Injective’s protocol community approved a major tokenomics overhaul on Monday, passing a governance proposal with 99.89% support based on staked voting power.

Injective is a layer-1 blockchain focused on decentralized finance applications, with INJ (INJ) serving as its native token for staking, governance and transaction fees.

The Supply Squeeze proposal (IIP-617) reduces its native token issuance and maintains the network’s buyback-and-burn program, which uses protocol-generated revenue to permanently remove tokens from circulation.

The network said it has removed about 6.85 million INJ from circulation through token burns. The proposal is designed to accelerate tokens removal by aligning reduced issuance with recurring buybacks.

According to an X post from Injective on Monday, the governance changes, which are live, will enable “INJ to become one of the most deflationary assets over time.”

The governance vote follows a prolonged downturn in INJ’s market price amid a broader altcoin sell-off. Over the past year, INJ has fallen nearly 80% and is down more than 90% from its all-time high achieved in March 2024. The token was down about 8% on Monday, according to CoinGecko data.

Community reaction on X after the vote was mostly optimistic, with users framing it as a structural shift rather than a short-term market catalyst.

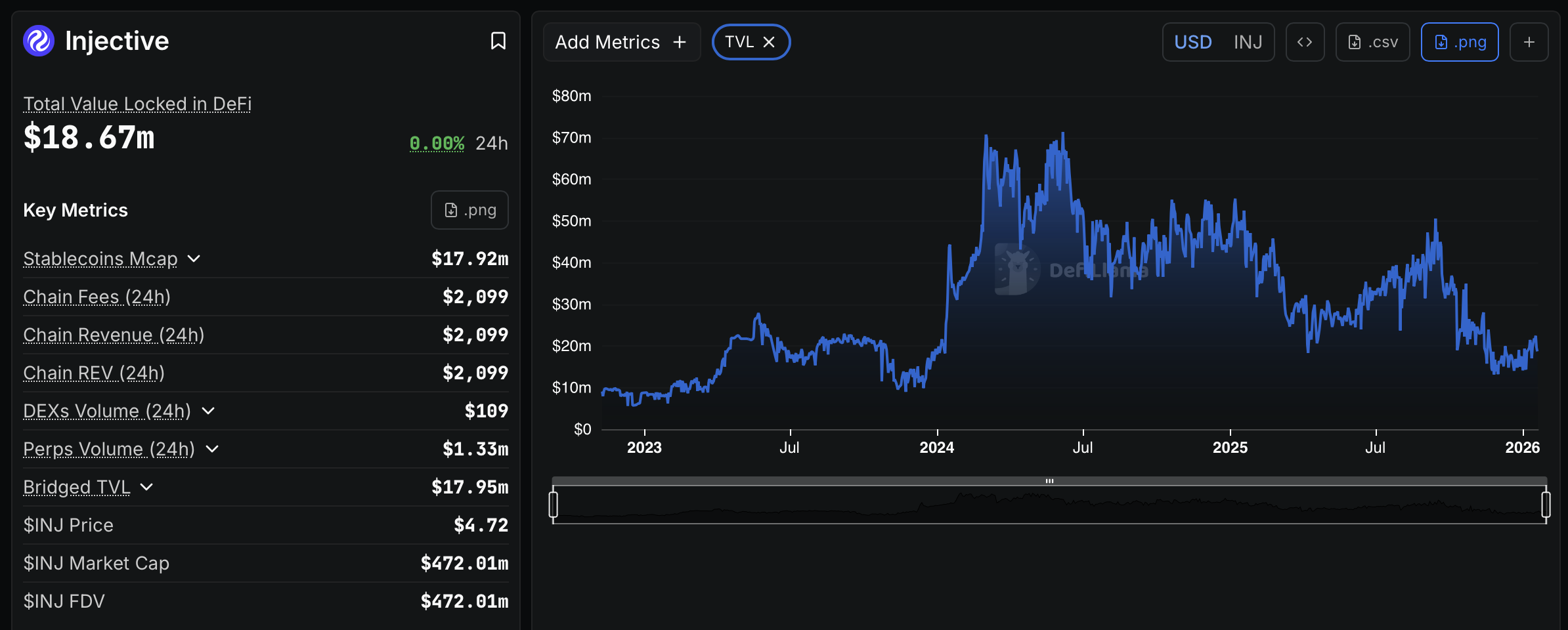

According to DefiLlama data, at time of writing Injective had $18.67 million in total value locked (TVL) across its DeFi ecosystem, down sharply from peaks above $60 million in 2024.

Related: After bitter vote, Aave founder pitches bigger future for DeFi lending giant

Injective sees ETF filings and new validators

Despite declines in INJ’s price and the network’s total value locked, Injective continued to attract institutional engagement in 2025, spanning regulated investment products, validator participation and new financial market offerings.

In July, Cboe and Canary Capital both filed regulatory applications for a staked Injective exchange-traded fund (ETF), with each seeking to list a fund that would hold and stake INJ to generate rewards through an “approved staking platform.”

Injective also continues to expand its validator set. In February, Deutsche Telekom’s IT services subsidiary, Deutsche Telekom MMS, joined the network as a validator.

More recently, Korea University became the first academic institution to operate a validator and conduct onchain research on the network, according to an announcement on Wednesday.

Magazine: Davinci Jeremie bought Bitcoin at $1… but $100K BTC doesn’t excite him