Coinspeaker

Hash Ribbon Signals End to Bitcoin Miner Crisis: What’s Next for BTC?

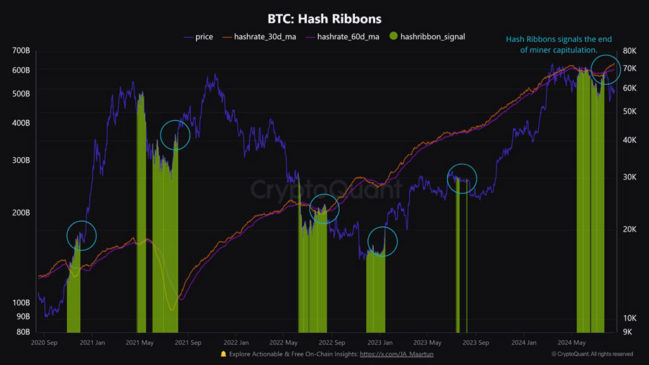

After the April post-halving event, which cut Bitcoin (BTC) miners’ revenue by half, the mining sector was hit by a profitability crisis (miner capitulation). However, after over three months, the segment’s health has seen improved recovery per the Hash Ribbon metric.

Per CryptoQuant, a crypto analytic platform, the metric has flashed an ‘end to miner capitulation’ signal.

For context, the metric tracks miner stress or crisis (green) and always coincides with a sharp drop in hash rate (the computational power needed to mine BTC).

The BTC miner crisis tends to force subscale and less-optimized players out of the market. However, major actors like MARA always adopt new machines and optimization techniques to stay afloat.

Will Less Miner Supply Allow BTC to Rally?

CryptoQuant noted that miners had adopted more effective equipment as BTC hashrate recovered and hit an all-time of 638 EH (exa hashes).

‘This is logical given that the Hash Rate has just reached a new all-time high of 638 EH/s. Miners are beginning to use more efficient equipment, turning their machines back on and becoming less likely to sell.’

In fact, miners like Marathon Digital have been holding their mined BTC and ramping up their acquisition spree.

Does that mean the supply pressure from BTC miners could be over?

Photo: IntoTheBlock

Most probably. According to Into The Block data, Miners’ Flow Volume Share has declined from its recent peak of 20% in May to below 10% in August. Miners’ Flow Volume Share tracks miners’ activity relative to the overall on-chain volume.

In short, the impact of miners on BTC prices has declined considerably over the past three months.

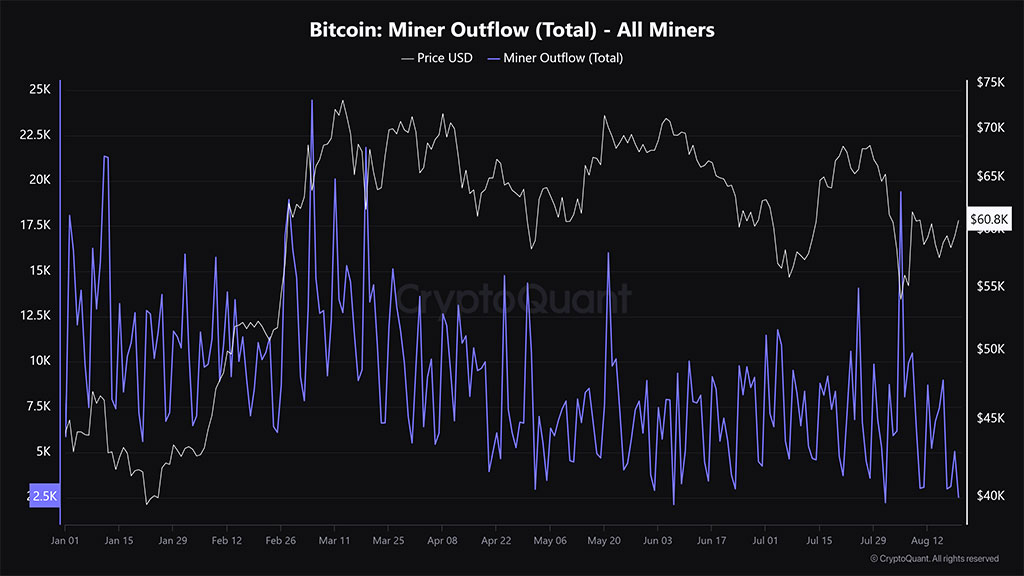

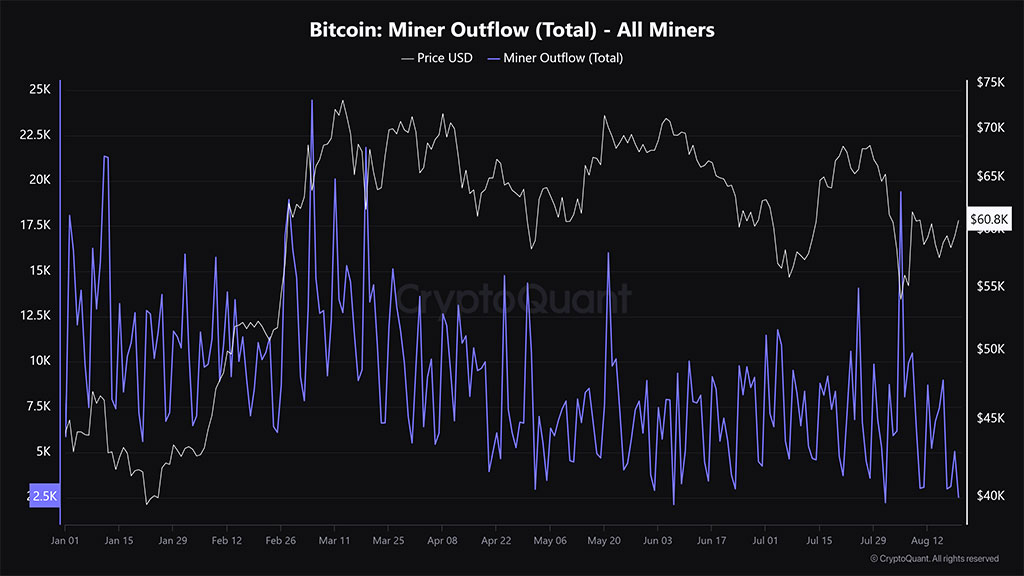

This trend was further supported by decreasing BTC sent from miner wallets to centralized exchanges as tracked by Miner Outflows.

Photo: CryptoQuant

After the April halving, BTC Miner Outflows trended higher between May and August. There were notable spikes of 16K BTC and 19K BTC moved to exchanges on 21 May and 5 August, respectively. These were supply pressures as miners sold part of their holdings to cover operational costs.

However, the Miner Outflows have declined significantly to 2.5K BTC as of press time. The reduced selling pressure from miners could allow BTC prices to rally and reverse recent losses.

BTC Price Analysis

Photo: TradingView

- On the daily chart, BTC has struggled to stay above $60K since the massive dump to $49K in early August. At the time of writing, it attempted to reclaim the range-lows ($60.7K).

However, BTC was still in a bearish market structure, as the price was below the 200-day SMA (Simple Moving Average). The 200-day SMA also aligned with the short-term supply near $63K.

So, BTC’s prospects of further recovery could only improve if the supply area at $63K was cleared and flipped into support.

Hash Ribbon Signals End to Bitcoin Miner Crisis: What’s Next for BTC?