Top Stories of The Week

SEC’s crypto pivot has ‘not been priced in,’ Bitwise exec says

Crypto investors may be underestimating the extent of the US securities regulator’s new stance on crypto, meaning that crypto prices would still have room to grow, according to Bitwise chief investment officer Matt Hougan.

US Securities and Exchange Commission Chair Paul Atkins published a speech he gave on July 31 at the America First Policy Institute about how blockchain will be integrated into the financial markets.

Hougan on Tuesday said the speech caught him “off guard” and left him wondering whether Atkins’ vision had been priced into the market.

“The most bullish document I’ve read on crypto wasn’t written by some yahoo on Twitter. It was written by the chairman of the SEC,” Hougan said. “I can’t imagine reading the speech and not wanting to allocate a significant portion of your capital to crypto, or, if you work in finance, a significant portion of your career.”

Vitalik backs Ethereum treasury firms, but warns of overleverage

Ethereum co-founder Vitalik Buterin threw his support behind Ether treasury companies, but warned that the trend could spiral into an “overleveraged game” if not handled responsibly.

In an interview with the Bankless podcast released on Thursday, Buterin said the growing number of public companies buying and holding Ether was valuable because it exposes the token to a broader range of investors.

“There’s definitely valuable services that are being provided there,” Buterin said. He added that companies buying into ETH treasury firms instead of holding the token directly gives people “more options,” especially those with “different financial circumstances.”

So-called crypto treasury companies have become a hot trend on Wall Street, garnering billions of dollars to buy up and hold swaths of cryptocurrencies, with the most popular plays being Bitcoin and Ether.

Trump to sign executive order punishing financial institutions for ‘debanking’: Report

US President Donald Trump is set to sign an executive order on Thursday instructing federal bank regulators to identify and fine financial institutions that engaged in “debanking.”

According to Bloomberg on Thursday, citing a senior White House official, regulators will be required to review complaint data, while financial institutions under the purview of the Small Business Administration will be asked to make efforts to reinstate clients who were unlawfully denied banking services.

Debanking has been a key concern among some political groups, who argue that businesses such as gun manufacturers and fossil fuel companies have been denied banking services for ideological reasons.

It was also a common complaint among crypto companies. During the administration of former President Joe Biden, allegations emerged of a new initiative called “Operation ChokePoint 2.0,” which some believed was an attempt to drive the crypto businesses offshore during the 2022 bear market.

Binance founder Changpeng Zhao seeks dismissal of $1.8B FTX lawsuit

Former Binance CEO Changpeng Zhao asked the court to dismiss a lawsuit by FTX that seeks to recover almost $1.8 billion from a deal between Binance and FTX, which the defunct exchange claims was fraudulently transferred.

Zhao told a Delaware bankruptcy court that the suit looks to “nonsensically blame” him for the actions of Sam Bankman-Fried, FTX’s founder, who was jailed for 25 years after a high-profile fraud trial.

Zhao, a resident of the United Arab Emirates, argued that the suit’s claims “are so far removed” from the US that “the statutes at issue, which lack extraterritorial application, do not even apply.”

FTX sued Zhao, Binance and other then-executives in November, claiming that FTX fraudulently transferred around $1.8 billion in crypto to Binance in 2021 to buy back shares that the exchange had purchased.

US government announces ChatGPT integration across agencies

US President Donald Trump’s administration has signed a deal with OpenAI to provide the enterprise-level version of the ChatGPT platform to all federal agencies in an effort to “modernize” operations.

Under the deal, all US government agencies will have access to the AI platform for $1 per agency to facilitate integration of AI into workflow operations, according to a Wednesday announcement from the US General Services Administration (GSA).

The GSA, which is the US government’s procurement office, said the private-public partnership “directly supports” the White House’s AI Action Plan, a three-pillar strategy to establish US leadership in AI development recently disclosed by the administration.

Winners and Losers

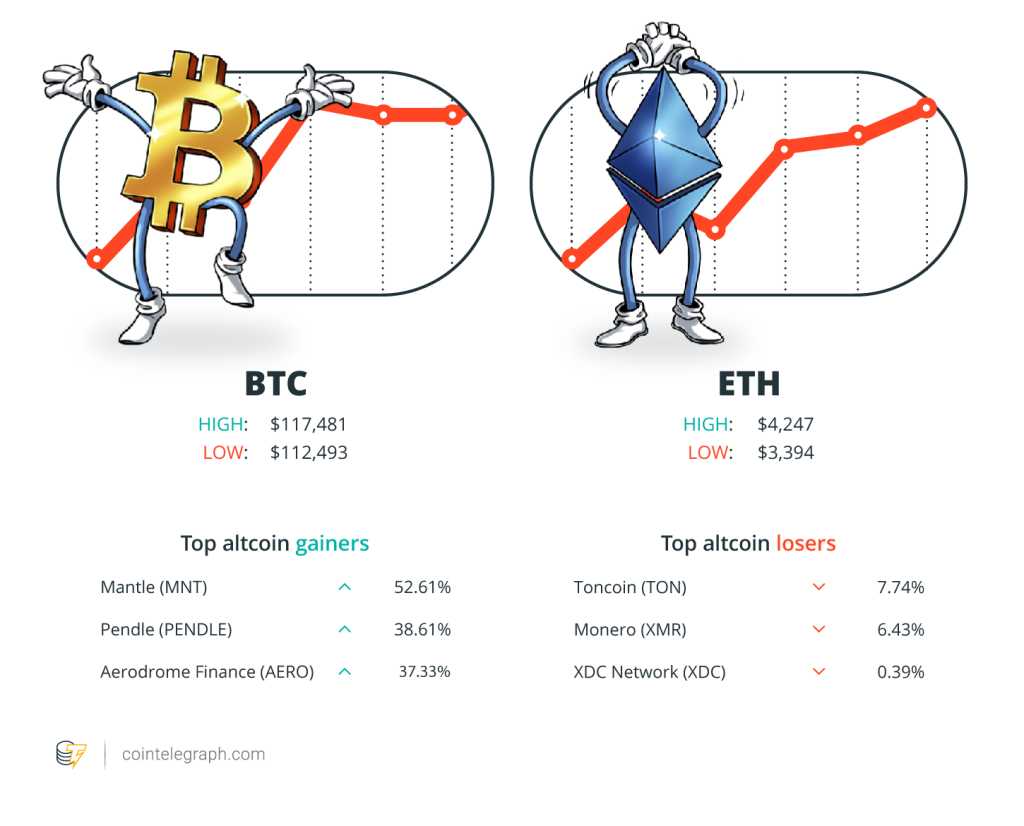

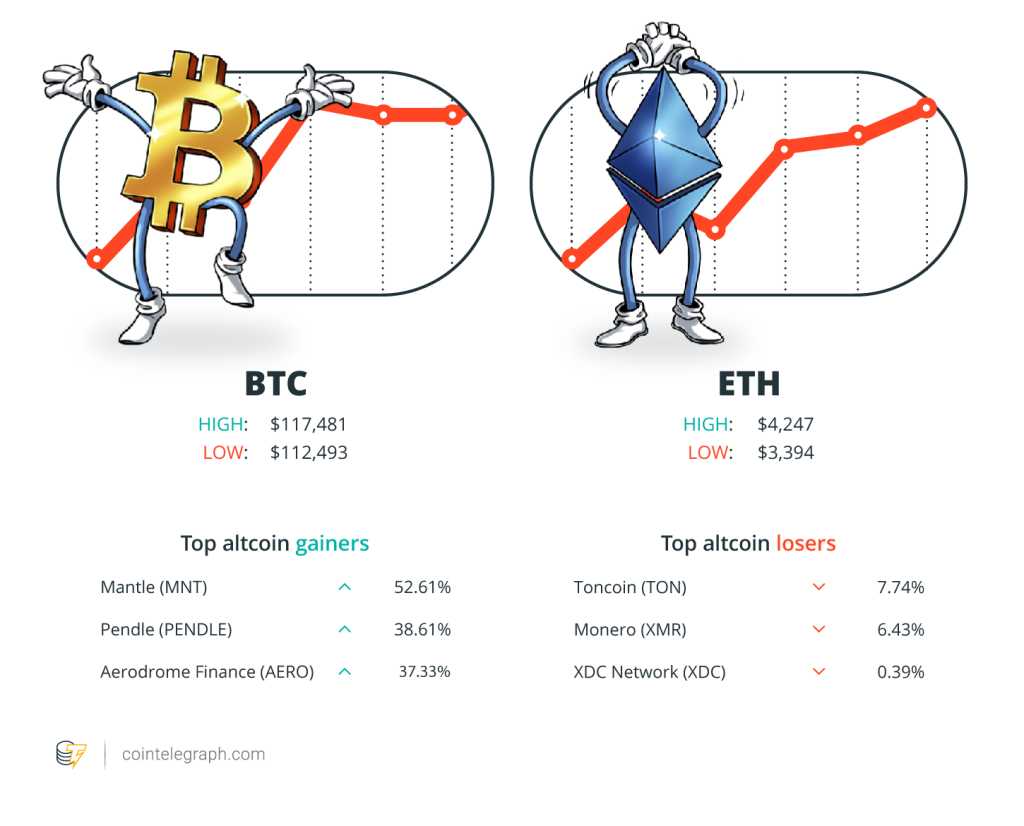

At the end of the week, Bitcoin (BTC) is at $116,618, Ether (ETH) at $4,156 and XRP at $3.31. The total market cap is at $3.93 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Mantle (MNT) at 52.61%, Pendle (PENDLE) at 38.61% and Aerodrome Finance (AERO) at 37.33%.

The top three altcoin losers of the week are Toncoin (TON) at 7.74%, Monero (XMR) at 6.43% and XDC Network (XDC) at 0.39%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“I’ve learned a lot about politics and how the game is played this year. I’m thinking about raising a $100m-$200m PAC, anchored by Nakamoto, to advance Bitcoin priorities.”

David Bailey, CEO of BTC Inc and crypto adviser to US President Donald Trump

“Last time it [Bitcoin] looked like this it was before the run from $70k to $100k.”

Galaxy, pseudonymous crypto trader

“The most bullish document I’ve read on crypto wasn’t written by some yahoo on Twitter. It was written by the chairman of the SEC.”

Matt Hougan, chief investment officer at Bitwise

“I was very surprised. Earth is so small. Basically, we could almost see the entire thing from the window, and that’s when it came to me, the mission’s name is right on point.”

Justin Sun, founder of Tron

“We should take concrete steps to protect people’s ability not only to communicate privately, but to transfer value privately, as they could have done with physical coins in the days in which the Fourth Amendment was crafted.”

Hester Peirce, commissioner at the US Securities and Exchange Commission

“Within alternative asset classes, digital assets and hedge funds have been seeing an acceleration of inflows this year, in sharp contrast to the weak fundraising seen in private equity and private credit.”

Nikolaos Panigirtzoglou, managing director at JPMorgan Chase

Prediction of The Week

Bitcoin may still have steam for $250K this year: Fundstrat’s Tom Lee

Fundstrat co-founder and BitMine chairman Tom Lee said Bitcoin may reach $250,000 in 2025, despite other crypto analysts cautiously pulling back targets.

“I think Bitcoin should really build upon this 120 before the end of the year; 200,000, maybe, 250,” Lee told Natalie Brunell on the Coin Stories podcast on Tuesday.

Read also

Last November, Lee gave a 12-month deadline for Bitcoin to reach $250,000.

While analysts like BitMEX co-founder Arthur Hayes and Unchained’s market research director Joe Burnett have recently echoed a similar price target for the year, others have adopted a more cautious outlook with less than five months left until the end of 2025.

In May, Bernstein and Standard Chartered set their year-end Bitcoin targets at $200,000, while 10x Research’s Markus Thielen recently projected a more modest $160,000.

Top FUD of The Week

Crypto exec to pay $10M to settle SEC claims over betting on TerraUSD

The creator of a now-defunct lending platform agreed to pay more than $10.5 million to settle US Securities and Exchange Commission claims that he used investor funds to buy millions worth of the stablecoin TerraUSD before it collapsed.

Huynh Tran Quang Duy, also known as Duy Huynh, told customers of his firm, MyConstant, that their money would go into a loan matching service backed by crypto that would yield 10%, the SEC said in an order on Tuesday.

The agency claimed that in reality, Huynh used $11.9 million of his customers’ money to buy TerraUSD, a stablecoin tied to the Terra blockchain that collapsed in mid-2022 and wiped out billions of dollars in value.

MyConstant was one of several crypto-linked businesses hurt by Terra’s collapse, which is estimated to have flushed half a trillion dollars from the crypto market.

The company has faced regulatory action since late 2022, when California’s finance regulator accused it of violating the state’s securities laws and ordered it to cease operations.

James Howells pivots from landfill dig to tokenization in lost Bitcoin saga

Twelve years after accidentally throwing away a hard drive containing 8,000 Bitcoin, James Howells is abandoning his long-running effort to excavate it from a Newport landfill. Instead, he plans to launch a new token inspired by the lost coins.

Read also

Howells, whose quest included legal battles, drone surveys and a 25-million British pound offer ($33.3 million) to buy the landfill outright, told Cointelegraph he’s shifting focus from physical recovery to a blockchain-backed project.

Rather than trying to dig up the stash, he aims to turn the story of the lost Bitcoin into a DeFi token — symbolically “vaulting” what can no longer be accessed.

In 2013, Howells mistakenly tossed the drive while tidying his office in Newport, South Wales. He had mined the 8,000 BTC when each coin was worth less than $1. Today, the lost stash is worth about $905 million, and his story has become a cautionary tale for anyone who self-custodies their crypto.

Crypto investor falls victim to phishing scam, loses $3M with single click

A cryptocurrency investor lost $3 million in a phishing scam after signing a malicious blockchain transaction without verifying the contract address, highlighting the risk posed by digital asset scams.

A single wrong click was all it took to drain $3 million worth of USDT from an investor who failed to verify the contract address before signing the blockchain transaction.

“Someone fell victim to a phishing attack, signed a malicious transfer, and lost 3.05M $USDT,” according to a Wednesday X post from blockchain analytics platform Lookonchain. “Stay alert, stay safe. One wrong click can drain your wallet. Never sign a transaction you don’t fully understand.”

Top Magazine Stories of The Week

How Ethereum treasury companies could spark ‘DeFi Summer 2.0’

Ethereum treasury companies will compete for yield in DeFi to be able to raise ever more funds from TradFi investors. The race has already begun.

Philippines blocks big crypto exchanges, Coinbase scammer’s stash: Asia Express

India freezes millions in assets tied to jailed Coinbase scammer, the MAS says Tokenize Xchange may have commingled customer funds and more.

Moonbirds floor price surges: Can Spencer pull a Luca Netz? NFT Creator

The former NFT blue chip project Moonbirds is surging again under new leader Spencer, an NFT trader with a builder’s mindset.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He’s also a standup comedian and has been a radio and TV presenter on Triple J, SBS and The Project.