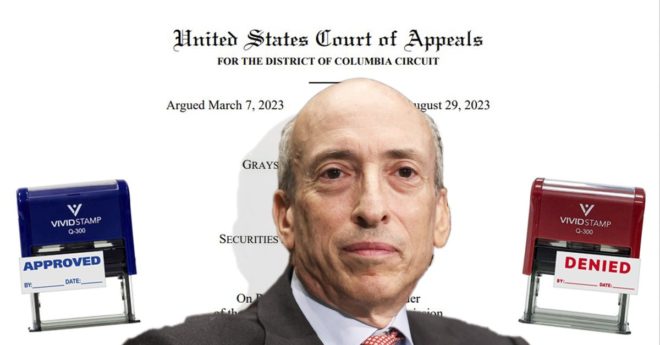

The U.S. securities regulator, led by Chair Gary Gensler, now faces several options: appeal the decision; grant Grayscale’s application to list its bitcoin spot ETF; let it be automatically approved by doing nothing; or start up a new, second effort to reject the application based on fresh objections. Much of the industry celebrated Tuesday, assuming this is the beginning of the end of this particular SEC roadblock for crypto, and bitcoin’s 6.5% price climb offered evidence of that optimism. But Gensler has been famously skeptical of crypto and the dangers he says it poses to investors.

Grayscale ETF Court Rout Puts SEC in Will-They, Won’t-They Role Starring Gensler