GameFi, the fusion of gaming and decentralized finance (DeFi), attracts a set of investors that tend to choose projects based on their use case rather than money-generating potential.

The GameFi ecosystem attracts GenZ investors and gaming enthusiasts. As a result, it stands as an entry point for numerous first-time investors. A ChainPlay survey participated by 2428 GameFi investors revealed that 75% of the respondents joined the crypto space solely because of GameFi.

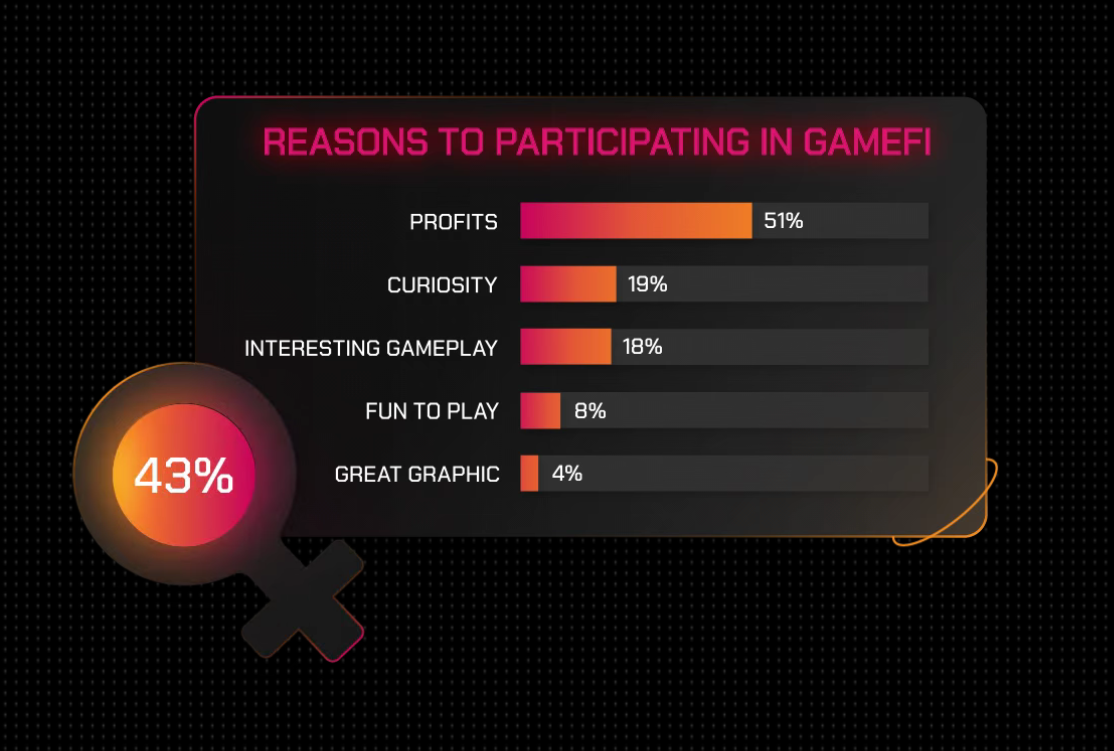

While roughly half of the investors joined the GameFi space initially for profits, 89% of GameFi investors succumbed to Crypto Winter 2022 — with 62% of them losing more than 50% of their profits.

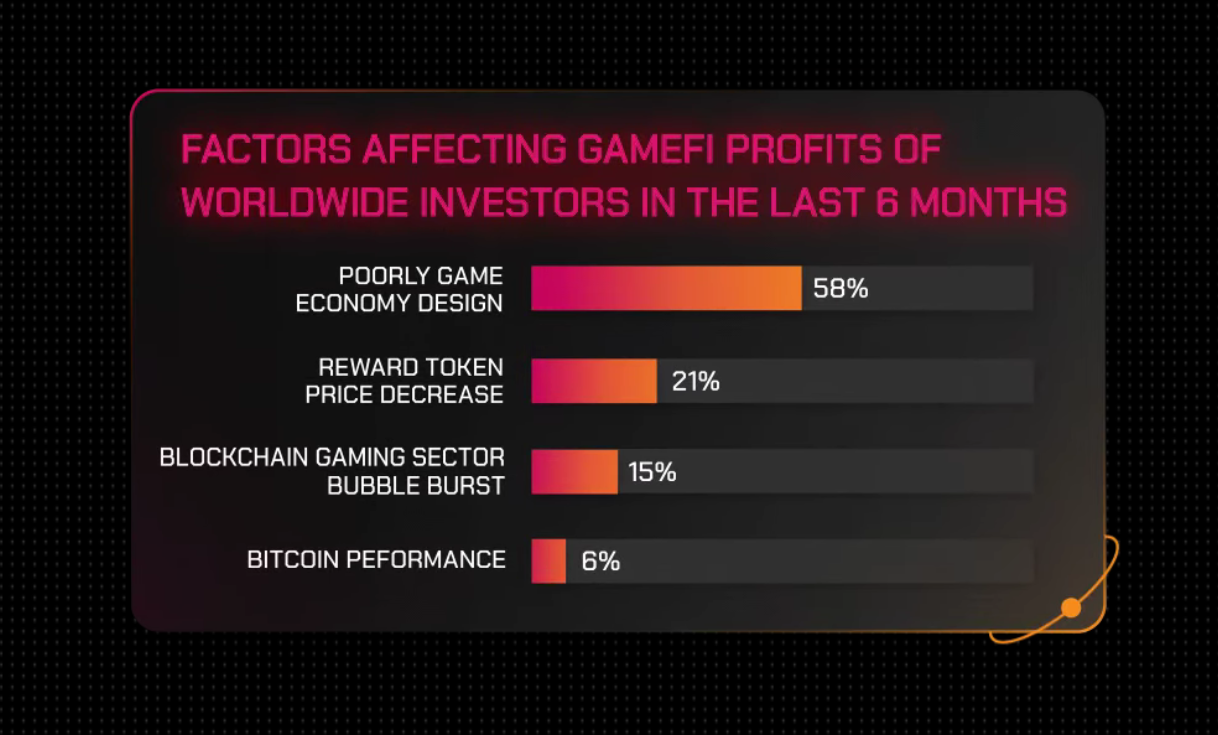

However, investors believe that poor in-game economy design was the main reason for their losses. In accordance with this sentiment, the survey revealed that, in 2022, investors worldwide spent an average of 2.5 hours per day participating in GameFi, which is down 43% to 4.4 hours from last year.

The fear of rug pulls and Ponzi schemes coupled with sub-par graphics are some of the biggest drivers preventing investments in new GameFi projects. As a result, 44% of investors believe that the involvement of traditional gaming companies can be key to GameFi’s growth.

Moreover, when it comes to future GameFi projects, 81% of GameFi investors are moving away from the traditional mindset and prioritizing the fun factor over profit-making as they seek positive in-game experiences.

Related: GameFi and crypto ‘natural fit’ for game publishers: KBW 2022

Blockchain gaming and the Metaverse were the least affected ecosystems by the Terra (LUNA) debacle, confirmed a DappRadar report.

In addition, a sustained institutional investment was seen in both blockchain gaming and the Metaverse, highlighting that many top companies see the potential for strong economic growth in both sectors moving forward.