With the approaching tsunami of central bank digital currencies (CBDCs) looming ever closer, it shouldn’t come as a surprise when central banks shill their coins at the expense of sounder assets. Recently, European Central Bank president Christine Lagarde went so far as to say that cryptocurrency is “worth nothing.” According to Lagarde, crypto has “no underlying asset” like the upcoming digital euro. But fiat money’s secret source of value is the real explosive scandal.

‘Worthless’ Innovation

European Central Bank President Christine Lagarde recently remarked that crypto is “worth nothing” and needs to be regulated. Nevermind the humor in trying to regulate something worthless, or her failure to understand subjective value, but the once-convicted criminal Christine said something that was very interesting:

[With crypto] there is no underlying asset to act as an anchor of safety.

She was making this observation in comparison to the upcoming digital euro central bank digital currency (CBDC), and claimed that “any digital euro, I will guarantee — so the central bank will be behind it and I think it’s vastly different.”

This begs the question of what guarantees the value of the euro itself, or the U.S. dollar, or any fiat currency. As their worth is supposedly established by the decree of governments (groups of mere individuals just like you and me), what then is the “underlying asset” which gives these currencies their value? In the case of government money, the answer might blow you away.

Guns vs. Gold, Silver, and Cowry Shells

Gold is sought after for its beauty, rarity, and utility. Societies across time have valued it almost ubiquitously, so it naturally became a good means of exchange and store of value.

Cowry shells have also historically enjoyed great currency (pun intended), and thanks to their limited quantity, ease of transport and transfer, and basically uniform units, were employed similarly. I’ve written an op-ed before on the erroneous idea that money is primarily a creation of the state. Money naturally arises in any given society where trade is occurring, regardless of politics: Jack has a wagon wheel. I have butter. I need a wagon wheel. Jack doesn’t need butter. A problem. But if we both like and have gold, or cowry shells, or bitcoin to trade — hey, problem solved.

States historically debase and devalue money, as Austrian economist Friedrich Hayek notes above, inflating it and building unsustainable credit bubbles. An early example of this is the Roman Empire, with the state progressively lowering the silver content of the denarius until it was almost nil. A modern example is the current global inflation crisis, brought on by the reckless and virtually endless printing of money.

Now, when a population is coerced into using certain monies at the forced exclusion of others they prefer, we are in the world of fiat, and there is effectively no (easy) escape from the bad money. Fiat means, literally, “by decree” — an arbitrary order. Merriam-Webster’s third definition of “fiat” contains an example that may be even more illustrative:

According to the Bible, the world was created by fiat.

Out of nothing. In the fiat world, central banks are God. Not just anybody can create money for market use. This privilege is afforded solely to the state. For a real life example of what this angry and vengeful god does when people freely try to make their own coinage or currencies, and use them against the will of the almighty, see here:

It does not matter how peaceful you are. It does not matter how beneficial to humanity your innovation or discovery is. If the money you create challenges the closed-market fiat hegemony, you will ultimately be presented with three basic options:

- Cease production and/or free use of your currency.

- Go to jail — or kill or be killed resisting being put in the cage.

- Find a “sly roundabout way,” to quote Hayek, to grow your economy and “introduce something they can’t stop.”

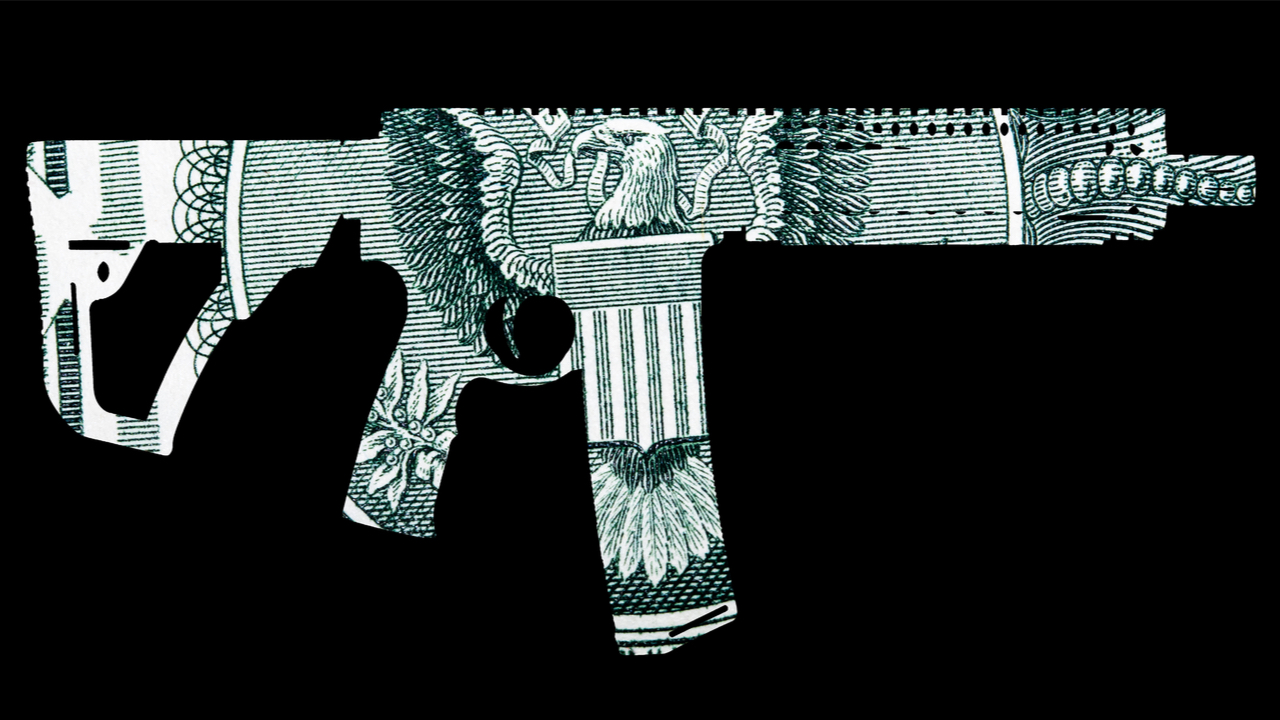

What I am driving at should be universally recognized, as obvious as it is. The underlying “value” of fiat money is guaranteed by a gun. By a legal monopoly on violence.

The reason inflationary and unsound fiat currencies like the euro remain dominant is because to use other, better currencies freely is forbidden. And when you’re from the holy pantheon of central bank elitists like Christine Lagarde, you simply cannot fail.

Take it from her:

The European Central Bank can neither go bankrupt nor run out of money even if it were to suffer losses on the multi-trillion-euro pile of bonds bought under its stimulus programmes.

Market Accountability and Crypto Competition

Let’s contrast the violent nature of fiat models for money, were those pointing out problems with the law, or trying to keep their own money are violated, with more voluntary models.

In a free and open market, if I decide to make a horrible crypto scam coin and dupe millions out of money, I may make a buck or two, but market actors learn something. One, they learn never to trust or do business with me again — thus severely compromising my ability to thrive in a given society aware of my fraud, even as a rich man. Those I scammed are now unlikely to let me participate in their markets to fulfill my needs. And two, they’ve learned how to better identify and control for avoiding similar scams in the future.

With government money, however, the scam itself is baked right into the regulations. The creator of the scam coin is able to demand everyone abandon their preferred assets, and switch over to his sh*tcoin. You may want to laugh in his face, but you can’t. He’s literally got a gun to your head.

Businesses everywhere are required by law to accept the government scam coin called fiat, and so in a complete lack of free market consequence, the scammers do whatever they want, and simply print more coins for themselves, devaluing the currency. All the while using this reckless printing to secure and hoard hard assets before the whole thing collapses.

Action Without Permission: The Escape From Fiscal Insanity

As purely peer-to-peer transactions are increasingly demonized in the mainstream media and so-called public discourse, private crypto transactions could come to be viewed just like the liberty dollar from the video above — illegal — with the scam coin creator (government) now having almost completely co-opted what started out as an experiment in freedom.

If this seems unrealistic or paranoid, keep in mind state-associated financial groups and central banks have already long been thinking about implementing measures to make non-custodial and unhosted crypto wallets illegal, as well as planning for the unified global regulation of bitcoin. As Lagarde said in early 2021:

It’s a matter that needs to be agreed at a global level, because if there is an escape, that escape will be used.

People definitely do want to escape the maniacal printing and debasement of monetary value. They want to escape being extorted to fund wars, and escape paying for the lavish lifestyles of legal criminals like Lagarde who suffer no consequences. The only way to stop this is through individual market action. Trading freely, en masse, regardless of what hypocrites in positions of illegitimate “authority” may say. Permissionless transactions at all levels — from grandiose purchases to tiny, everyday exchanges of value.

There are many ways to make sure scams, violent acts, and other undesirable actions are mitigated and defended against even in so-called unregulated, decentralized, stateless economies. But the first recognition that must be made to establish this more peaceful, rational, actually desirable “new normal,” is that the fiat system of money is predicated on violence and intentional ineptitude.

If Lagarde’s central bank-based digital euro will indeed be superior to peer-to-peer permissionless cash, what’s she so concerned about? Let the market decide. There’s no need to bring guns into this.

What are your thoughts on Lagarde’s recent statements about crypto? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Alexandros Michailidis

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.