A recent survey conducted by Binance Research and Binance VIP & Institutional provides insights into the thoughts and preferences of institutional investors in the cryptocurrency market.

The Institutional Crypto Outlook Survey gathered responses from 208 Binance institutional clients and VIP users, offering information about their attitudes, preferences, adoption, and motivations regarding cryptocurrency investments.

The survey reveals that 63.5% of respondents are optimistic about the crypto market in the next 12 months. Additionally, 88.0% have a positive outlook for the next decade, indicating their long-term confidence in crypto.

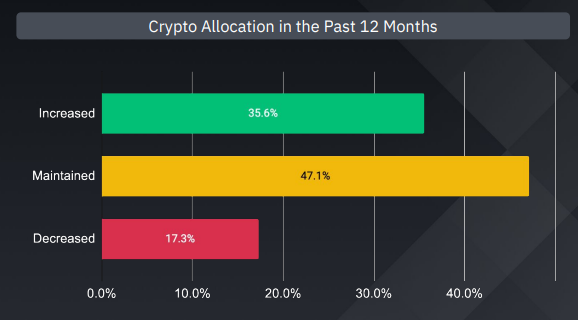

Regarding portfolio allocation, 47.1% of institutional investors maintained their crypto holdings over the past year, while 35.6% increased their allocation. Looking ahead, 50% of respondents plan to increase their allocation in the next 12 months, showing a positive sentiment towards cryptocurrencies as an investment asset.

The survey focuses on the interests of institutional investors, particularly in infrastructure, Layer 1 (L1), and Layer 2 (L2) sectors. Infrastructure is considered the most critical sector by 53.9% of investors, followed closely by L1 and L2 sectors at 48.1% and 43.8%, respectively. DeFi dApps have been widely used by institutional investors, indicating their growing interest in decentralized finance applications.

Key drivers for adoption

The report highlights the drivers of crypto adoption according to institutional investors. Respondents believe that real-world use cases and increased regulatory clarity are key factors driving cryptocurrency adoption. They also emphasize the importance of more institutional involvement and robust security measures to encourage adoption.

Although regulatory and counterparty risks are significant concerns, over 80% of respondents feel comfortable with the volatility of cryptocurrencies, showing resilience in the face of market fluctuations.

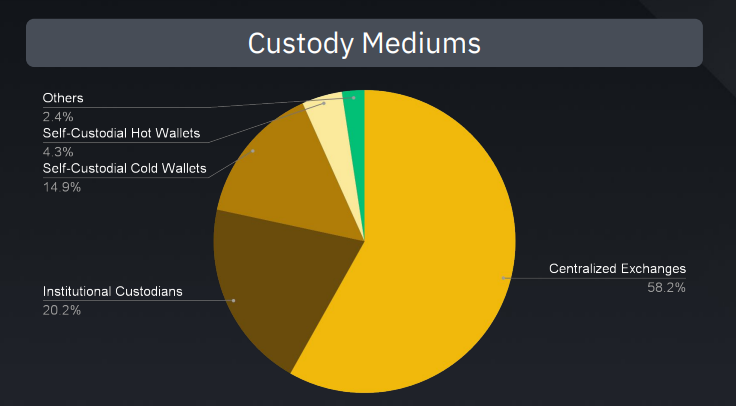

Regarding trading and custody, centralized exchanges (CEXes) are the preferred venues for institutional investors, with 90.5% executing most of their trades on CEXes. However, larger institutional investors are increasingly drawn to decentralized exchanges (DEXes) and over-the-counter (OTC) desks.

Which custody is more preferred?

Regarding custody, most institutional investors store their crypto assets on centralized exchanges. In contrast, institutional custodians are preferred by some, especially those managing assets of $50M to $75M, indicating a focus on enhanced security measures.

For institutional investors, liquidity is the most critical factor when evaluating centralized exchanges, followed by security and reputation. Competitive fees are less important, indicating a greater emphasis on smooth and secure trading experiences.

The survey also explores the sources of information relied upon by institutional investors. Social media platforms like Twitter, Telegram, and Discord are frequently used by 65.4% of respondents for up-to-date crypto information. Additionally, crypto news outlets (50.0%) and industry professionals (39.9%) are trusted sources, while mainstream and business news outlets play a lesser role in their information-seeking process.