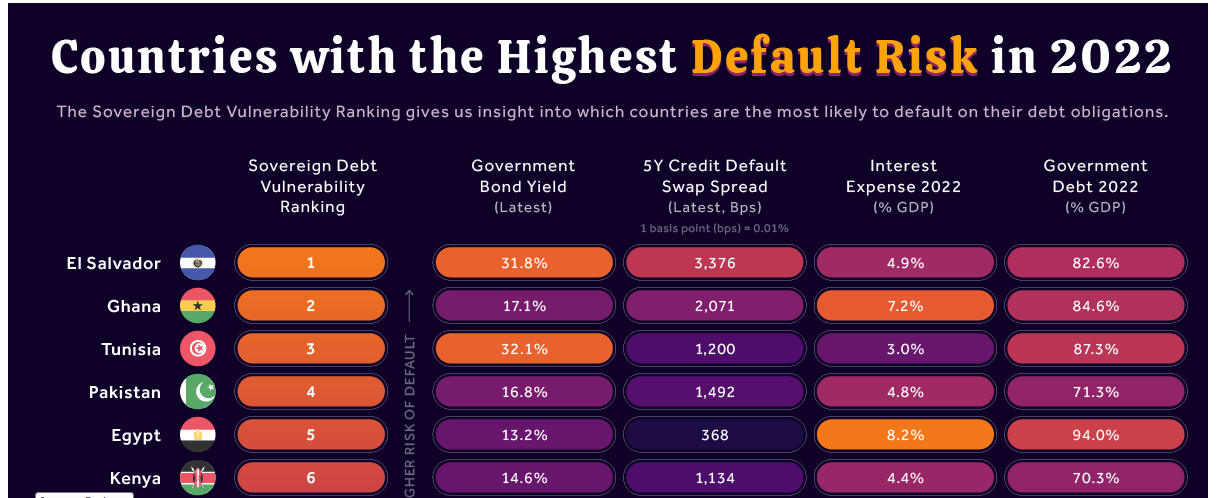

According to Visual Capitalist, Ghana is now placed second on its list of countries with the highest default risk in 2022. Only four countries, namely, Ukraine 10,856 basis points (bps), Argentina (4,470), El Salvador (3,376), and Ethiopia (3,035) have a credit default swap spread that is higher than Ghana’s at 2,071 bps.

El Salvador Has Highest Default Risk

After seeing inflation surge to over 29% in June, Ghana, West Africa’s second-largest economy, is now ranked as one of the countries most likely to default this year, Visual Capitalist’s latest sovereign debt vulnerability rankings have shown. According to the data, Ghana is now placed second, just behind the Central American state and the first country to make bitcoin legal tender, El Salvador.

As shown by data from Visual Capitalist — an online publisher focused on technology and the global economy, among others — Ghana’s five-year credit default swap spread (CDSS) of 2,071 basis points (bps) is one of the highest globally. Only four countries have a credit default swap spread that is higher than that of Ghana: Ukraine (10,856 bps), Argentina (4,470 bps), El Salvador (3,376 bps), and Ethiopia (3,035 bps).

As explained by Investopedia, CDS is “a financial derivative that allows an investor to swap or offset their credit risk with that of another investor.”

Interest Expense Ratio

Another metric pointing to Ghana’s likely default is the country’s interest expense as a percentage of the gross domestic product (GDP). According to Visual Capitalist data, with a share of 7.2%, Ghana’s interest expense ratio is the second-highest in the world behind only that of Egypt (8.2%).

When these metrics are combined with the country’s debt as a percentage of the GDP of 84.6%, and a government bond yield of 17.1%, Ghana, which finally agreed to seek the International Monetary Fund (IMF)’s help, looks destined to follow in the footsteps of Sri Lanka, which defaulted on its obligations in May.

Meanwhile, according to the Visual Capitalist rankings, Tunisia is the African country with the next highest default risk in 2022 and is followed by Egypt. Globally, Tunisia is ranked third while Egypt and Kenya are ranked fifth and sixth, respectively. Completing the top ten countries with the highest default is Namibia.

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.