Indonesia has entered Chainalysis’ global crypto adoption index for the first time, climbing into the top 3 as global crypto activity surged past 2021 bull market levels.

Indonesia has made its debut in Chainalysis‘ global crypto adoption index, climbing to third position, surpassing Vietnam, as global crypto activity reached levels not seen since the 2021 bull market.

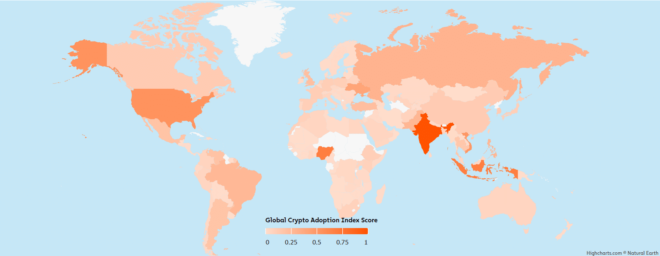

Between the last quarter of 2023 and the first quarter of 2024, the total value of global crypto activity increased significantly, outpacing the previous peak, data from Chainalysis shows. The new ranking places Indonesia behind India and Nigeria, which continues to lead the index since 2023.

The surge in adoption is part of a broader trend, with crypto activity increasing across countries in all income brackets, though high-income countries have seen a pullback since early 2024.

Last year, growth in crypto adoption was driven primarily by lower-middle income countries. This year, however, crypto activity increased across countries of all income brackets, with a pullback in high income countries since the beginning of 2024.

Chainalysis

Indonesia rises in global crypto adoption

Indonesia’s crypto ascent comes amid efforts to build a regulatory framework around digital assets. In April 2024, the country signed an agreement with Australia to establish a crypto information-sharing framework aimed at improving tax compliance and asset identification.

Indonesia’s financial watchdog, the Financial Services Authority, also ramped up efforts to regulate the sector, requiring crypto firms to go through a regulatory sandbox before obtaining licenses by 2025.

Chainalysis says the surge in crypto activity globally has been driven by a variety of factors. The launch of spot Bitcoin exchange-traded funds in the U.S. fueled institutional growth, while stablecoin adoption has risen in low-income regions, particularly for retail transactions in Sub-Saharan Africa and Latin America.