and supply liquidity in order to earn exchange fees. This means that the more volume exchanged on the platform, the more rewards liquidity providers receive. The growing volume and, consequently, growing rewards explain why Uniswap’s total value locked is increasing so much, currently sitting close to $1.45 billion, making it the largest decentralized finance protocol out there, according to DeFi Pulse data.

Although decentralized exchanges have existed for a while, traditional centralized exchanges have always been more popular for a variety of reasons, the biggest of which is convenience. However, as technology progresses, DEXs are becoming increasingly sophisticated and easy to use. Here’s a closer look at decentralized exchanges and what they have to offer the crypto community and beyond.

Types of DEXs and popular implementations

There are several types of decentralized exchanges, with different implementations that are based on different networks. Popular examples include the aforementioned Uniswap, which is an Ethereum-based DEX, as well as Curve, dYdX, EtherDelta, Waves and many others.

Uniswap is an automated market maker, which means trades are automatically arranged through smart contracts that source funds from the aforementioned liquidity pools. This means that there is always liquidity for trades, but that the exchange itself is quite limited. While Uniswap (and its fork, SushiSwap) allow users to trade all sorts of ERC-20 tokens, Curve focuses on stablecoins, offering traders extremely low slippage, which does not always happen with all stablecoins that may have low liquidity.

While protocols such as Uniswap and Curve have become popular, 0x and EtherDelta were previously the most popular decentralized exchanges on Ethereum, although they look more like a typical exchange, featuring traditional order books but powered completely through smart contracts on the Ethereum blockchain.

Why are decentralized exchanges becoming popular?

Generally speaking, decentralized exchanges are becoming popular for the same reason that people like Bitcoin (BTC): They do not rely on any third party, so users control their funds at all times simply by plugging their wallet in and signing off on the transaction. Provided that the smart contract is safe, there is virtually no way of anyone misappropriating funds.

As such, decentralized exchanges are, in theory, impervious to hacks, although DeFi liquidity pools have previously been siphoned. Given that there is no centralized party involved, there is also no need to provide any additional information or documents or go through any Know Your Customer verification procedures.

It’s also worth noting that DEXs do not allow users to cash out into fiat currencies, only stablecoins. Moreover, given that these protocols are decentralized, there have been some issues with people adding fake tokens to the exchanges. Notably, Uniswap doesn’t have any listing rules. Nevertheless, DEXs have gained tremendous popularity. On Yavin, founder of Cointelligence and author of The Cointelligence Guide to Decentralized Finance, told Cointelegraph:

“We are in the middle of another financial crisis during 2020 due to the Coronav Virus pandemic and quarantine and that drives more people to be interested in alternative financial instruments and assets. I am sure it will continue and it might take a few years to grow and progress.”

Decentralized exchanges have some problems

There are both advantages and disadvantages to using decentralized exchanges, but the shortfalls seemingly outweigh the benefits. Moreover, centralized exchanges were, at one point, the only possible option, so they have had a starter’s advantage.

Lack of liquidity is the obvious issue that still persists, and while the growth in liquidity providers has clearly changed that, there is still a long way to go. Ilya Abugov, OpenData lead at DappRadar — a DeFi analytics platform — told Cointelegraph:

“Exchanges still need to be able to obtain and sustain meaningful liquidity levels. Given the recent meme-DeFi trend, they have to become and stay relevant. At the same time with speed and marketing coming to the forefront the tech needs to not become a liability.”

There are other drawbacks, as well, including high transaction fees that may jump unexpectedly in accordance with network congestion. Given the current state of Ethereum, this may be the biggest problem at this time.

User interface has always been thought of as an issue in DeFi too. While this may not be the biggest concern for some, ease-of-use and visually pleasant presentation are important when it comes to mainstream adoption. Given the nature of these platforms, UI may sometimes be harder to nail down, but it has certainly been evolving.

Decentralized exchanges do not offer the wide range of services and functions that other exchanges do, such as certain types of derivatives or margin trading or even having multiple services like the latter aggregated. Given that they are decentralized, there is no one to moderate cases of misuse or any other issues.

CeFi and DeFi: Interoperability, institutionalization and competition

So far in 2020, DeFi has become the talking point of the crypto world, and several institutional investors have also begun to dip their toes in the DeFi sector. Lanre Ige, research associate at 21Shares, told Cointelegraph that there are a few signs of institutional interest in altcoins and DeFi:

“It’s still very early to judge to what extent institutions will get involved in DeFi given that there currently aren’t many products that currently provide exposure to DeFi for the institutional investor. However, both are BNB and Tezos ETPs are two of our most popular historically and currently which is a signal of some institutional interest in altcoins and DeFi. We think this will grow as more products, such as ETPs, are available for DeFi.“

As such, interoperability, both within DeFi itself and with the traditional financial sector, becomes a major focus. Synthetix DEX is already bringing traditional assets to a decentralized setting and has seen major success in doing so, being the sixth-largest DeFi protocol at the time of writing. Other projects such as Komodo have focused on providing decentralized exchange services between different blockchains with atomic swap technology.

Related: Powering DeFi market: Overview of the top 5 DEXs by total trade volume

Some centralized exchanges such as Bitrue and OKEx have begun providing high-yield options, both through centralized and decentralized finance tools, as a means to compete with the continued expansion of DeFi. However, it’s unclear if the current growth will be sustained or if DEXs will eventually return to their lower-volume days. According to Abugov, decentralized exchanges still face some challenges in the long run:

“Exchanges may struggle with their incentives models. As more projects opt for governance tokens and liquidity mining to boost volumes, focus shifts from cheapest most user friendly experience for average traders and long-term viable models for liquidity providers to highest yield for farmers.”