Hong Kong has launched a public consultation on how to implement the international Crypto-Asset Reporting Framework, or CARF, as it moves to bring crypto tax data sharing in line with global standards.

According to a Tuesday news release, Hong Kong is seeking input on both the implementation of CARF and changes to tax reporting standards. The announcement explicitly ties the move to the local administration’s efforts to fight cross-border tax evasion.

The move constitutes standardization rather than a change of direction by the local government. As the announcement points out, Hong Kong authorities have been annually exchanging financial account information with partner jurisdictions since 2018.

Hong Kong’s secretary for financial services and the Treasury, Christopher Hui, said adopting CARF would demonstrate the government’s “commitment to promoting international tax co-operation and combating cross-border tax evasion.”

In addition to joining CARF, Hong Kong is also seeking comments on adopting the Common Reporting Standard (CRS). Just like CARF, CRS is an Organisation for Economic Co-operation and Development (OECD) initiative that aims to standardize aspects of tax reporting internationally.

Related: Japan’s new crypto tax could wake ‘sleeping giant’ of retail investors

CARF sees widespread international adoption

CARF has gained traction with regulators worldwide. In early November, reports indicated that 47 national governments had issued a joint pledge to adopt it quickly. Brazil has also reportedly been considering joining the data exchange program.

Others appear to be dragging their feet. At the end of November, Switzerland delayed implementing CARF until 2027 and is still deciding which countries it will share data with. Also in November, the US was reviewing the Internal Revenue Service’s (IRS) proposal to join the CARF program.

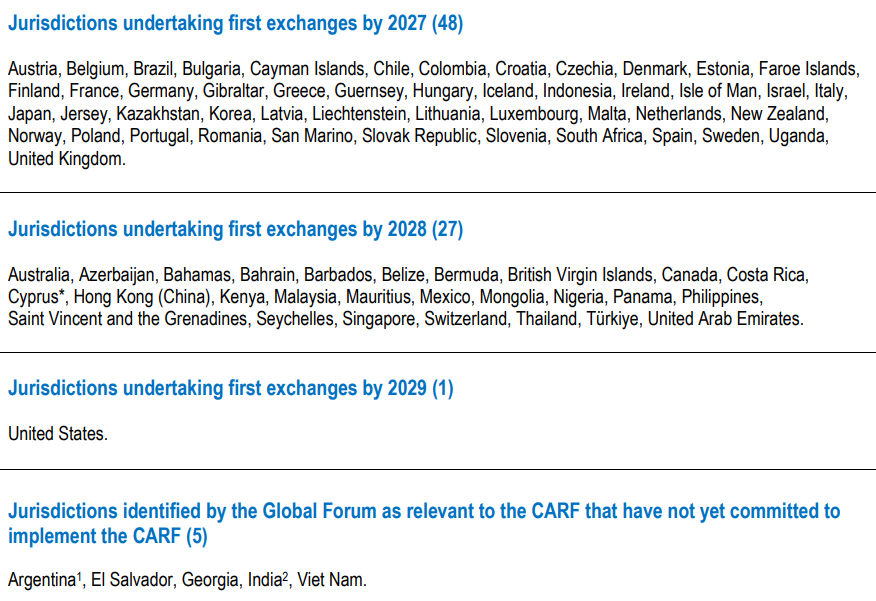

However, adoption of the data sharing program has been growing at a steady pace. A list — maintained by the OECD and updated on Dec. 4 — shows that 48 nations pledged to adopt CARF by 2027, 27 by 2028, and the US by 2029.

Related: UK takes ‘meaningful step forward’ with proposed DeFi tax overhaul

This brings the total to 76 countries that have pledged to share crypto data so far. A separate OECD list shows that 53 countries have already signed the Multilateral Competent Authority Agreement, the legal instrument that enables automatic data exchange.

Recent figures show a 70% year-on-year increase in Cayman Islands foundation company registrations. Legal professionals at Walkers said that CARF likely excludes structures that merely hold crypto assets, such as protocol treasuries, investment funds, or passive foundations, making Cayman Islands foundations a potential escape.

Magazine: When privacy and AML laws conflict: Crypto projects’ impossible choice