Digital asset exchange Huobi Global has spun out a new investment arm focused on decentralized finance (DeFi) and Web3 projects, further highlighting venture capital interest in the blockchain economy.

Dubbed Ivy Blocks, the new investment arm has over $1 billion in crypto assets under management to deploy, a spokesperson for Huobi confirmed. These funds have been earmarked for “identifying and investing in promising blockchain projects,” the company said.

In addition to financing, Ivy Blocks will offer various services to selected projects, including an asset management platform, a new blockchain incubator and a dedicated research arm. The firm’s asset management department will provide “liquidity investments” to help DeFi and Web3 projects get up and running, according to Lily Zhang, Huobi Global’s chief financial officer.

Ivy Blocks on Friday also announced that Capricorn Finance, an automated market maker built on the Cube blockchain, was the first project to receive funding.

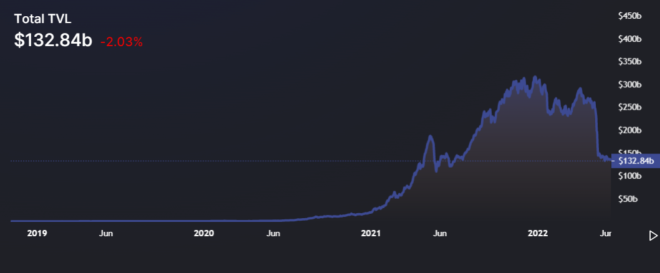

The firm’s focus on DeFi comes at a time when the sector’s overall value has declined by more than half from its peak. When measured in total value locked, or TVL, the DeFi sector is currently worth just under $133 billion, according to industry data. DeFi TVL peaked north of $316 billion in December 2021.

DeFi’s woes are a symptom of the so-called crypto winter, which has swept the market since the start of 2022. Analysts say market-cleansing bear cycles are healthy because they usually follow “irrational” periods where asset prices are bid up recklessly.

Related: After record growth, VC crypto investments decline 38% in May

Despite the downtrend, venture capital continues to flood the crypto scene, with investors prioritizing Web3 and metaverse plays. As reported by Cryptox Research, blockchain and crypto projects saw $14.6 billion in capital investments in the first quarter alone. To put that in perspective, venture capital investment in all of 2021 was roughly $30.5 billion.